- China

- /

- Auto Components

- /

- SHSE:603809

Chengdu Haoneng Technology Co., Ltd. (SHSE:603809) Looks Just Right With A 27% Price Jump

Despite an already strong run, Chengdu Haoneng Technology Co., Ltd. (SHSE:603809) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 197% following the latest surge, making investors sit up and take notice.

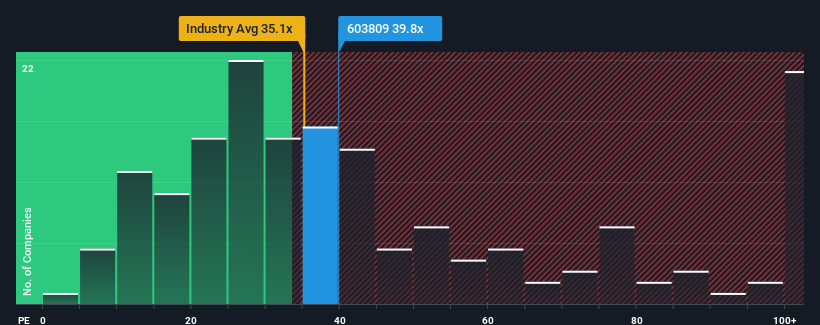

Although its price has surged higher, it's still not a stretch to say that Chengdu Haoneng Technology's price-to-earnings (or "P/E") ratio of 39.8x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 37x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Chengdu Haoneng Technology as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Chengdu Haoneng Technology

How Is Chengdu Haoneng Technology's Growth Trending?

The only time you'd be comfortable seeing a P/E like Chengdu Haoneng Technology's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. The latest three year period has also seen a 16% overall rise in EPS, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 35% over the next year. Meanwhile, the rest of the market is forecast to expand by 37%, which is not materially different.

In light of this, it's understandable that Chengdu Haoneng Technology's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

Its shares have lifted substantially and now Chengdu Haoneng Technology's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Chengdu Haoneng Technology's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Chengdu Haoneng Technology, and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Chengdu Haoneng Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603809

Chengdu Haoneng Technology

Engages in the research, development, production, and sale of automotive transmission system components in China and internationally.

Solid track record and good value.

Market Insights

Community Narratives