- China

- /

- Communications

- /

- SZSE:002792

Exploring High Growth Tech Stocks This December 2024

Reviewed by Simply Wall St

As global markets reach new heights, with indices like the Russell 2000 hitting record intraday highs, investor sentiment remains buoyed by domestic policy developments and easing geopolitical tensions. In this environment, identifying high-growth tech stocks that can capitalize on current economic trends and technological advancements is crucial for investors seeking to navigate the evolving landscape of December 2024.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 28.04% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1285 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Grifols (BME:GRF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grifols, S.A. is a plasma therapeutic company with operations in Spain, the United States, Canada, and internationally, and has a market cap of €5.32 billion.

Operations: Grifols generates revenue primarily from its Biopharma segment, which accounts for €5.95 billion, followed by the Diagnostic and Bio Supplies segments at €651.33 million and €204.55 million, respectively.

Grifols, a player in the biotech sector, has demonstrated robust financial performance with earnings skyrocketing by 590.4% over the past year, significantly outpacing its industry's average decline of 18.2%. Despite these gains, its projected annual revenue growth at 6% lags behind the broader tech sector's expectations but surpasses Spain's market growth rate of 4.9%. The company is poised for substantial future earnings growth, forecasted at an impressive rate of 33.9% annually. This financial trajectory is underpinned by Grifols' strategic emphasis on R&D investments which have fostered innovation and sustained competitive advantages in biotechnology and pharmaceuticals.

- Dive into the specifics of Grifols here with our thorough health report.

Explore historical data to track Grifols' performance over time in our Past section.

Shanghai BOCHU Electronic Technology (SHSE:688188)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai BOCHU Electronic Technology Corporation Limited operates in the electronic technology sector and has a market capitalization of CN¥36.73 billion.

Operations: Shanghai BOCHU Electronic Technology focuses on the electronic technology sector, generating revenue primarily through its diverse range of electronic products and services. The company has experienced fluctuations in its net profit margin, which is currently at 12.5%.

Shanghai BOCHU Electronic Technology has shown a remarkable performance with its earnings growth of 32.7% over the past year, surpassing the electronic industry's average of just 1.8%. This growth trajectory is supported by robust revenue forecasts, expected to increase by 28.1% annually, significantly outpacing the Chinese market projection of 13.8%. Furthermore, the company's commitment to innovation is evident from its substantial R&D investments which have not only fueled these financial metrics but also positioned it well against competitors in high-tech sectors. With earnings projected to grow at an impressive rate of 29.8% per year, Shanghai BOCHU is strategically poised for sustained future growth, leveraging advanced technologies and a strong market presence to potentially enhance its industry standing further.

- Delve into the full analysis health report here for a deeper understanding of Shanghai BOCHU Electronic Technology.

Learn about Shanghai BOCHU Electronic Technology's historical performance.

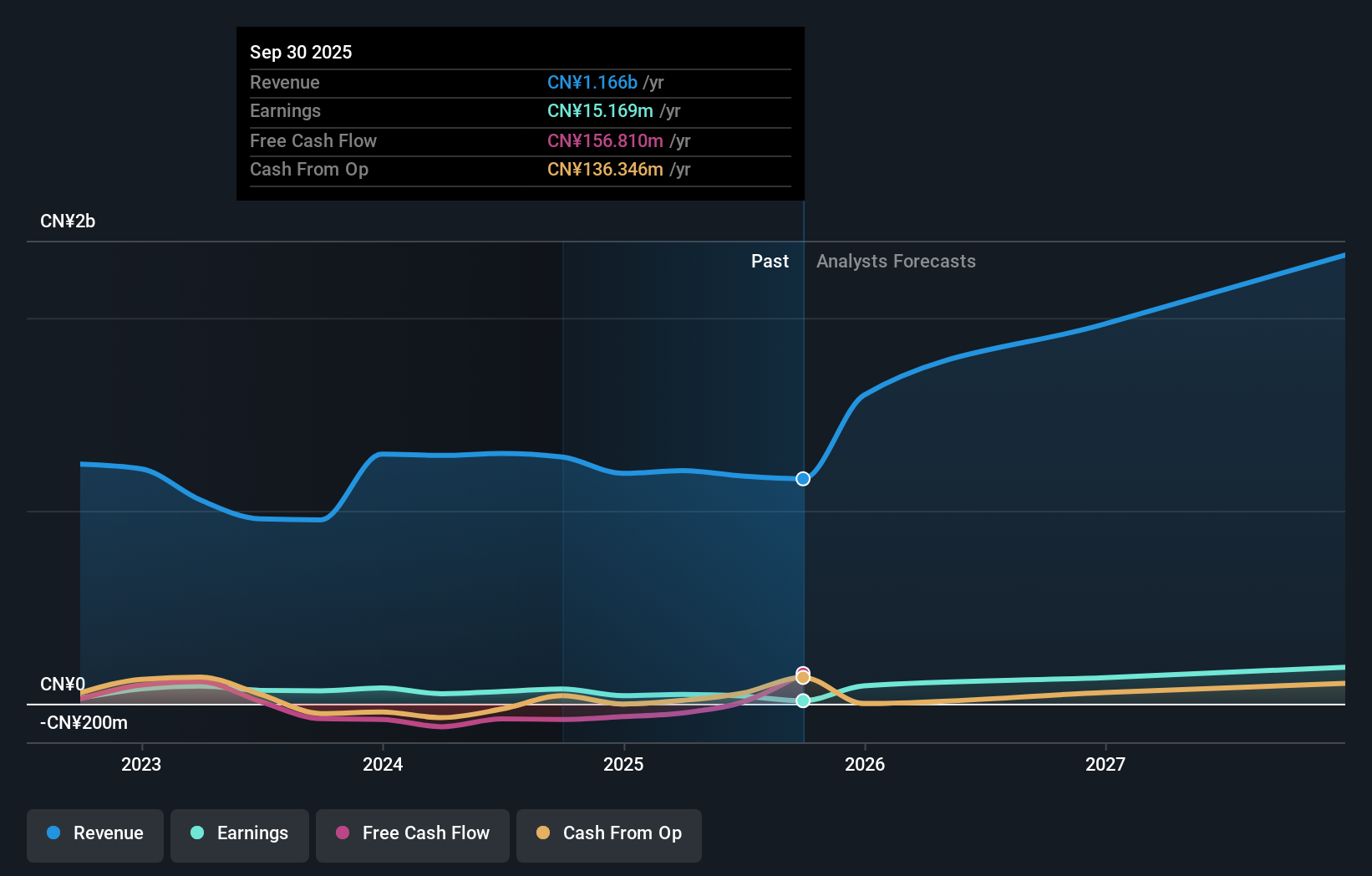

Tongyu Communication (SZSE:002792)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tongyu Communication Inc. engages in the research, development, manufacturing, sales, and servicing of mobile communication antennas, RF devices, optical modules, and other products globally with a market cap of CN¥8.57 billion.

Operations: The company generates revenue through the global sale and servicing of mobile communication antennas, RF devices, and optical modules. It operates in the telecommunications sector, focusing on innovative technology solutions for communication infrastructure.

Tongyu Communication has demonstrated resilience despite a slight dip in recent earnings, with sales reaching CNY 843.08 million and net income at CNY 51.49 million for the nine months ending September 2024. This performance is underpinned by an aggressive R&D strategy, crucial in a sector where innovation leads market trends. The company's commitment to research has propelled its revenue growth forecast at an impressive rate of 21.2% annually, significantly outstripping the broader Chinese market's expectation of 13.8%. Moreover, Tongyu's projected annual earnings growth stands at a robust 50.1%, reflecting potential for substantial future gains amidst evolving technological landscapes and increasing demand within the communications industry.

Key Takeaways

- Click through to start exploring the rest of the 1282 High Growth Tech and AI Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongyu Communication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002792

Tongyu Communication

Researches and develops, manufactures, sells, and services mobile communication antennas, radio frequency (RF) devices, optical modules, and other products worldwide.

High growth potential with adequate balance sheet.