- China

- /

- Auto Components

- /

- SZSE:002265

Jianshe Industry Group (Yunnan) Co., Ltd.'s (SZSE:002265) 47% Jump Shows Its Popularity With Investors

Despite an already strong run, Jianshe Industry Group (Yunnan) Co., Ltd. (SZSE:002265) shares have been powering on, with a gain of 47% in the last thirty days. The annual gain comes to 179% following the latest surge, making investors sit up and take notice.

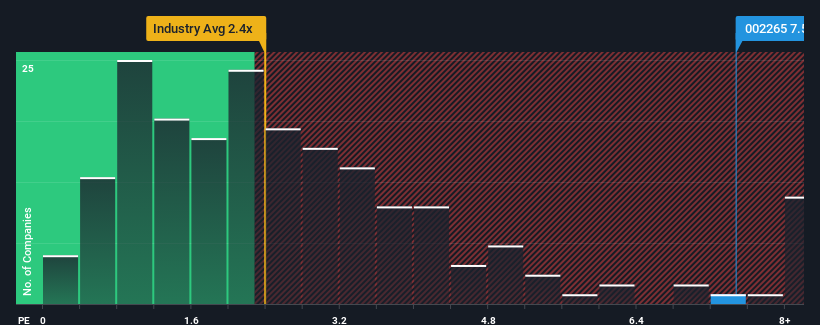

After such a large jump in price, given around half the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.4x, you may consider Jianshe Industry Group (Yunnan) as a stock to avoid entirely with its 7.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Jianshe Industry Group (Yunnan)

How Has Jianshe Industry Group (Yunnan) Performed Recently?

As an illustration, revenue has deteriorated at Jianshe Industry Group (Yunnan) over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jianshe Industry Group (Yunnan)'s earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Jianshe Industry Group (Yunnan)'s to be considered reasonable.

Retrospectively, the last year delivered a frustrating 8.7% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Comparing that to the industry, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Jianshe Industry Group (Yunnan)'s P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

The strong share price surge has lead to Jianshe Industry Group (Yunnan)'s P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Jianshe Industry Group (Yunnan) can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Jianshe Industry Group (Yunnan) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002265

Jianshe Industry Group (Yunnan)

Jianshe Industry Group (Yunnan) Co., Ltd.

Excellent balance sheet with acceptable track record.