- China

- /

- Metals and Mining

- /

- SHSE:600392

3 Growth Companies With Insider Ownership Ranging From 13% To 31%

Reviewed by Simply Wall St

As global markets continue to reach record highs, with major indices like the Dow Jones Industrial Average and S&P 500 Index achieving new intraday peaks, investor sentiment remains buoyed by domestic policy developments and geopolitical events. In this environment of robust market activity, growth companies with significant insider ownership can offer unique insights into potential investment opportunities, as insider confidence often signals strong alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 63.6% |

| Alkami Technology (NasdaqGS:ALKT) | 10.9% | 98.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

Shenghe Resources Holding (SHSE:600392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenghe Resources Holding Co., Ltd is involved in the research, development, production, and supply of rare earth products both in China and internationally, with a market cap of CN¥20.47 billion.

Operations: Shenghe Resources Holding Co., Ltd generates revenue primarily from its activities in the rare earth sector, focusing on research, development, production, and supply both domestically and globally.

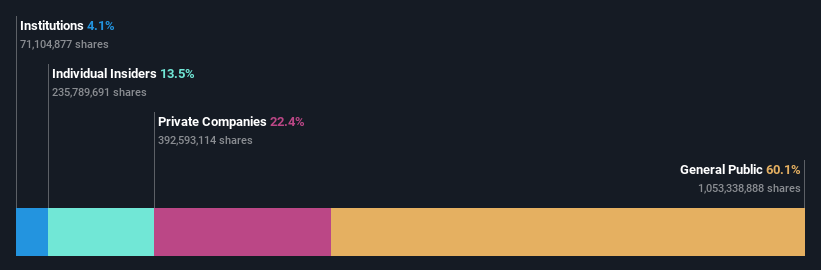

Insider Ownership: 13.5%

Shenghe Resources Holding demonstrates potential as a growth company with high insider ownership, despite recent financial challenges. For the nine months ending September 2024, revenue dropped to CNY 8.24 billion from CNY 13.11 billion a year ago, and net income decreased to CNY 92.87 million from CNY 158.19 million. However, the company's earnings are forecasted to grow significantly at 53.5% annually, outpacing both its past performance and the broader Chinese market expectations.

- Dive into the specifics of Shenghe Resources Holding here with our thorough growth forecast report.

- Our valuation report here indicates Shenghe Resources Holding may be overvalued.

Bangyan Technology (SHSE:688132)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bangyan Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of information communication and security equipment for the military industry in China with a market cap of CN¥3.05 billion.

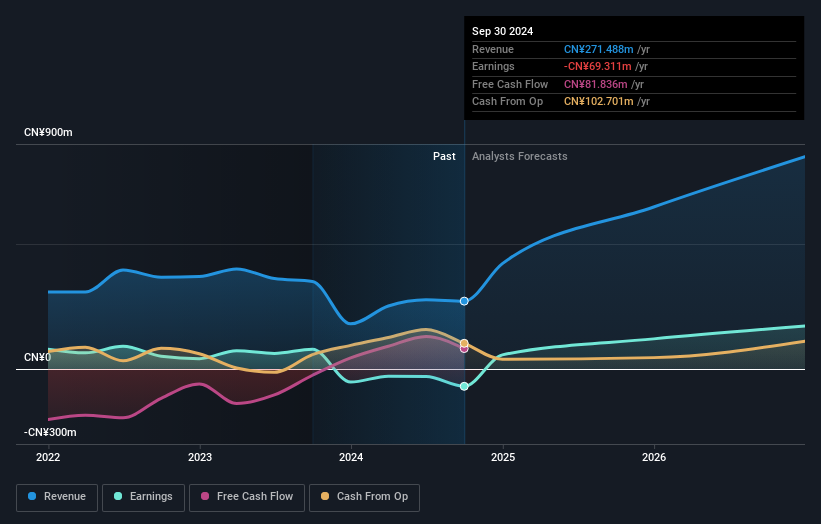

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, which generated CN¥271.49 million.

Insider Ownership: 29.2%

Bangyan Technology faces volatility but shows strong growth potential, with revenue forecasted to rise 42.7% annually, surpassing market expectations. Despite a net loss of CNY 0.93 million for the first nine months of 2024, the company is expected to become profitable in three years. Recent private placement plans and completed share buybacks indicate strategic financial maneuvers aimed at strengthening its position amid fluctuating earnings performance.

- Click to explore a detailed breakdown of our findings in Bangyan Technology's earnings growth report.

- Our expertly prepared valuation report Bangyan Technology implies its share price may be too high.

Scientech (TWSE:3583)

Simply Wall St Growth Rating: ★★★★★★

Overview: Scientech Corporation focuses on the R&D, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power industries with a market cap of NT$35.10 billion.

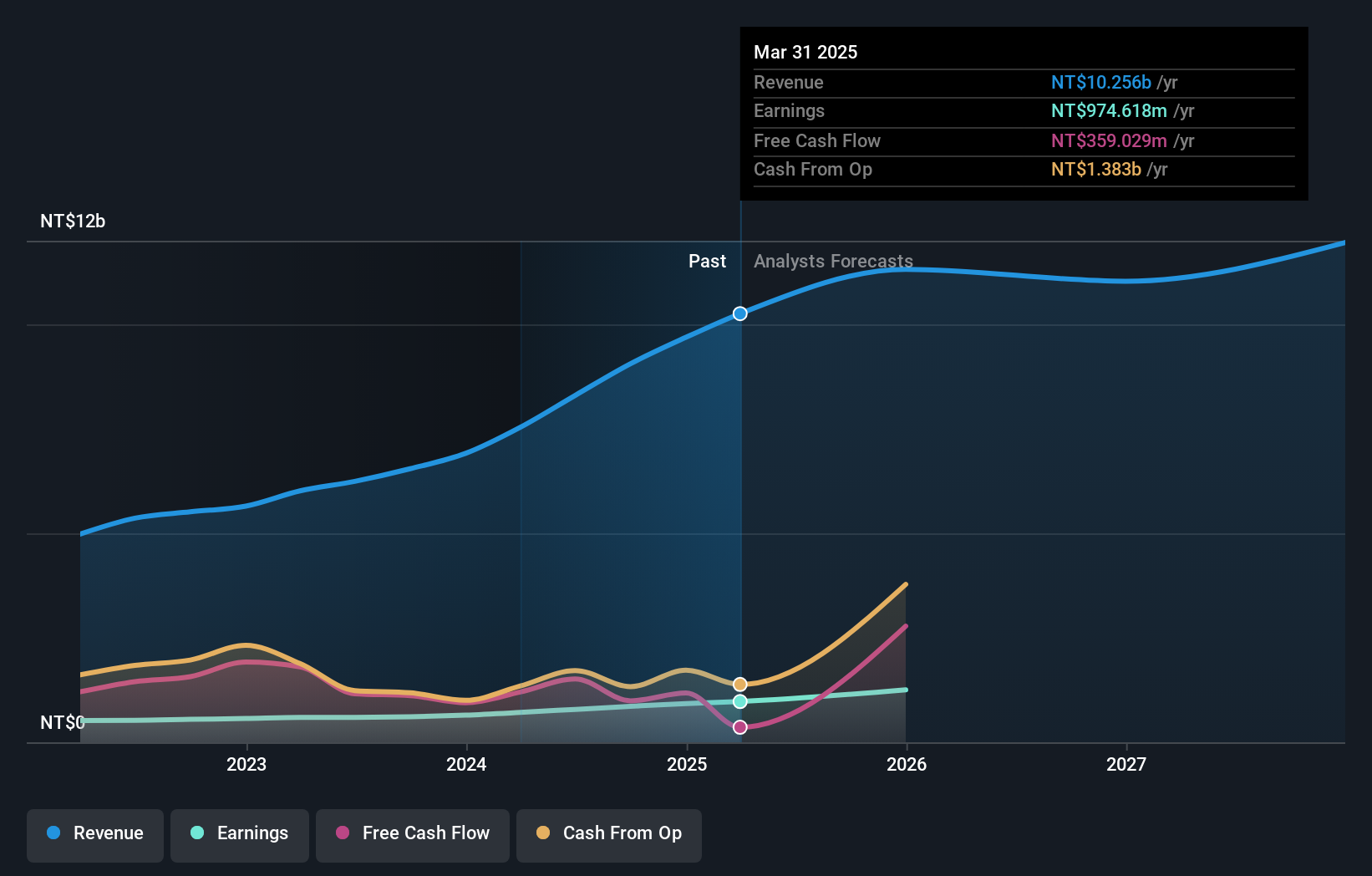

Operations: The company's revenue is derived from its involvement in the research, development, production, sale, and maintenance of process equipment across the semiconductor, LCD, LED, and solar power generation sectors.

Insider Ownership: 31.3%

Scientech's earnings are forecast to grow significantly at 50.4% annually, outpacing the market's 19.4% growth expectation. Revenue is projected to increase by 20.3% per year, exceeding the TW market's rate of 12.1%. Recent financial results show substantial growth with Q3 sales reaching TWD 2,415 million from TWD 1,692 million a year prior and net income rising to TWD 240.92 million from TWD 167.95 million, indicating robust performance without significant insider trading activity recently reported.

- Delve into the full analysis future growth report here for a deeper understanding of Scientech.

- In light of our recent valuation report, it seems possible that Scientech is trading beyond its estimated value.

Summing It All Up

- Click through to start exploring the rest of the 1511 Fast Growing Companies With High Insider Ownership now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600392

Shenghe Resources Holding

Engages in the research and development, production, and supply of rare earth and related products in China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives