- China

- /

- Auto Components

- /

- SHSE:603949

Exploring 3 Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets continue to navigate a landscape shaped by geopolitical tensions and economic policy shifts, U.S. small-cap stocks have reached record territory, buoyed by robust consumer spending despite ongoing manufacturing challenges. This dynamic environment presents opportunities for investors seeking undiscovered gems, as small-cap companies often offer unique growth potential when they align with favorable market conditions and demonstrate resilience amid broader economic fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

VBG Group (OM:VBG B)

Simply Wall St Value Rating: ★★★★★★

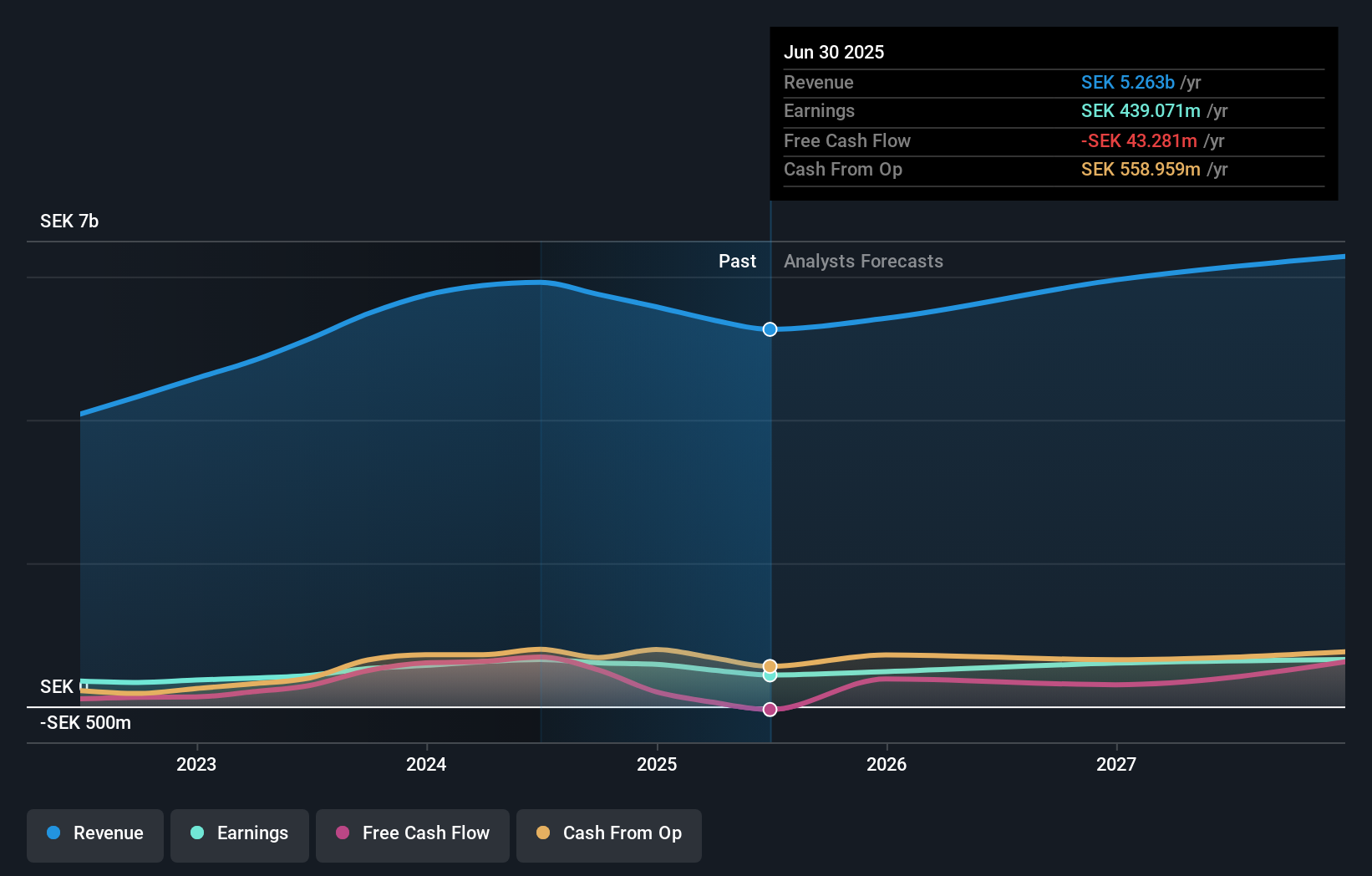

Overview: VBG Group AB (publ) is a company that develops, manufactures, markets, and sells various industrial products across Sweden, Germany, other Nordic countries and Europe, North America, Brazil, Australia/New Zealand, China, and internationally with a market capitalization of approximately SEK7.29 billion.

Operations: The company's revenue streams are primarily derived from Mobile Thermal Solutions (SEK3.20 billion), Truck & Trailer Equipment (SEK1.58 billion), and RINGFEDER Power Transmission (SEK965.80 million).

VBG Group, a smaller player in the machinery sector, showcases robust financial health with its debt to equity ratio dropping from 32.6% to 15.7% over five years and earnings growth of 14.3%, outpacing the industry average of -5%. The company trades at a compelling price-to-earnings ratio of 12x, below Sweden's market average of 22.7x, indicating potential value for investors. Despite recent third-quarter sales dipping to SEK 1,272.9 million from SEK 1,439.8 million last year, net income for nine months improved to SEK 475.9 million compared to SEK 439.1 million previously, reflecting resilience amidst challenges.

- Click here to discover the nuances of VBG Group with our detailed analytical health report.

Understand VBG Group's track record by examining our Past report.

Xuelong GroupLtd (SHSE:603949)

Simply Wall St Value Rating: ★★★★★★

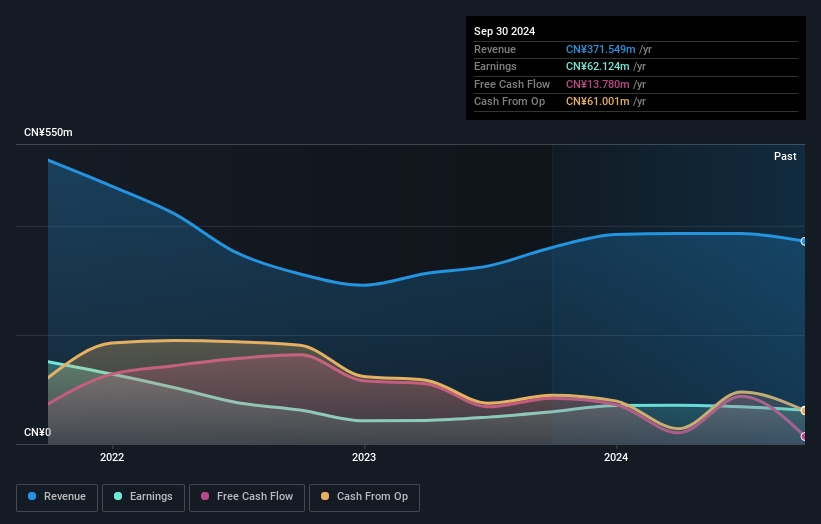

Overview: Xuelong Group Co., Ltd. specializes in the R&D, production, and sales of internal combustion engine cooling systems and automotive lightweight plastic products for various industries globally, with a market cap of CN¥3.03 billion.

Operations: The company generates revenue through the sale of internal combustion engine cooling systems and automotive lightweight plastic products. It operates in various industries both domestically and internationally. The net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

Xuelong Group Ltd, a small player in the auto components industry, has faced some challenges recently. Despite being debt-free and boasting high-quality past earnings, its revenue for the nine months ending September 2024 was CNY 268 million, down from CNY 281 million last year. Net income also dropped to CNY 45 million from CNY 53 million. The company seems to be struggling with growth as its earnings have decreased by an average of 16.8% annually over five years. However, it remains profitable with positive free cash flow of approximately US$13.78 million as of September this year.

Winstech Precision Holding (SZSE:001319)

Simply Wall St Value Rating: ★★★★★★

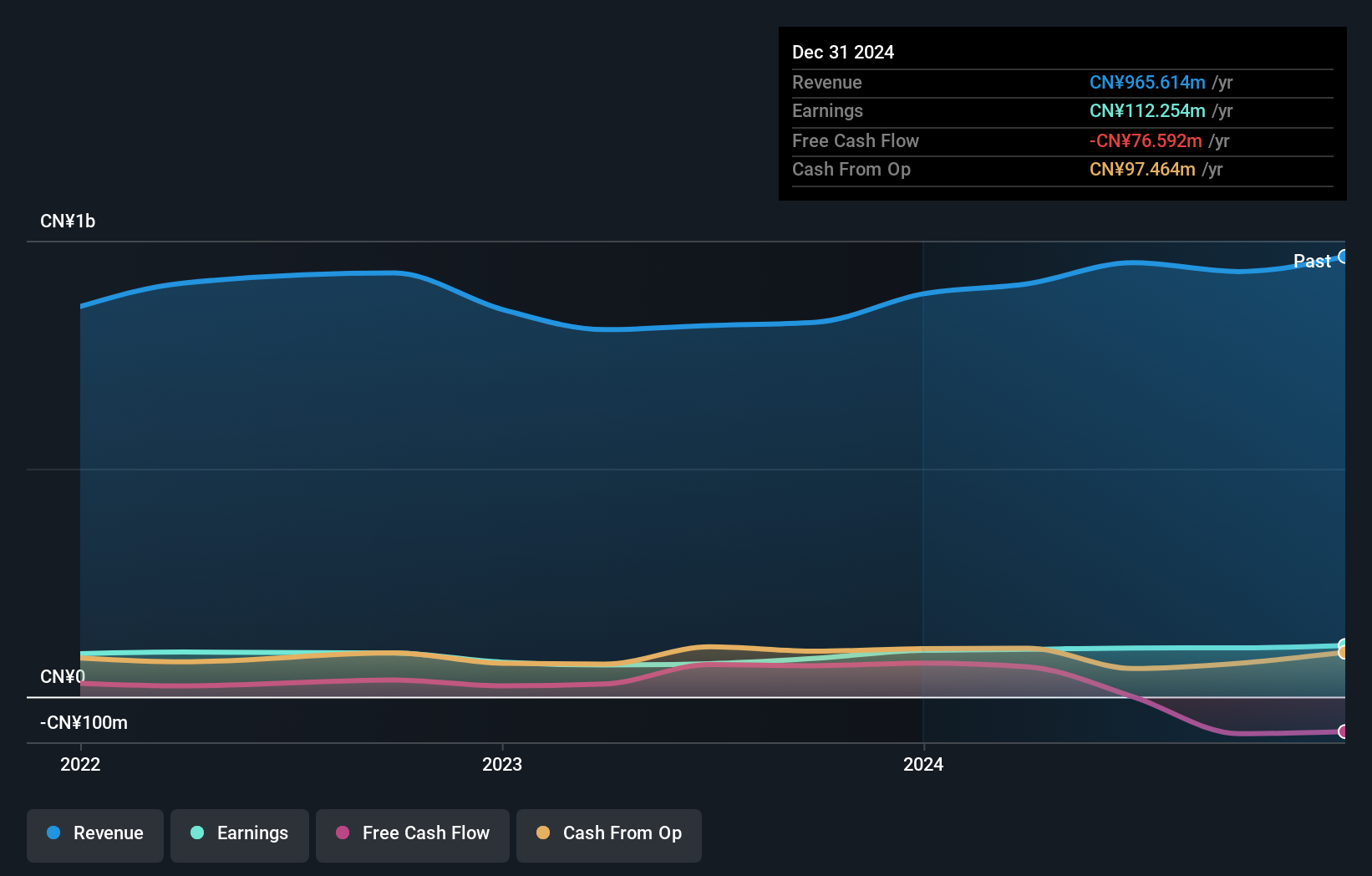

Overview: Winstech Precision Holding Co., LTD. specializes in the stamping, welding, and assembly of precision automobile stamping dies and auto parts for the automotive industry, with a market cap of CN¥3.56 billion.

Operations: Winstech derives its revenue primarily from the stamping, welding, and assembly of precision automobile parts. The company's cost structure is significantly influenced by material and labor expenses. Its net profit margin has shown variability across recent periods.

Winstech Precision Holding, a notable player in its sector, has shown promising financial strides with earnings growth of 27% over the past year, outpacing the Auto Components industry's 10.5%. The company's debt to equity ratio impressively reduced from 14.4% to 0.9% over five years, indicating strong financial management. Despite not being free cash flow positive lately, Winstech's net income rose to CNY 76.52 million for the first nine months of 2024 from CNY 70.86 million last year. Its price-to-earnings ratio stands at a competitive 33x against the CN market's average of about 37x, suggesting potential value for investors seeking opportunities in smaller companies within this industry space.

Where To Now?

- Delve into our full catalog of 4640 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603949

Xuelong GroupLtd

Xuelong Group Co., Ltd. engages in the research and development, production, and sales of internal combustion engine cooling systems and automotive lightweight plastic products that are used in automobiles, construction and agricultural machinery, and other industries in China and internationally.

Flawless balance sheet with acceptable track record.