- China

- /

- Auto Components

- /

- SHSE:605088

GSP Automotive Group Wenzhou Co.,Ltd.'s (SHSE:605088) Share Price Boosted 34% But Its Business Prospects Need A Lift Too

GSP Automotive Group Wenzhou Co.,Ltd. (SHSE:605088) shares have continued their recent momentum with a 34% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 17% is also fairly reasonable.

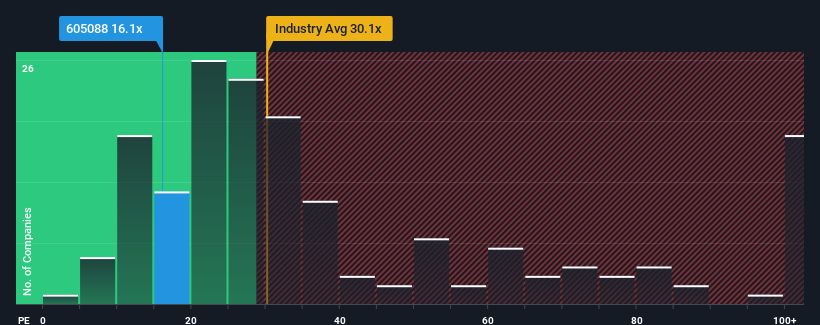

In spite of the firm bounce in price, GSP Automotive Group WenzhouLtd may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.1x, since almost half of all companies in China have P/E ratios greater than 36x and even P/E's higher than 70x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

GSP Automotive Group WenzhouLtd's negative earnings growth of late has neither been better nor worse than most other companies. One possibility is that the P/E is low because investors think the company's earnings may begin to slide even faster. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. At the very least, you'd be hoping that earnings don't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for GSP Automotive Group WenzhouLtd

How Is GSP Automotive Group WenzhouLtd's Growth Trending?

In order to justify its P/E ratio, GSP Automotive Group WenzhouLtd would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 2.1%. Still, the latest three year period has seen an excellent 156% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 19% over the next year. Meanwhile, the rest of the market is forecast to expand by 39%, which is noticeably more attractive.

In light of this, it's understandable that GSP Automotive Group WenzhouLtd's P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From GSP Automotive Group WenzhouLtd's P/E?

Shares in GSP Automotive Group WenzhouLtd are going to need a lot more upward momentum to get the company's P/E out of its slump. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that GSP Automotive Group WenzhouLtd maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for GSP Automotive Group WenzhouLtd (1 can't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on GSP Automotive Group WenzhouLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:605088

GSP Automotive Group WenzhouLtd

Researches, develops, and sells automobile chassis systems in China, Europe, North America, South America, Asia, Oceania, and Africa.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026