- China

- /

- Auto Components

- /

- SHSE:603239

Floridienne And 2 High Growth Companies With Strong Insider Confidence

Reviewed by Simply Wall St

Amid a backdrop of record highs in major indices like the Dow Jones and S&P 500, global markets are navigating a complex landscape shaped by geopolitical tensions and domestic policy changes. As investors seek opportunities in this environment, companies with high insider ownership often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 63.6% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

Floridienne (ENXTBR:FLOB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Floridienne S.A. operates in the chemicals, gourmet food, and life sciences sectors both in Belgium and internationally, with a market cap of €612.18 million.

Operations: The company's revenue is generated from its Food segment (€150.05 million), Chemicals Division (€39.25 million), and Life Sciences Division (€409.99 million).

Insider Ownership: 19.3%

Revenue Growth Forecast: 13.7% p.a.

Floridienne S.A. demonstrates potential as a growth company with high insider ownership, trading at 7.8% below its estimated fair value. Despite a decline in net income to €5.3 million for the half year ending June 2024, revenue increased to €317.5 million. Forecasts indicate revenue growth of 13.7% annually, outpacing the Belgian market's 7.2%. Earnings are projected to grow significantly at 48.22% per year, despite recent profit margin declines and large one-off items affecting results.

- Unlock comprehensive insights into our analysis of Floridienne stock in this growth report.

- Our expertly prepared valuation report Floridienne implies its share price may be lower than expected.

Zhejiang Xiantong Rubber&PlasticLtd (SHSE:603239)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Xiantong Rubber&Plastic Co., Ltd focuses on the research, development, design, production, and sale of automobile parts in China with a market cap of CN¥3.87 billion.

Operations: The company generates revenue of CN¥1.17 billion from its automotive parts segment.

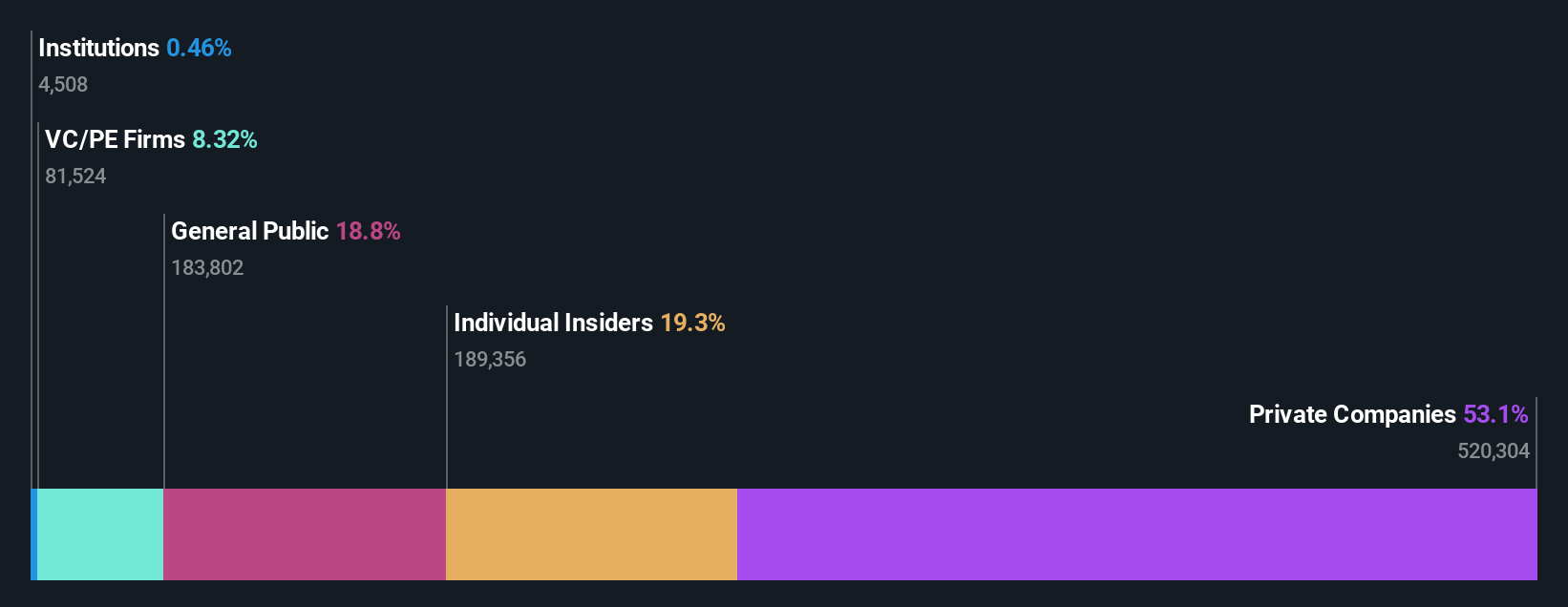

Insider Ownership: 32.1%

Revenue Growth Forecast: 24.3% p.a.

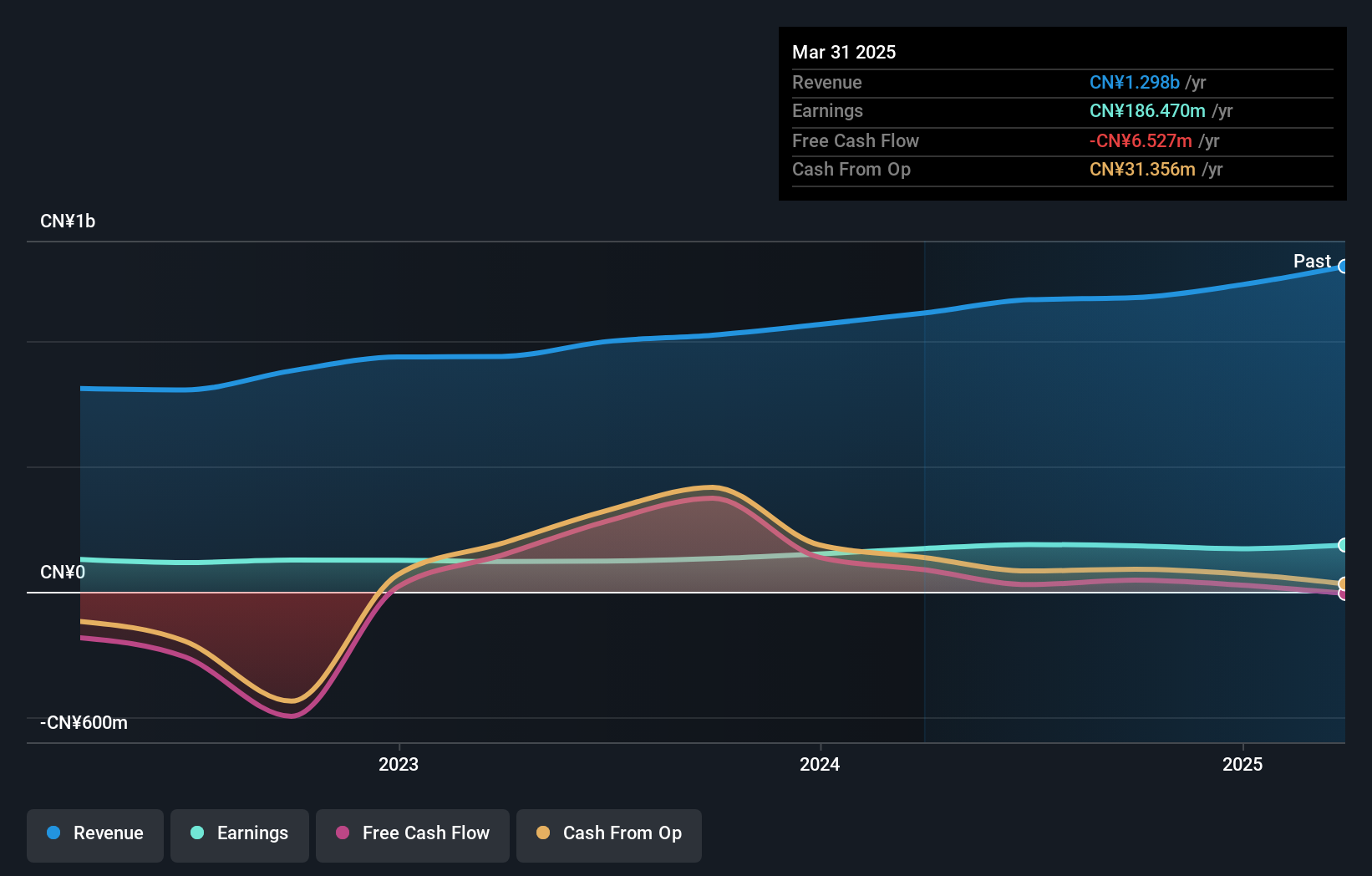

Zhejiang Xiantong Rubber & Plastic Ltd shows promise with significant insider ownership and a favorable price-to-earnings ratio of 21.6x, below the CN market average. The company reported sales of CNY 841.51 million for the first nine months of 2024, up from CNY 734.25 million the previous year, with earnings growth at 38.7%. Revenue is projected to grow annually by 24.3%, exceeding market expectations, although its dividend coverage remains weak due to limited free cash flow.

- Take a closer look at Zhejiang Xiantong Rubber&PlasticLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Zhejiang Xiantong Rubber&PlasticLtd is trading behind its estimated value.

Shanghai Sinyang Semiconductor Materials (SZSE:300236)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Sinyang Semiconductor Materials Co., Ltd. operates in the semiconductor industry, focusing on the production and supply of materials for semiconductor manufacturing, with a market cap of CN¥12.55 billion.

Operations: Shanghai Sinyang Semiconductor Materials Co., Ltd. generates revenue from its focus on producing and supplying materials essential for semiconductor manufacturing.

Insider Ownership: 15.1%

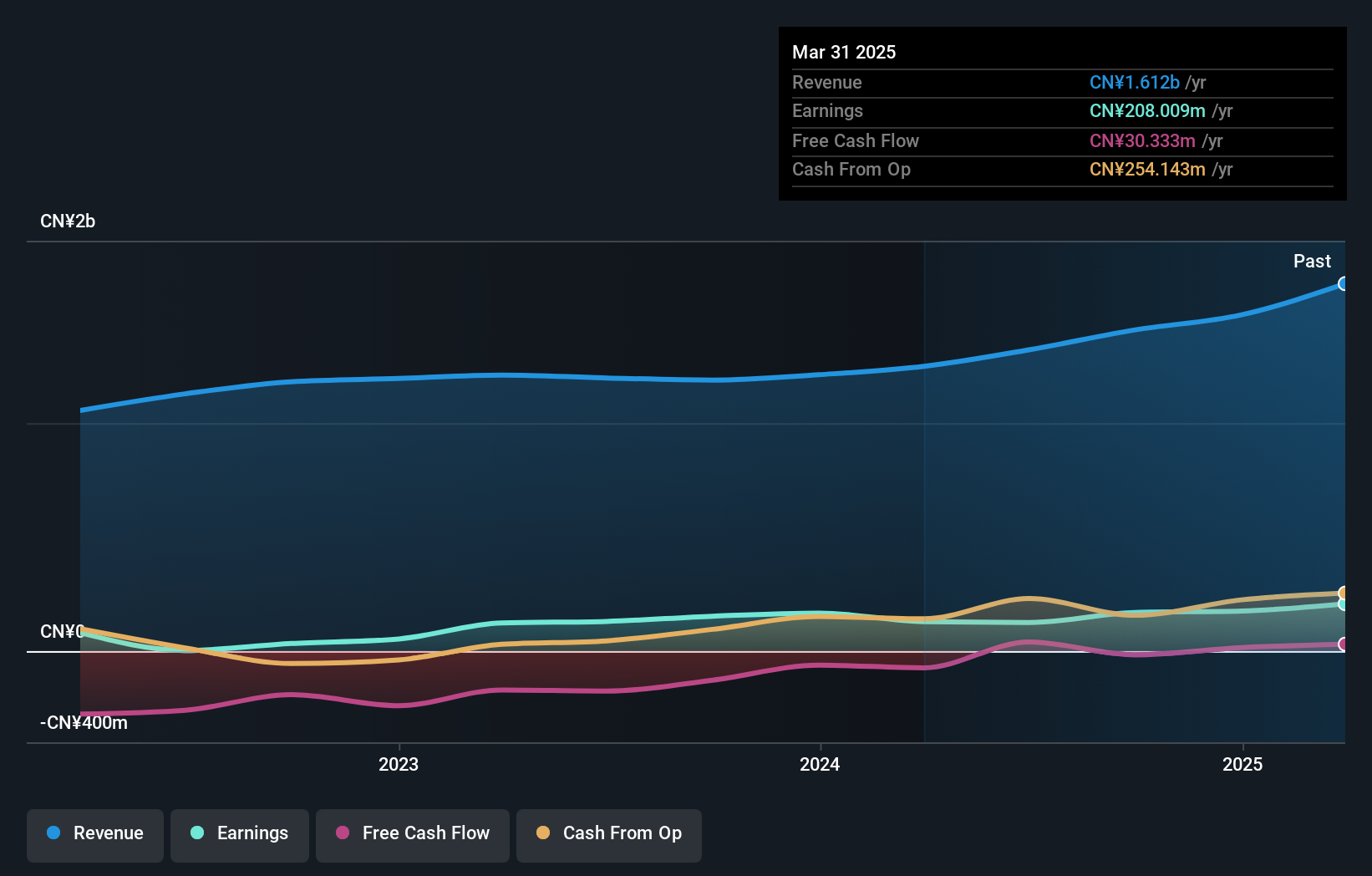

Revenue Growth Forecast: 26.9% p.a.

Shanghai Sinyang Semiconductor Materials recently reported sales of CNY 1.07 billion for the first nine months of 2024, up from CNY 870.51 million a year ago, with net income rising to CNY 129.76 million. Despite amendments to its articles of association, the company maintains high insider ownership and is expected to see annual earnings growth of over 31%, outpacing the CN market's average growth rate and projecting robust revenue expansion at nearly 27% annually.

- Get an in-depth perspective on Shanghai Sinyang Semiconductor Materials' performance by reading our analyst estimates report here.

- Our valuation report here indicates Shanghai Sinyang Semiconductor Materials may be overvalued.

Next Steps

- Access the full spectrum of 1514 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Xiantong Rubber&PlasticLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603239

Zhejiang Xiantong Rubber&PlasticLtd

Engages in the research and development, design, production, and sale of automobile sealing strips and other automobile parts in China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives