- China

- /

- Auto Components

- /

- SZSE:002126

3 Promising Stocks Estimated To Be Undervalued By Up To 38.4%

Reviewed by Simply Wall St

Amidst a week marked by tariff uncertainties and mixed economic signals, global markets have shown resilience with the S&P 500 Index experiencing only a slight decline despite broader volatility. As investors navigate these fluctuating conditions, identifying undervalued stocks can offer potential opportunities; such stocks are often characterized by strong fundamentals and earnings potential that may not yet be fully recognized by the market.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shihlin Electric & Engineering (TWSE:1503) | NT$175.00 | NT$348.90 | 49.8% |

| National World (LSE:NWOR) | £0.225 | £0.45 | 49.9% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.20 | 49.7% |

| World Fitness Services (TWSE:2762) | NT$89.80 | NT$178.28 | 49.6% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.24 | SEK165.67 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.03 | 49.7% |

| Hanwha Systems (KOSE:A272210) | ₩25300.00 | ₩50252.31 | 49.7% |

| Kinaxis (TSX:KXS) | CA$165.40 | CA$330.68 | 50% |

| PR TIMES (TSE:3922) | ¥2232.00 | ¥4432.57 | 49.6% |

| Ming Yuan Cloud Group Holdings (SEHK:909) | HK$3.56 | HK$7.11 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

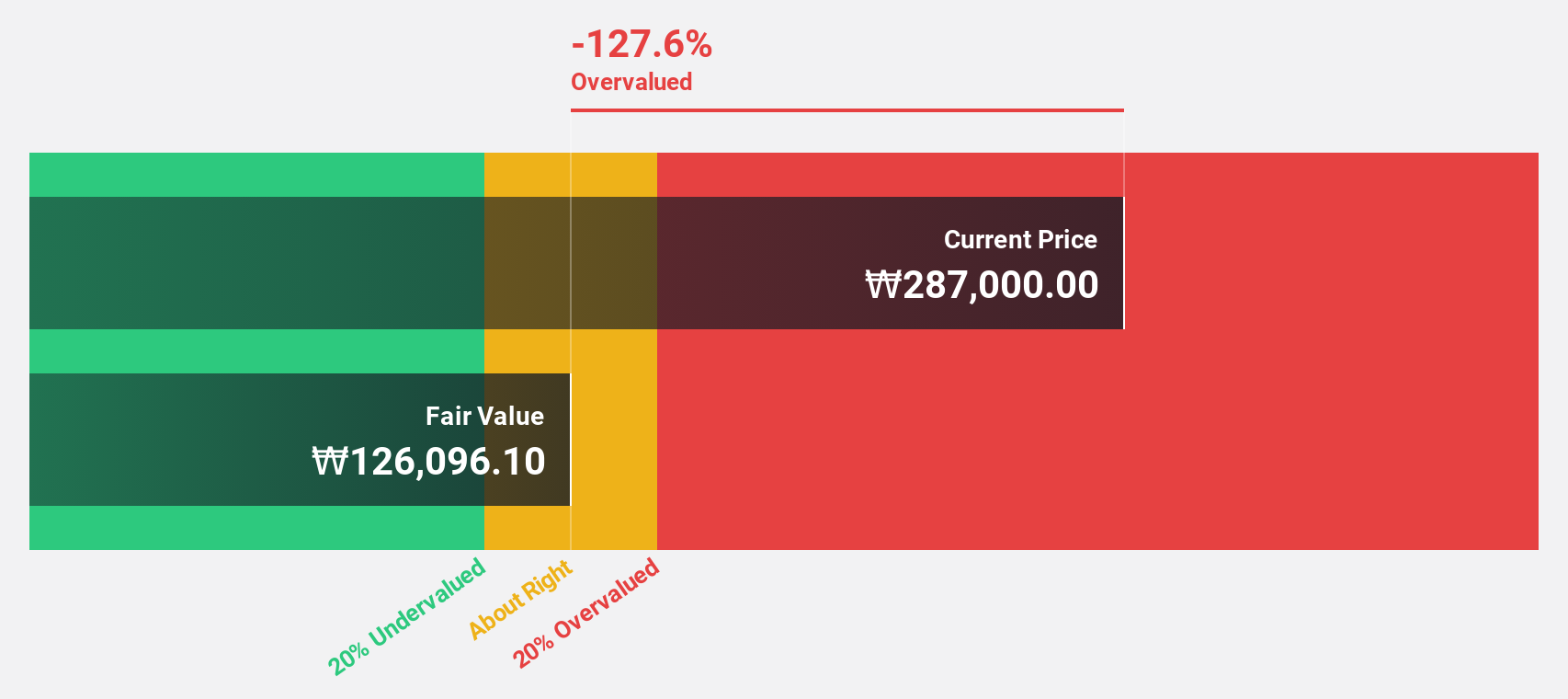

HYBE (KOSE:A352820)

Overview: HYBE Co., Ltd. operates in music production, publishing, and artist development and management, with a market cap of ₩9.77 trillion.

Operations: The company's revenue is primarily derived from its Label segment at ₩1.29 trillion, followed by the Solution segment at ₩1.21 trillion, and the Platform segment at ₩337.18 million.

Estimated Discount To Fair Value: 10.8%

HYBE's stock is trading at ₩234,500, about 10.8% below its estimated fair value of ₩262,981.44, suggesting it may be slightly undervalued based on discounted cash flow analysis. Despite recent leadership changes and a significant drop in net income for the third quarter compared to last year, revenue growth is expected to outpace the Korean market at 16.8% annually. The company aims for sustainable growth and competitiveness in the global music market under new leadership.

- Insights from our recent growth report point to a promising forecast for HYBE's business outlook.

- Click here to discover the nuances of HYBE with our detailed financial health report.

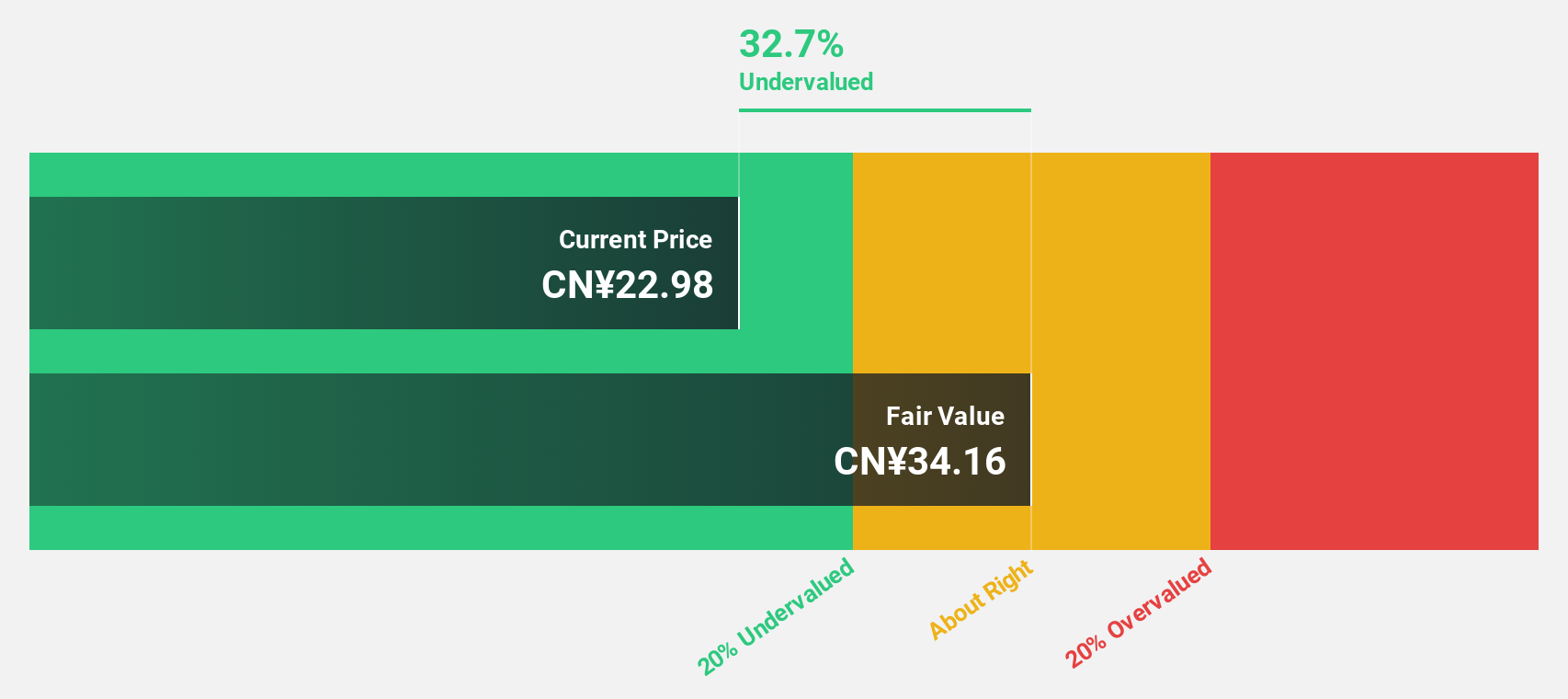

Zhejiang Yinlun MachineryLtd (SZSE:002126)

Overview: Zhejiang Yinlun Machinery Co., Ltd. focuses on the research, development, manufacturing, and sale of thermal management and exhaust gas post-treatment products, with a market cap of CN¥18.83 billion.

Operations: The company generates revenue from its thermal management and exhaust gas post-treatment product segments.

Estimated Discount To Fair Value: 12.3%

Zhejiang Yinlun Machinery Ltd. is trading at CN¥22.67, slightly below its estimated fair value of CN¥25.84, indicating potential undervaluation based on discounted cash flow analysis. The company’s earnings are forecast to grow significantly at 25.94% annually, outpacing the Chinese market's growth rate of 25.4%. Recent developments include its addition to the Shenzhen Stock Exchange Component Index and a planned public share offering for a controlled subsidiary, potentially enhancing visibility and liquidity.

- The analysis detailed in our Zhejiang Yinlun MachineryLtd growth report hints at robust future financial performance.

- Get an in-depth perspective on Zhejiang Yinlun MachineryLtd's balance sheet by reading our health report here.

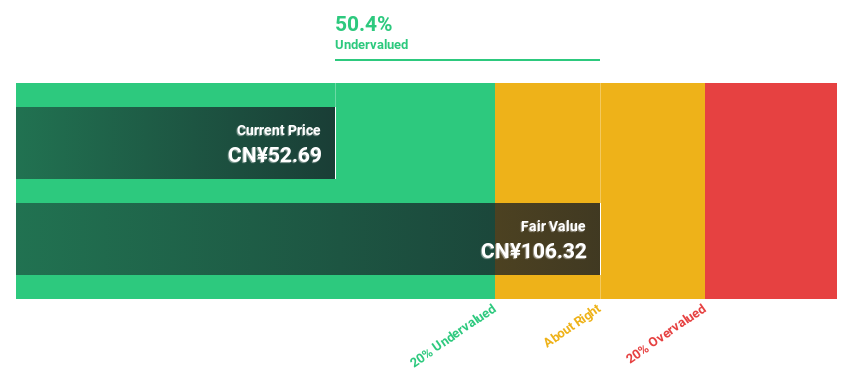

iFLYTEKLTD (SZSE:002230)

Overview: iFLYTEK CO., LTD. operates in the field of artificial intelligence (AI) technology services in China, with a market cap of CN¥124.52 billion.

Operations: The company's revenue segments include AI technology services in China.

Estimated Discount To Fair Value: 38.4%

iFLYTEK LTD is trading at CN¥54.3, significantly below its estimated fair value of CN¥88.1, suggesting potential undervaluation based on discounted cash flow analysis. Despite high non-cash earnings and a low forecasted return on equity of 7%, the company's earnings are expected to grow substantially by 62.26% annually, surpassing the Chinese market's growth rate of 25.4%. Recent shareholder meetings focused on stock repurchase and employee ownership plans may impact capital structure.

- According our earnings growth report, there's an indication that iFLYTEKLTD might be ready to expand.

- Take a closer look at iFLYTEKLTD's balance sheet health here in our report.

Taking Advantage

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 912 more companies for you to explore.Click here to unveil our expertly curated list of 915 Undervalued Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Yinlun MachineryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002126

Zhejiang Yinlun MachineryLtd

Engages in the research and development, manufacturing, and sale of various thermal management and exhaust gas post-treatment products.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives