- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:2382

Asian Value Stock Picks That Could Be Overlooked In March 2025

Reviewed by Simply Wall St

As global markets grapple with tariff fears, inflation, and growth concerns, Asian indices have shown resilience amid the uncertainty. In this environment, identifying undervalued stocks requires a keen eye for companies with strong fundamentals and potential for growth despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIT (KOSDAQ:A110990) | ₩13940.00 | ₩27509.18 | 49.3% |

| Zhejiang Cfmoto PowerLtd (SHSE:603129) | CN¥174.40 | CN¥347.82 | 49.9% |

| Aidma Holdings (TSE:7373) | ¥1735.00 | ¥3423.39 | 49.3% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩423000.00 | ₩844530.73 | 49.9% |

| OPT Machine Vision Tech (SHSE:688686) | CN¥103.65 | CN¥204.49 | 49.3% |

| BalnibarbiLtd (TSE:3418) | ¥1104.00 | ¥2172.96 | 49.2% |

| Food & Life Companies (TSE:3563) | ¥4221.00 | ¥8305.97 | 49.2% |

| ASMPT (SEHK:522) | HK$58.15 | HK$115.96 | 49.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | HK$41.75 | HK$82.70 | 49.5% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15890.00 | ₩31552.20 | 49.6% |

Let's explore several standout options from the results in the screener.

Sunny Optical Technology (Group) (SEHK:2382)

Overview: Sunny Optical Technology (Group) Company Limited is an investment holding company involved in the design, research, development, manufacturing, and sale of optical and optical-related products as well as scientific instruments, with a market cap of approximately HK$98.52 billion.

Operations: The company's revenue is primarily derived from three segments: Optical Components (CN¥12.32 billion), Optoelectronic Products (CN¥25.10 billion), and Optical Instruments (CN¥587.78 million).

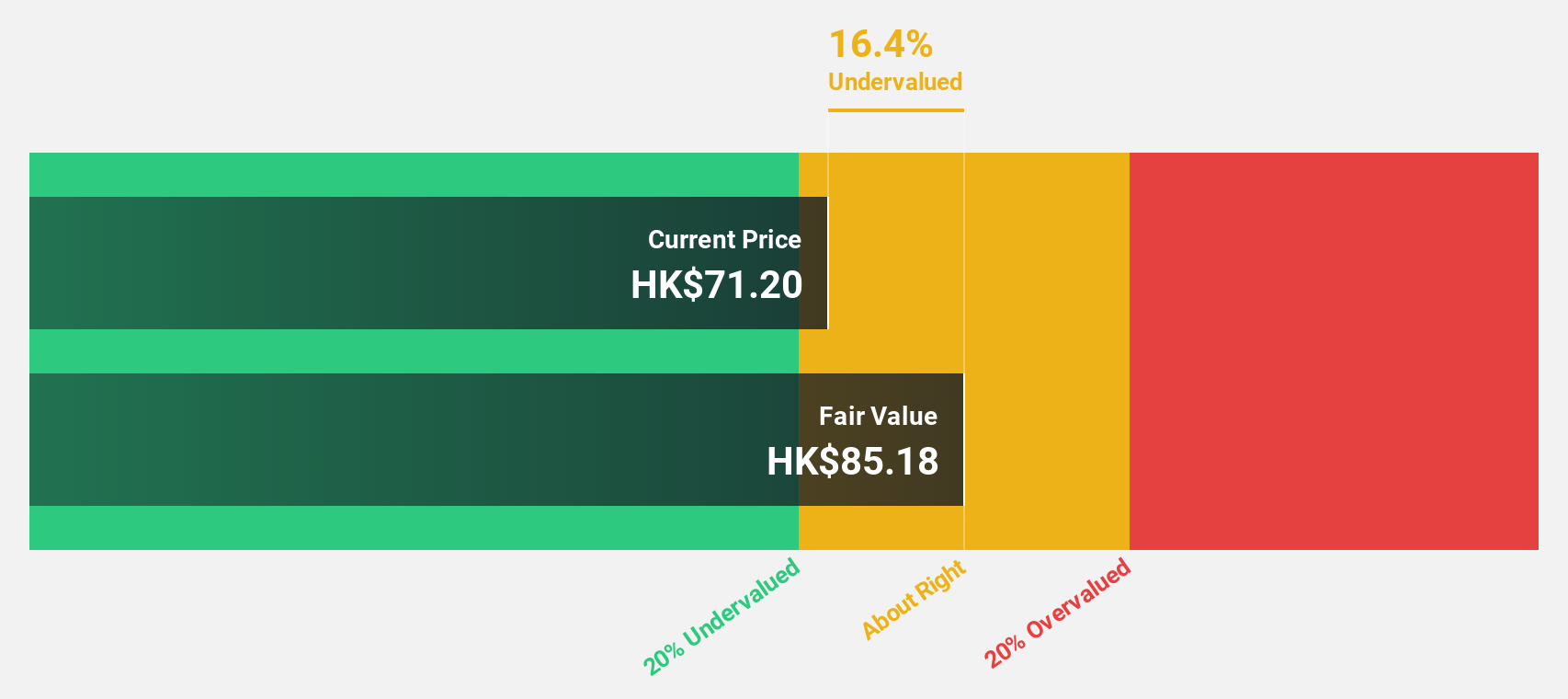

Estimated Discount To Fair Value: 47.2%

Sunny Optical Technology is trading at HK$90, significantly below its estimated fair value of HK$170.38, suggesting undervaluation based on discounted cash flow analysis. Earnings are forecast to grow 22.9% annually, outpacing the Hong Kong market's 11.6%. Recent guidance indicates a profit increase of approximately 140% to 150% for 2024 compared to the previous year. Despite a low forecasted return on equity of 13.4%, revenue growth remains faster than the market average.

- In light of our recent growth report, it seems possible that Sunny Optical Technology (Group)'s financial performance will exceed current levels.

- Dive into the specifics of Sunny Optical Technology (Group) here with our thorough financial health report.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD19.08 billion.

Operations: The company's revenue is derived from three primary segments: Commercial Aerospace (SGD4.44 billion), Urban Solutions & Satcom (SGD2.01 billion), and Defence & Public Security (SGD4.97 billion).

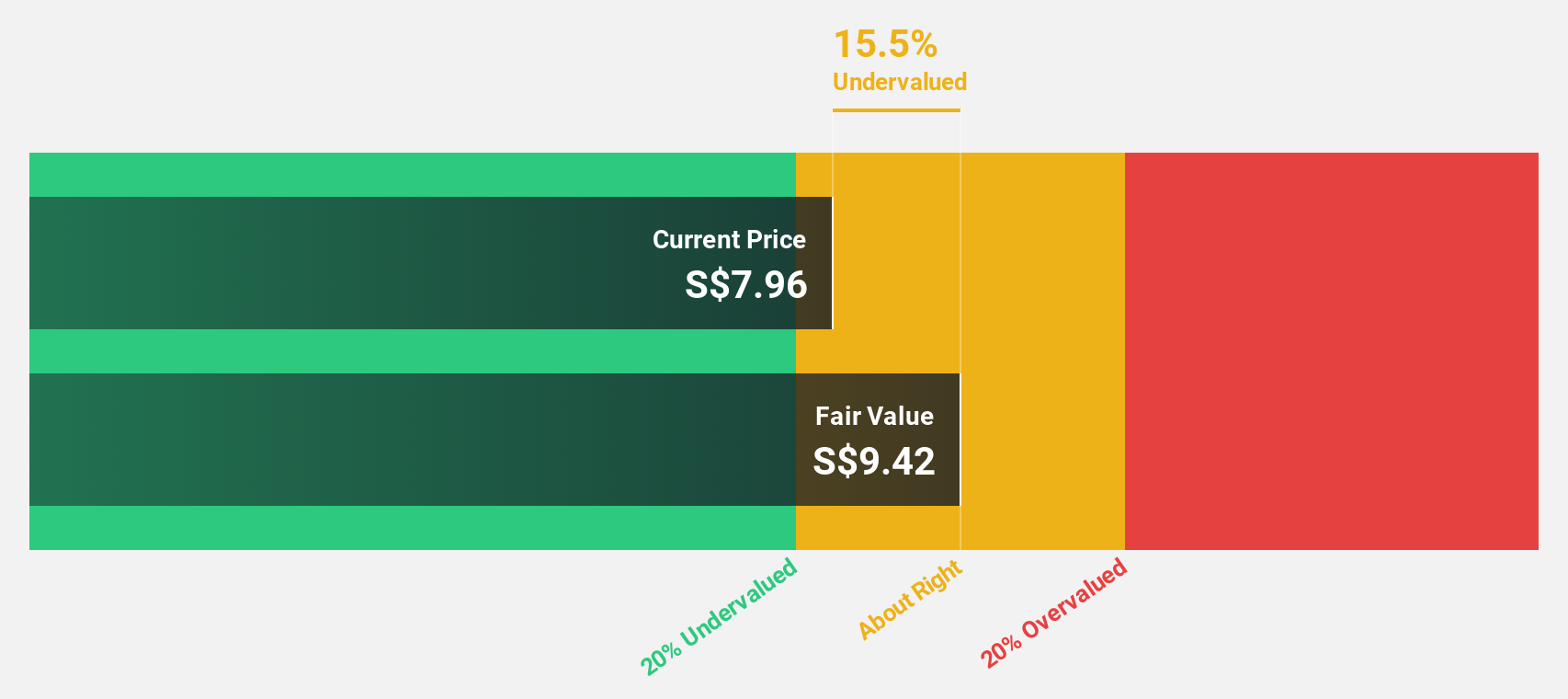

Estimated Discount To Fair Value: 21.6%

Singapore Technologies Engineering is trading at S$6.13, below its estimated fair value of S$7.82, highlighting undervaluation based on cash flow analysis. The company's earnings are expected to grow 10.8% annually, surpassing the Singapore market's 9.5%. Despite a high debt level and an unstable dividend track record, revenue growth is projected at 6.4% per year, faster than the local market's average of 4.1%. Recent earnings show sales rose to S$11.28 billion with net income increasing to S$702 million for 2024.

- Our earnings growth report unveils the potential for significant increases in Singapore Technologies Engineering's future results.

- Unlock comprehensive insights into our analysis of Singapore Technologies Engineering stock in this financial health report.

Kunshan Huguang Auto HarnessLtd (SHSE:605333)

Overview: Kunshan Huguang Auto Harness Co., Ltd. specializes in the research, development, production, and sales of automotive high and low voltage wiring harness assemblies both in China and internationally, with a market cap of CN¥16.89 billion.

Operations: Kunshan Huguang Auto Harness Co., Ltd. generates revenue through its focus on automotive high and low voltage wiring harness assembly products, serving both domestic and international markets.

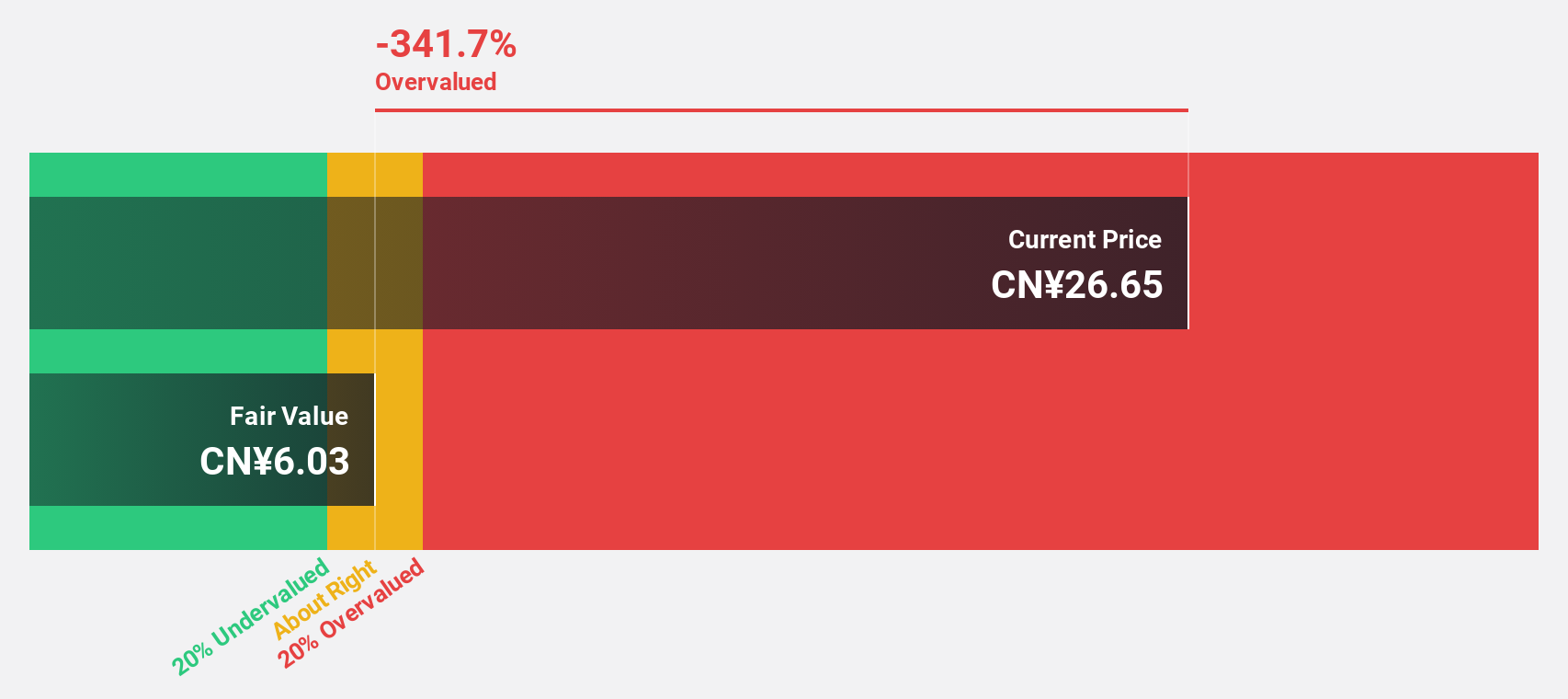

Estimated Discount To Fair Value: 11.6%

Kunshan Huguang Auto Harness Ltd. is trading at CN¥38.67, slightly below its fair value estimate of CN¥43.77, indicating some undervaluation based on cash flows. The company faces high debt but shows promising growth prospects with earnings expected to grow 30.93% annually, outpacing the Chinese market's average growth rate of 25.5%. Revenue is also forecasted to increase by 23.4% per year, surpassing the market's 13.3%.

- The analysis detailed in our Kunshan Huguang Auto HarnessLtd growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Kunshan Huguang Auto HarnessLtd's balance sheet health report.

Seize The Opportunity

- Unlock our comprehensive list of 283 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2382

Sunny Optical Technology (Group)

An investment holding company, engages in designing, researching, developing, manufacturing, and selling optical and optical related products, and scientific instruments.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives