- China

- /

- Auto Components

- /

- SZSE:300969

Undiscovered Gems To Explore In December 2024

Reviewed by Simply Wall St

As global markets continue to reach new heights, with the Russell 2000 Index hitting record intraday highs, small-cap stocks are capturing increased investor attention amid a backdrop of robust consumer spending and geopolitical developments. In this dynamic environment, identifying promising stocks involves looking for companies that exhibit resilience and potential for growth despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

NINGBO HENGSHUAI (SZSE:300969)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Hengshuai Co., Ltd. is a global manufacturer and seller of automotive micro-motors and components, with a market cap of CN¥6.92 billion.

Operations: The primary revenue stream for Ningbo Hengshuai comes from its Auto Parts & Accessories segment, generating CN¥965.11 million.

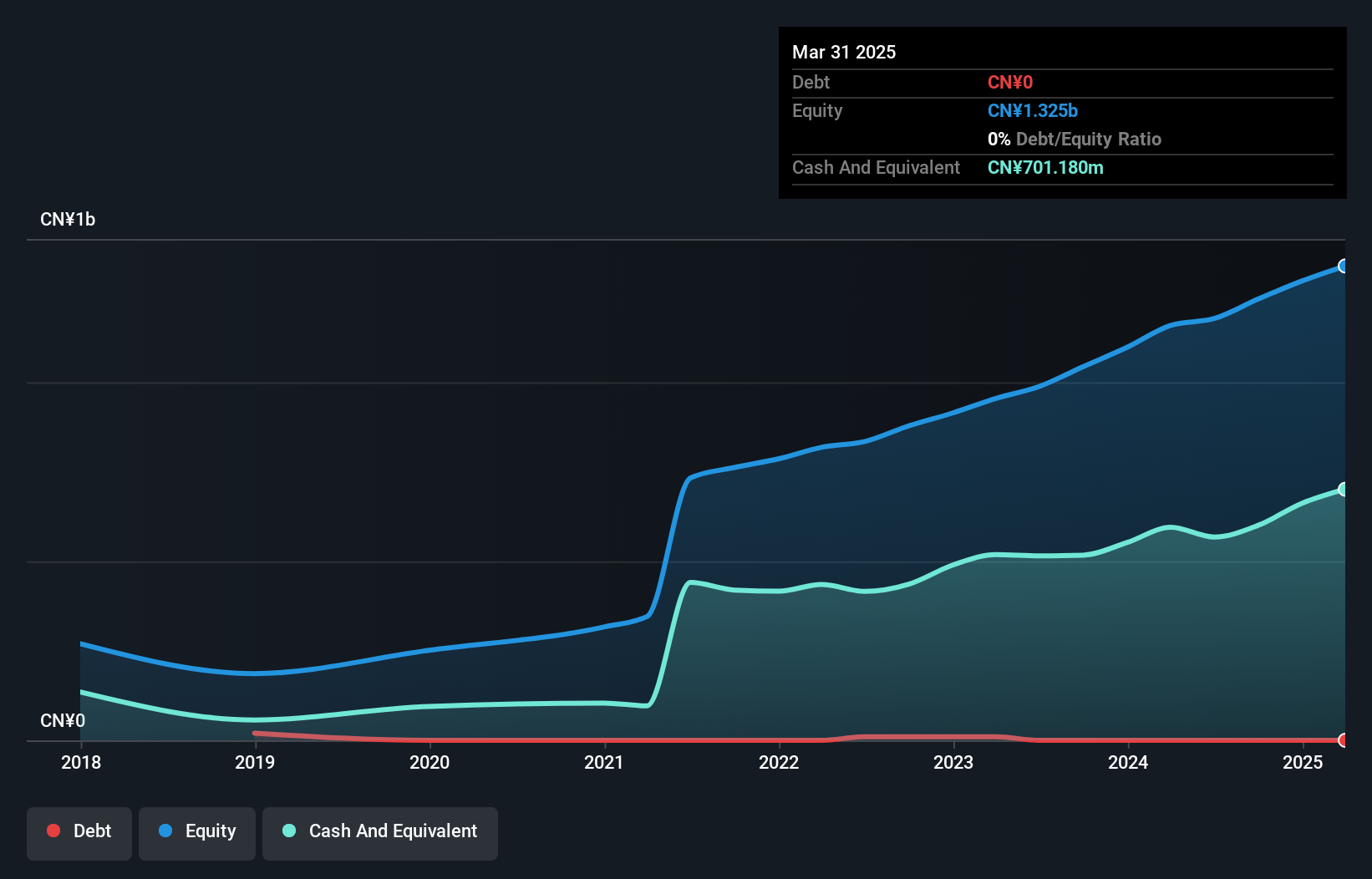

With a market capitalization that keeps it under the radar, Ningbo Hengshuai has demonstrated solid financial health and growth. Over the past year, earnings grew by 14.7%, outpacing the Auto Components industry at 10.5%. The company is debt-free, which enhances its financial stability and reduces interest payment concerns. Its price-to-earnings ratio of 31.5x remains attractive compared to the broader CN market's 36.7x, suggesting potential undervaluation. Recent results show sales climbing to CNY 704 million from CNY 662 million last year, with net income rising to CNY 163 million from CNY 150 million, reflecting robust operational performance amidst volatility in share prices over recent months.

- Delve into the full analysis health report here for a deeper understanding of NINGBO HENGSHUAI.

Understand NINGBO HENGSHUAI's track record by examining our Past report.

Xiamen East Asia Machinery Industrial (SZSE:301028)

Simply Wall St Value Rating: ★★★★★☆

Overview: Xiamen East Asia Machinery Industrial Co., Ltd. is a company engaged in the production and sale of machinery and industrial equipment, with a market capitalization of CN¥4.42 billion.

Operations: The company's primary revenue stream is from the sale of machinery and industrial equipment, totaling CN¥1.12 billion.

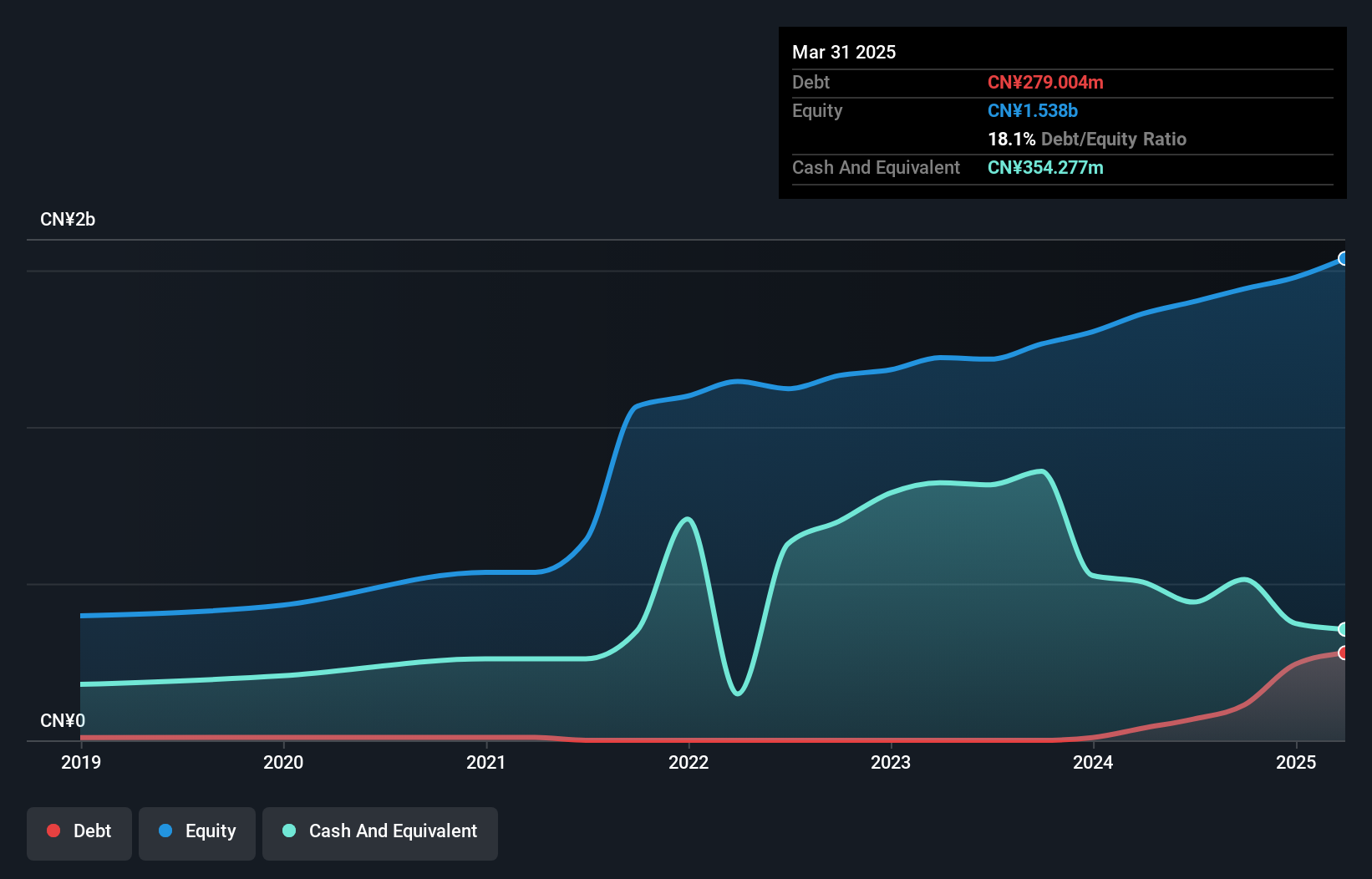

Xiamen East Asia Machinery Industrial seems to be an intriguing find in the machinery sector, with its earnings growth of 43% over the past year outpacing the industry average. The company reported a net income of CNY 183 million for the nine months ending September 2024, up from CNY 131 million in the prior year. Its price-to-earnings ratio stands at a favorable 20.6x compared to China's market average of 36.7x, suggesting potential value for investors. Additionally, it has more cash than debt and maintains positive free cash flow, indicating solid financial health and operational efficiency.

Logwin (XTRA:TGHN)

Simply Wall St Value Rating: ★★★★★★

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, Asia/Pacific, and internationally with a market capitalization of €714.05 million.

Operations: Logwin AG generates revenue primarily from its Air + Ocean segment, contributing €954.25 million, and the Solutions segment, which adds €275.78 million.

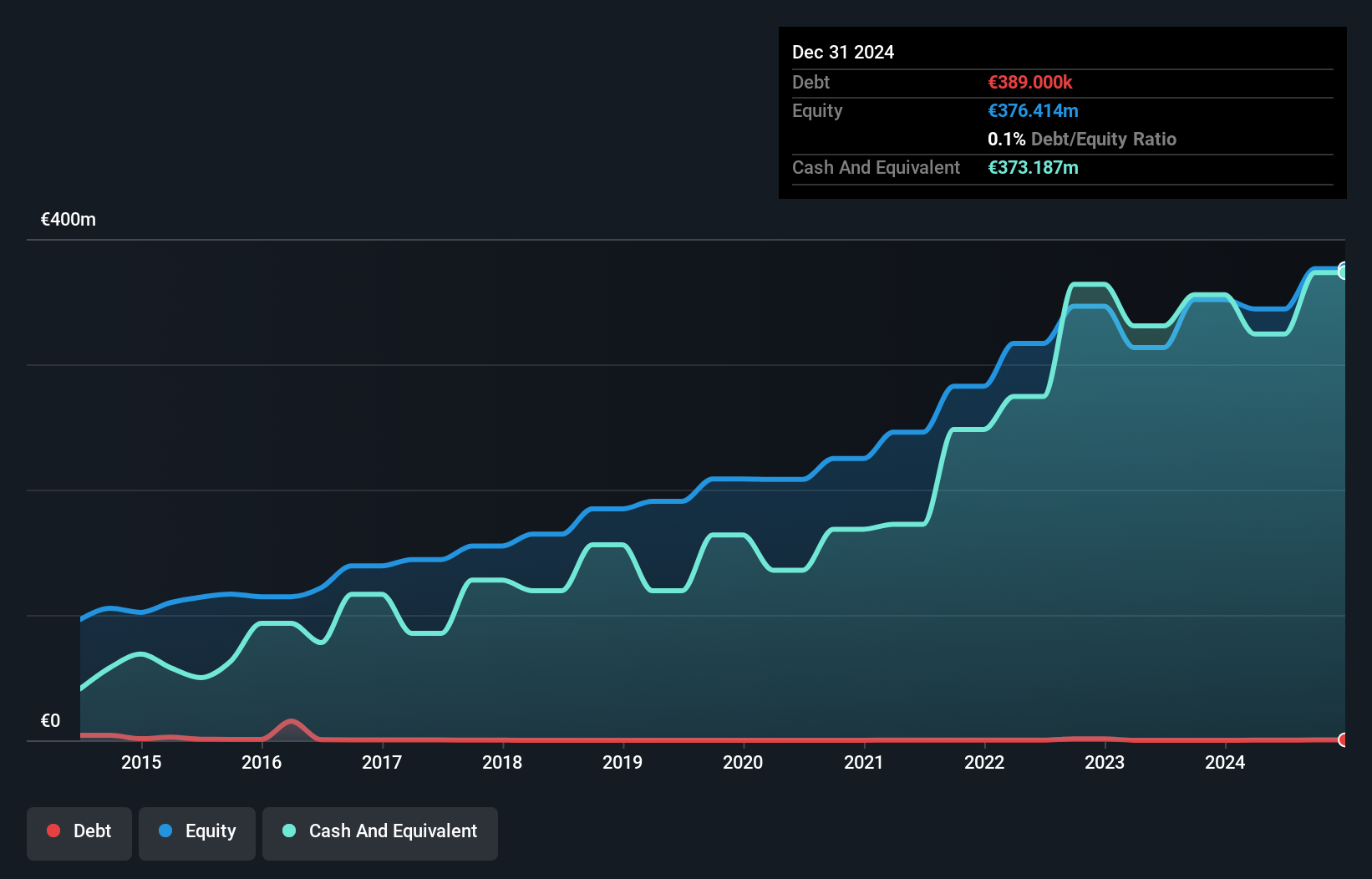

Logwin, a player in the logistics sector, offers an intriguing mix of strengths and challenges. The company trades at 31.6% below its estimated fair value, suggesting potential undervaluation. Despite having high-quality past earnings and positive free cash flow, Logwin's earnings growth has been negative at -2.2%, contrasting with the industry average of 11.3%. On a brighter note, their debt-to-equity ratio improved from 0.04% to 0.03% over five years, indicating prudent financial management with more cash on hand than total debt obligations. However, forecasts suggest an annual decline in earnings by 7.4% over the next three years.

- Dive into the specifics of Logwin here with our thorough health report.

Evaluate Logwin's historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 4640 Undiscovered Gems With Strong Fundamentals selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NINGBO HENGSHUAI might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300969

NINGBO HENGSHUAI

Ningbo Hengshuai Co., Ltd. manufactures and sells automotive micro-motors and components worldwide.

Flawless balance sheet with reasonable growth potential.