- China

- /

- Auto Components

- /

- SZSE:002472

The total return for Zhejiang Shuanghuan DrivelineLtd (SZSE:002472) investors has risen faster than earnings growth over the last five years

Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. For example, the Zhejiang Shuanghuan Driveline Co.,Ltd. (SZSE:002472) share price is up a whopping 303% in the last half decade, a handsome return for long term holders. And this is just one example of the epic gains achieved by some long term investors. On the other hand, we note it's down 8.1% in about a month. We note that the broader market is down 6.0% in the last month, and this may have impacted Zhejiang Shuanghuan DrivelineLtd's share price.

While the stock has fallen 4.8% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Zhejiang Shuanghuan DrivelineLtd

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

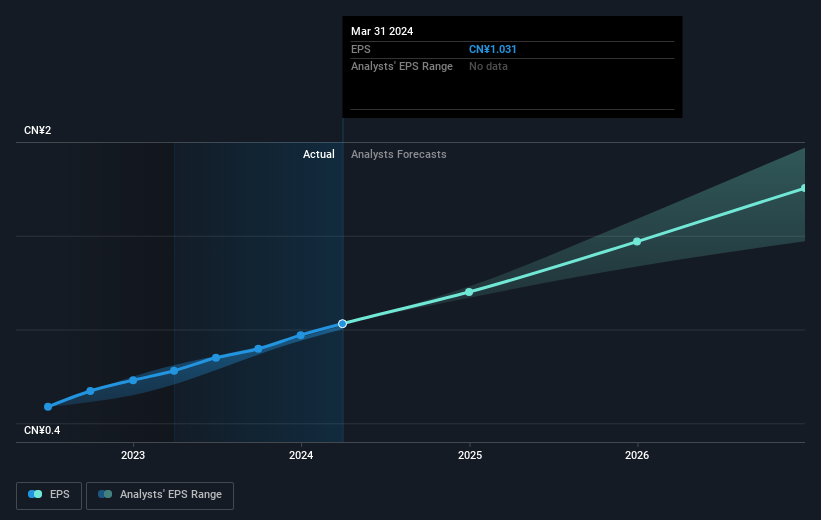

During five years of share price growth, Zhejiang Shuanghuan DrivelineLtd achieved compound earnings per share (EPS) growth of 31% per year. That makes the EPS growth particularly close to the yearly share price growth of 32%. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. Rather, the share price has approximately tracked EPS growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Zhejiang Shuanghuan DrivelineLtd has grown profits over the years, but the future is more important for shareholders. This free interactive report on Zhejiang Shuanghuan DrivelineLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Zhejiang Shuanghuan DrivelineLtd's TSR for the last 5 years was 312%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 17% in the twelve months, Zhejiang Shuanghuan DrivelineLtd shareholders did even worse, losing 37% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 33%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Is Zhejiang Shuanghuan DrivelineLtd cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Shuanghuan DrivelineLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002472

Zhejiang Shuanghuan DrivelineLtd

Researches and develops, manufactures, and sells gears, transmission, and drive components under the FOISH brand in China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives