- China

- /

- Metals and Mining

- /

- SZSE:301261

Undiscovered Gems And Two Other Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week marked by record highs for major indices, including the Russell 2000's impressive performance, small-cap stocks have finally caught up with their larger peers in capturing investor attention. With domestic policy and geopolitical factors influencing market sentiment, identifying promising small-cap opportunities requires a keen eye for companies that can thrive amidst economic shifts and evolving trade dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Haitong Unitrust International Financial Leasing (SEHK:1905)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Haitong Unitrust International Financial Leasing Co., Ltd. operates as a financial leasing company in the People’s Republic of China with a market cap of HK$7.08 billion.

Operations: Haitong Unitrust generates revenue primarily from its financial services segment, specifically commercial leasing, amounting to CN¥3.68 billion.

Haitong Unitrust, a player in the financial leasing sector, recently reported net income of CNY 1.25 billion for the nine months ending September 2024, up from CNY 1.21 billion a year earlier. The company has seen its debt to equity ratio improve significantly over five years, dropping from 403% to 205%. Despite high debt levels with a net debt to equity ratio at 160%, Haitong Unitrust trades at about two-thirds below its estimated fair value and maintains positive free cash flow. Recent board changes and finance lease contracts suggest strategic adjustments are underway for future growth.

Hengong Precision Equipment (SZSE:301261)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hengong Precision Equipment Co., Ltd. focuses on the research, development, production, processing, and sales of new fluid technology materials both in China and internationally with a market cap of CN¥3.81 billion.

Operations: Hengong Precision Equipment generates revenue primarily through the sales of new fluid technology materials. The company's cost structure includes expenses related to research, development, production, and processing activities. The net profit margin has shown fluctuations across recent periods, reflecting changes in operational efficiency and market conditions.

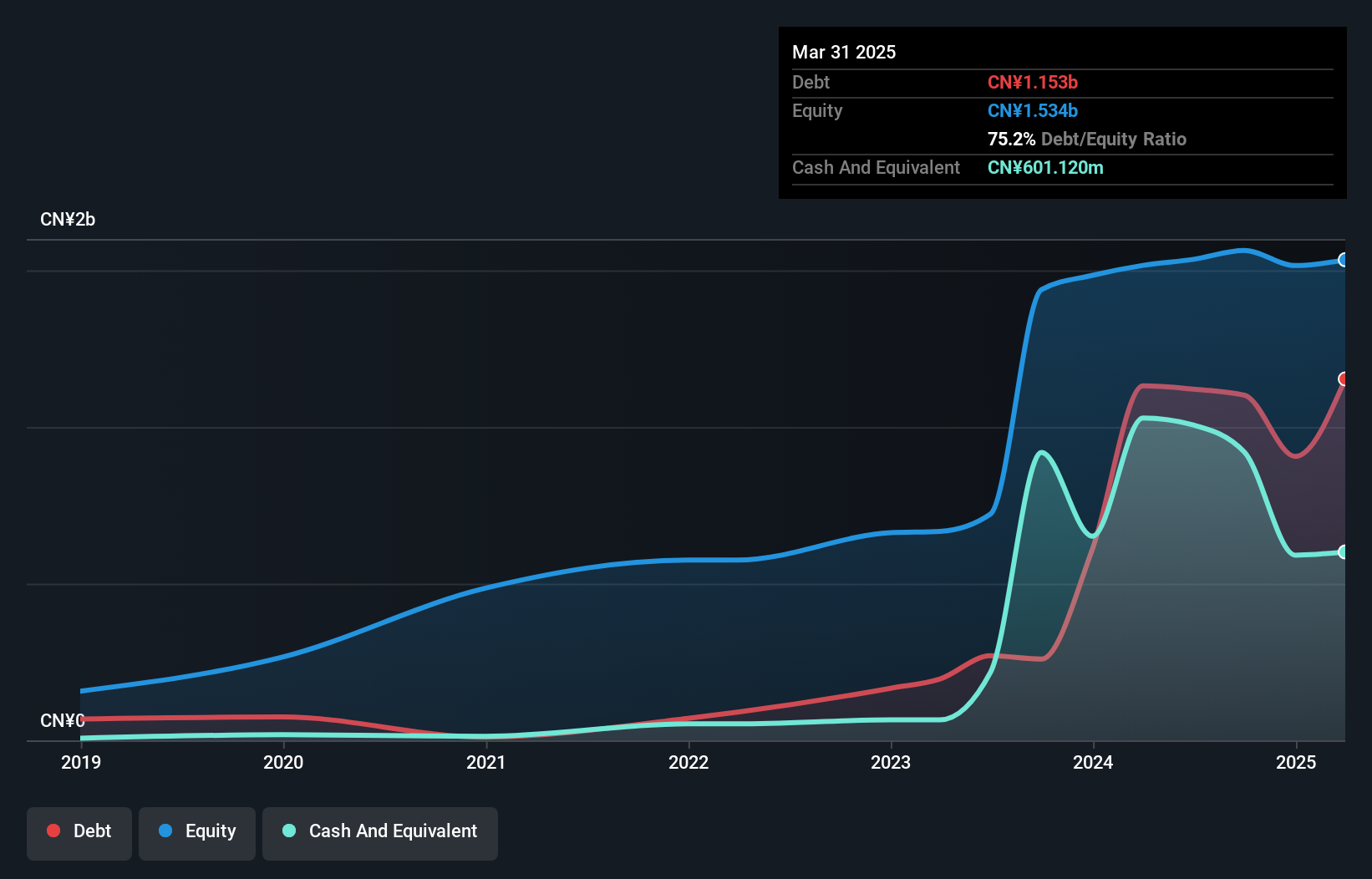

Hengong Precision Equipment, a notable player in its niche, has shown robust earnings growth of 32.3% over the past year, outpacing the broader Metals and Mining industry which saw a contraction of 2.3%. The company’s net debt to equity ratio stands at a satisfactory 11.6%, although its overall debt to equity ratio has risen from 30.5% to 70.5% over five years, indicating increased leverage. Despite reporting sales of CNY 747 million for the nine months ending September 2024—a rise from CNY 630 million last year—its basic earnings per share dipped slightly to CNY 1.09 from CNY 1.15 previously due to decreased interim dividends and high non-cash earnings levels impacting free cash flow negatively this year.

- Click here to discover the nuances of Hengong Precision Equipment with our detailed analytical health report.

Understand Hengong Precision Equipment's track record by examining our Past report.

Net Protections Holdings (TSE:7383)

Simply Wall St Value Rating: ★★★★★☆

Overview: Net Protections Holdings, Inc. specializes in providing buy now pay later (BNPL) services both in Japan and internationally, with a market capitalization of approximately ¥44.86 billion.

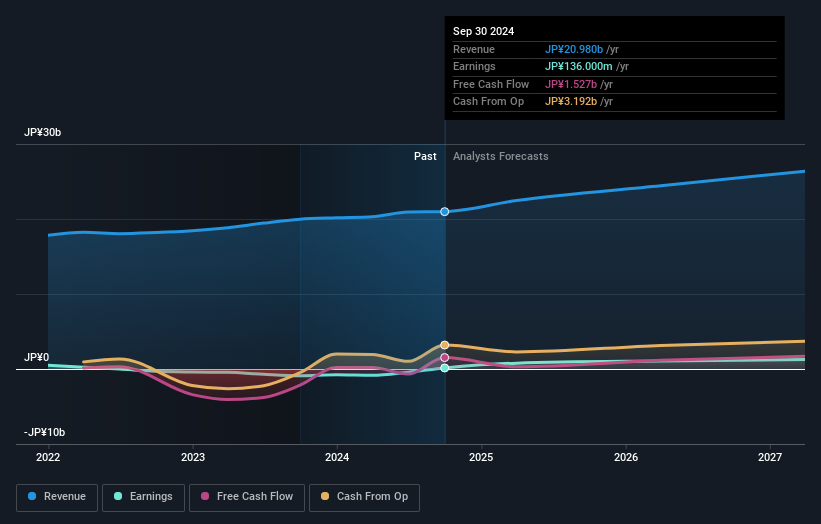

Operations: The company generates revenue primarily from its Payment Solutions Business, which reported ¥20.98 billion. The net profit margin for the period is not provided, so further analysis would be required to assess profitability trends.

Net Protections Holdings, a nimble player in the consumer finance sector, has shown resilience by becoming profitable recently. With cash exceeding total debt and interest payments well-covered at 11.5 times by EBIT, the company demonstrates financial prudence. Despite its volatile share price over the past three months, Net Protections forecasts earnings growth of 34% annually. Recent adjustments to their fiscal guidance reveal an optimistic outlook with expected operating revenue of ¥23.28 billion and profit attributable to owners at ¥1.04 billion for March 2025, reflecting improved expectations from earlier projections this year.

Key Takeaways

- Unlock our comprehensive list of 4640 Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hengong Precision Equipment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301261

Hengong Precision Equipment

Engages in the research and development, production and processing, and sales services of new fluid technology materials in China and internationally.

Reasonable growth potential with proven track record.