- China

- /

- Auto Components

- /

- SZSE:002031

Risks Still Elevated At These Prices As Greatoo Intelligent Equipment Inc. (SZSE:002031) Shares Dive 29%

To the annoyance of some shareholders, Greatoo Intelligent Equipment Inc. (SZSE:002031) shares are down a considerable 29% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 23% share price drop.

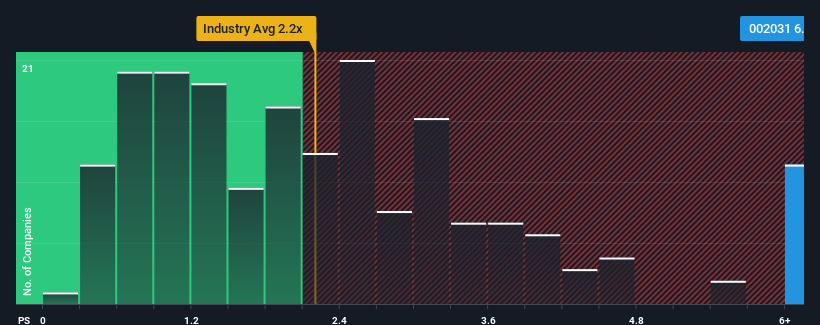

Even after such a large drop in price, given around half the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.2x, you may still consider Greatoo Intelligent Equipment as a stock to avoid entirely with its 6.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Greatoo Intelligent Equipment

What Does Greatoo Intelligent Equipment's Recent Performance Look Like?

For example, consider that Greatoo Intelligent Equipment's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Greatoo Intelligent Equipment's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Greatoo Intelligent Equipment would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 63% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 26% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Greatoo Intelligent Equipment is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Greatoo Intelligent Equipment's P/S Mean For Investors?

Even after such a strong price drop, Greatoo Intelligent Equipment's P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Greatoo Intelligent Equipment currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Before you take the next step, you should know about the 2 warning signs for Greatoo Intelligent Equipment that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002031

Greatoo Intelligent Equipment

Researches and develops, manufactures, and sells tire molds, hydraulic vulcanizing presses, robots, intelligent equipment, and precision machine tools in China and internationally.

Low with imperfect balance sheet.

Market Insights

Community Narratives