- China

- /

- Auto Components

- /

- SHSE:688326

Beijing Jingwei Hirain Technologies Co., Inc. (SHSE:688326) Might Not Be As Mispriced As It Looks After Plunging 26%

Beijing Jingwei Hirain Technologies Co., Inc. (SHSE:688326) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 21% share price drop.

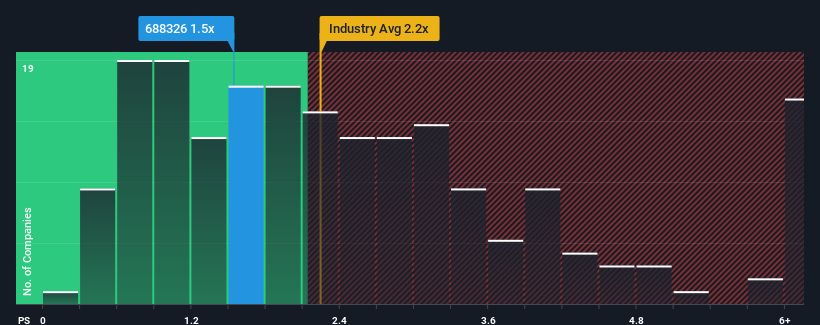

After such a large drop in price, considering around half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.2x, you may consider Beijing Jingwei Hirain Technologies as an solid investment opportunity with its 1.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Beijing Jingwei Hirain Technologies

What Does Beijing Jingwei Hirain Technologies' Recent Performance Look Like?

Recent times have been advantageous for Beijing Jingwei Hirain Technologies as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Beijing Jingwei Hirain Technologies' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Beijing Jingwei Hirain Technologies' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 28% gain to the company's top line. Pleasingly, revenue has also lifted 67% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 24%, which is not materially different.

With this in consideration, we find it intriguing that Beijing Jingwei Hirain Technologies' P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Beijing Jingwei Hirain Technologies' P/S

The southerly movements of Beijing Jingwei Hirain Technologies' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It looks to us like the P/S figures for Beijing Jingwei Hirain Technologies remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Beijing Jingwei Hirain Technologies with six simple checks.

If you're unsure about the strength of Beijing Jingwei Hirain Technologies' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingwei Hirain Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688326

Beijing Jingwei Hirain Technologies

Beijing Jingwei Hirain Technologies Co., Inc.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026