- China

- /

- Auto Components

- /

- SHSE:603786

Insider-Led Growth Companies To Watch Now

Reviewed by Simply Wall St

As global markets respond to China's robust stimulus measures, with U.S. stocks reaching record highs and technology sectors outperforming, investors are keenly observing the influence of insider ownership on growth companies. In such a buoyant market environment, companies where insiders hold significant stakes often signal confidence in the business's potential, making them intriguing prospects for those looking to align with leadership that has a vested interest in long-term success.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 100.3% |

Let's explore several standout options from the results in the screener.

Shanghai Aiko Solar EnergyLtd (SHSE:600732)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai Aiko Solar Energy Co., Ltd. specializes in the research, manufacture, and sale of crystalline silicon solar cells and has a market capitalization of approximately CN¥18.59 billion.

Operations: Shanghai Aiko Solar Energy Co., Ltd. generates revenue from its research, manufacturing, and sales activities focused on crystalline silicon solar cells.

Insider Ownership: 18.2%

Earnings Growth Forecast: 103% p.a.

Shanghai Aiko Solar Energy Ltd. faces challenges with recent earnings showing a net loss of CNY 1.74 billion, contrasting last year's profit. Despite this, the company is trading significantly below its estimated fair value and is expected to achieve substantial revenue growth of 42.5% annually, outpacing the broader Chinese market. While profitability is anticipated within three years, current debt levels are not well covered by operating cash flow, indicating financial vulnerabilities despite promising growth forecasts.

- Navigate through the intricacies of Shanghai Aiko Solar EnergyLtd with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Shanghai Aiko Solar EnergyLtd shares in the market.

KEBODA TECHNOLOGY (SHSE:603786)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KEBODA TECHNOLOGY Co., Ltd. manufactures and sells automotive electronics and related products for the automotive industry in China, with a market cap of CN¥24.58 billion.

Operations: KEBODA TECHNOLOGY Co., Ltd.'s revenue primarily comes from the manufacture and sale of automotive electronics and related products within China's automotive sector.

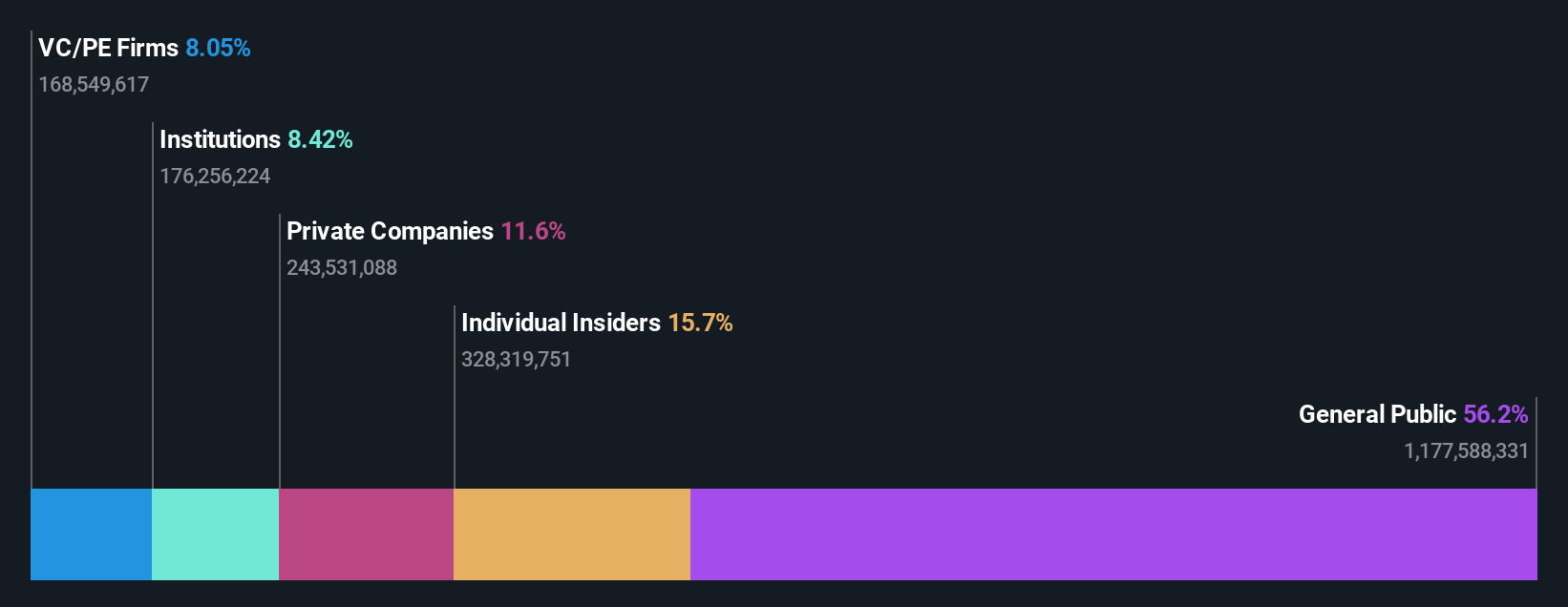

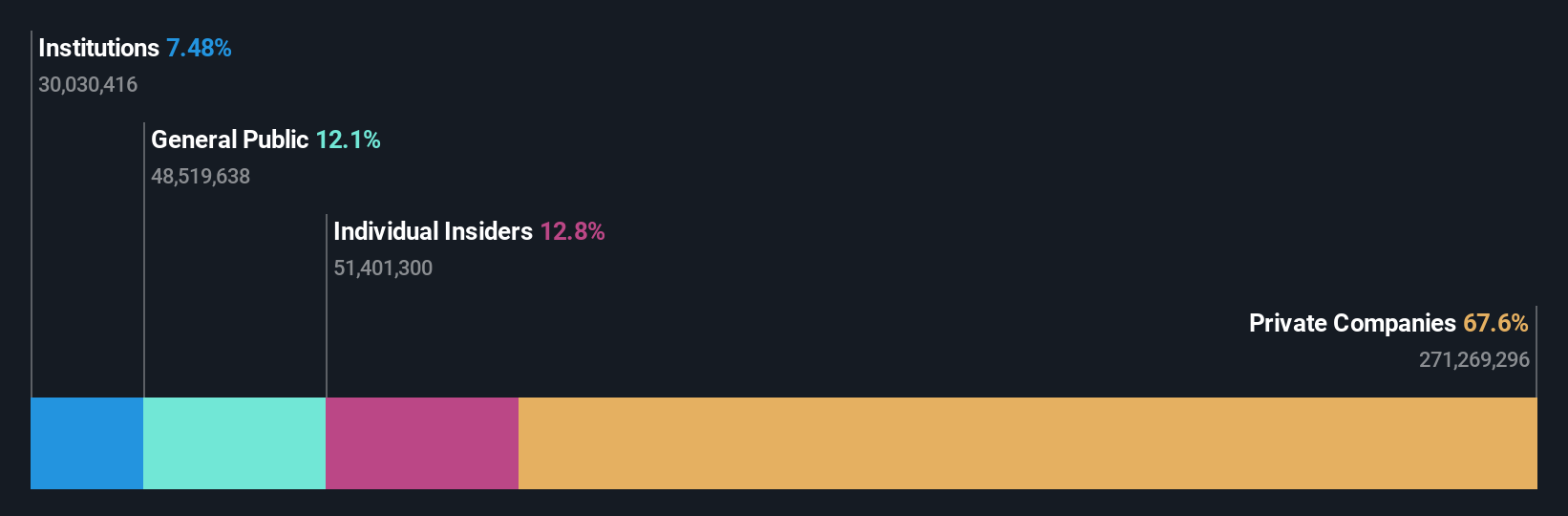

Insider Ownership: 12.8%

Earnings Growth Forecast: 26.3% p.a.

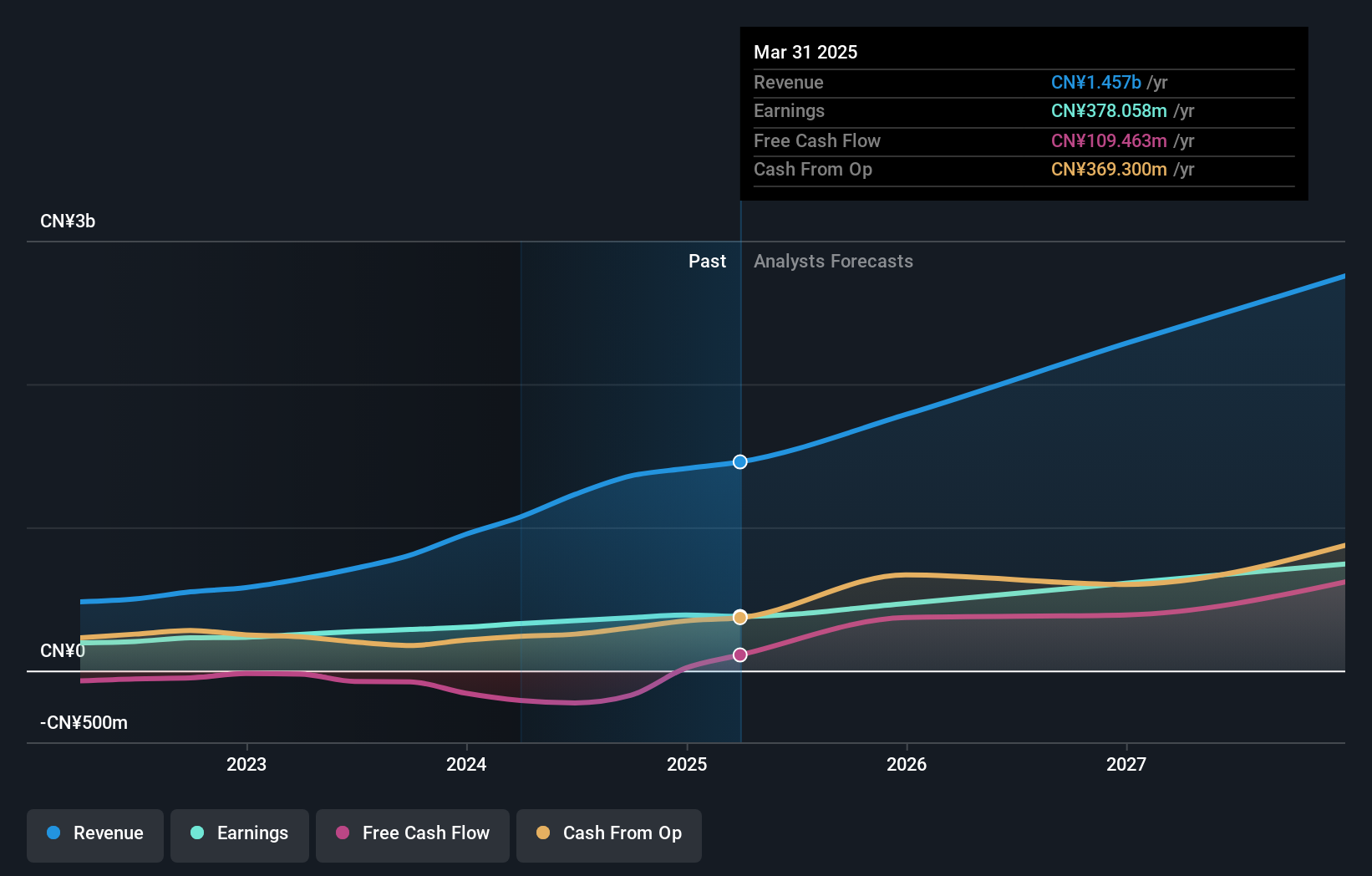

KEBODA TECHNOLOGY has demonstrated strong growth, with recent earnings showing a net income increase to CNY 371.57 million for the half-year ended June 2024. Revenue grew significantly by 33.9% year-over-year, and future revenue is forecasted to grow at 21.8% annually, surpassing the Chinese market average of 13.2%. Although insider ownership details are limited, the company's earnings are expected to grow significantly over the next three years, indicating robust growth potential despite a low dividend coverage by free cash flows.

- Take a closer look at KEBODA TECHNOLOGY's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, KEBODA TECHNOLOGY's share price might be too optimistic.

Eyebright Medical Technology (Beijing) (SHSE:688050)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. specializes in developing and manufacturing ophthalmic medical devices, with a market cap of CN¥18.84 billion.

Operations: The company's revenue is primarily generated from its Medical Products segment, which amounts to CN¥1.51 billion.

Insider Ownership: 21.5%

Earnings Growth Forecast: 28.1% p.a.

Eyebright Medical Technology (Beijing) shows significant growth potential, with half-year revenue rising to CNY 685.72 million and net income increasing to CNY 208.04 million. The company's earnings are forecasted to grow over 28% annually, outpacing the Chinese market average of 23.2%. Despite its volatile share price and low future return on equity, it trades at a discount to estimated fair value, indicating room for appreciation amidst strong insider ownership dynamics.

- Click here and access our complete growth analysis report to understand the dynamics of Eyebright Medical Technology (Beijing).

- Our expertly prepared valuation report Eyebright Medical Technology (Beijing) implies its share price may be too high.

Taking Advantage

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1508 more companies for you to explore.Click here to unveil our expertly curated list of 1511 Fast Growing Companies With High Insider Ownership.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if KEBODA TECHNOLOGY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603786

KEBODA TECHNOLOGY

Engages in the manufacture and sale of automotive electronics and related products for automotive industry in China.

Flawless balance sheet with high growth potential.