- China

- /

- Auto Components

- /

- SZSE:002031

Greatoo Intelligent Equipment Inc.'s (SZSE:002031) Popularity With Investors Is Under Threat From Overpricing

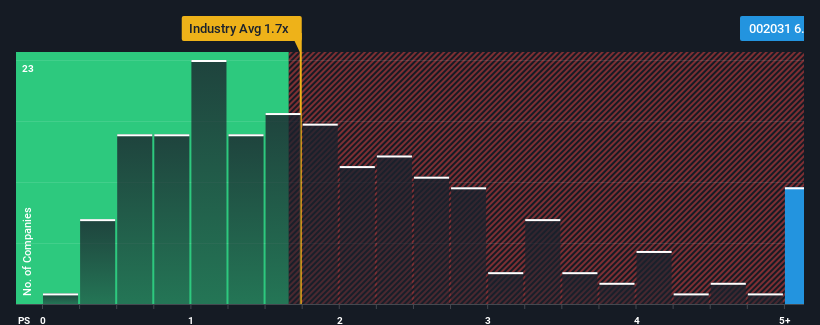

When close to half the companies in the Auto Components industry in China have price-to-sales ratios (or "P/S") below 1.7x, you may consider Greatoo Intelligent Equipment Inc. (SZSE:002031) as a stock to avoid entirely with its 6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Greatoo Intelligent Equipment

How Has Greatoo Intelligent Equipment Performed Recently?

The revenue growth achieved at Greatoo Intelligent Equipment over the last year would be more than acceptable for most companies. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Greatoo Intelligent Equipment will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Greatoo Intelligent Equipment?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Greatoo Intelligent Equipment's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.4% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 57% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Greatoo Intelligent Equipment's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Greatoo Intelligent Equipment revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Having said that, be aware Greatoo Intelligent Equipment is showing 2 warning signs in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002031

Greatoo Intelligent Equipment

Researches and develops, manufactures, and sells tire molds, hydraulic vulcanizing presses, robots, intelligent equipment, and precision machine tools in China and internationally.

Low with imperfect balance sheet.

Market Insights

Community Narratives