Is Chongqing Changan Automobile (SZSE:000625) A Risky Investment?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Chongqing Changan Automobile Company Limited (SZSE:000625) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Chongqing Changan Automobile

What Is Chongqing Changan Automobile's Debt?

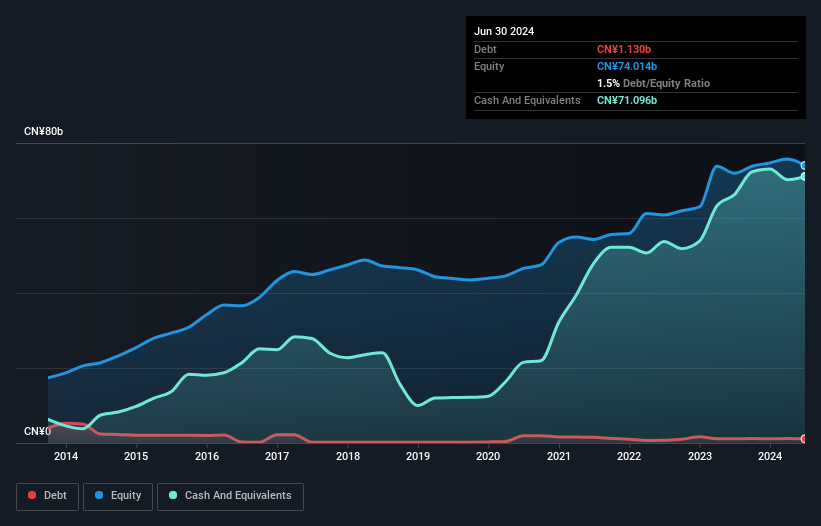

The chart below, which you can click on for greater detail, shows that Chongqing Changan Automobile had CN¥1.13b in debt in June 2024; about the same as the year before. But on the other hand it also has CN¥71.1b in cash, leading to a CN¥70.0b net cash position.

How Healthy Is Chongqing Changan Automobile's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Chongqing Changan Automobile had liabilities of CN¥100.2b due within 12 months and liabilities of CN¥13.1b due beyond that. Offsetting this, it had CN¥71.1b in cash and CN¥39.7b in receivables that were due within 12 months. So its liabilities total CN¥2.54b more than the combination of its cash and short-term receivables.

Of course, Chongqing Changan Automobile has a titanic market capitalization of CN¥101.2b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Chongqing Changan Automobile boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for Chongqing Changan Automobile if management cannot prevent a repeat of the 44% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Chongqing Changan Automobile can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Chongqing Changan Automobile may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Chongqing Changan Automobile actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that Chongqing Changan Automobile has CN¥70.0b in net cash. And it impressed us with free cash flow of CN¥13b, being 217% of its EBIT. So we don't have any problem with Chongqing Changan Automobile's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Chongqing Changan Automobile you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000625

Chongqing Changan Automobile

Manufactures and sells automobiles, automotive engines, supporting parts, and components in the People’s Republic of China.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives