Global Equity Opportunities: 3 Stocks That May Be Trading At A Discount In August 2025

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by potential interest rate cuts and fluctuating economic indicators, investors are keenly observing sectors that exhibit resilience amid these shifts. In this context, identifying undervalued stocks can offer strategic opportunities, especially when they demonstrate strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥82.73 | CN¥165.09 | 49.9% |

| Winning Health Technology Group (SZSE:300253) | CN¥10.38 | CN¥20.62 | 49.7% |

| Suzumo Machinery (TSE:6405) | ¥1613.00 | ¥3201.11 | 49.6% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.485 | SGD0.97 | 49.8% |

| Norconsult (OB:NORCO) | NOK45.55 | NOK90.57 | 49.7% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.94 | 49.6% |

| Honkarakenne Oyj (HLSE:HONBS) | €2.80 | €5.59 | 49.9% |

| Canatu Oyj (HLSE:CANATU) | €8.98 | €17.84 | 49.7% |

| Camurus (OM:CAMX) | SEK713.00 | SEK1416.78 | 49.7% |

| Apotea (OM:APOTEA) | SEK105.26 | SEK209.15 | 49.7% |

Let's review some notable picks from our screened stocks.

Chongqing Qianli Technology (SHSE:601777)

Overview: Chongqing Qianli Technology Co., Ltd. is involved in the research, development, production, and sale of automobiles, motorcycles, engines, and general machinery both in China and internationally with a market cap of CN¥49.42 billion.

Operations: Chongqing Qianli Technology generates its revenue through the research, development, production, and sale of automobiles, motorcycles, engines, and general machinery across domestic and international markets.

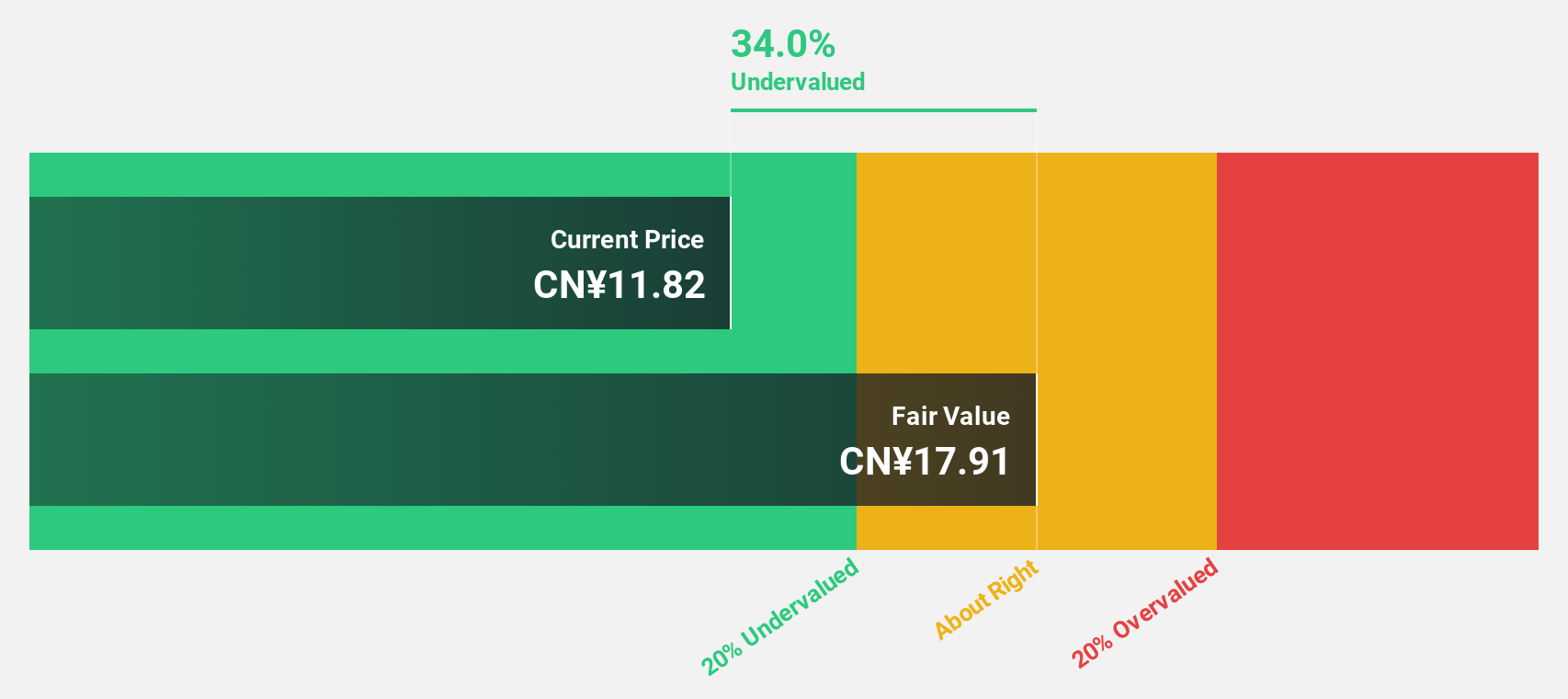

Estimated Discount To Fair Value: 35%

Chongqing Qianli Technology is trading at CN¥11.57, significantly below its estimated fair value of CN¥17.8, highlighting potential undervaluation based on discounted cash flow analysis. The company's earnings are projected to grow substantially at 60% annually over the next three years, outpacing the broader Chinese market's expected growth rate. Despite recent earnings showing modest net income improvement, large one-off items have impacted financial results and return on equity remains low.

- The growth report we've compiled suggests that Chongqing Qianli Technology's future prospects could be on the up.

- Get an in-depth perspective on Chongqing Qianli Technology's balance sheet by reading our health report here.

Suzhou Dongshan Precision Manufacturing (SZSE:002384)

Overview: Suzhou Dongshan Precision Manufacturing Co., Ltd. operates in the precision manufacturing industry and has a market cap of CN¥100.98 billion.

Operations: Suzhou Dongshan Precision Manufacturing's revenue segments are not specified in the provided text.

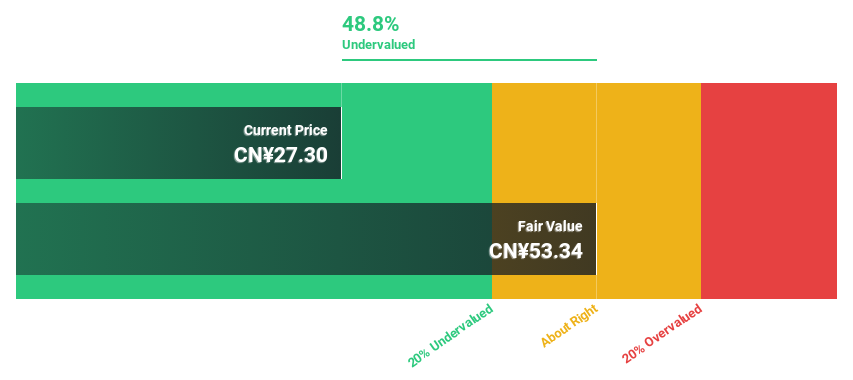

Estimated Discount To Fair Value: 24.8%

Suzhou Dongshan Precision Manufacturing is trading at CN¥60.94, well below its estimated fair value of CN¥81.06, indicating potential undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow significantly at 44.4% annually, surpassing the Chinese market's growth rate. Recent earnings reports show solid performance with net income rising to CN¥758 million from CN¥560.6 million a year ago, although share price volatility remains a concern for investors.

- Insights from our recent growth report point to a promising forecast for Suzhou Dongshan Precision Manufacturing's business outlook.

- Take a closer look at Suzhou Dongshan Precision Manufacturing's balance sheet health here in our report.

Nan Ya Printed Circuit Board (TWSE:8046)

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards (PCBs) across Taiwan, the United States, Mainland China, Korea, and internationally, with a market cap of NT$132.79 billion.

Operations: The company generates revenue from several segments, including NT$14.24 billion from Asia, NT$30.74 million from America, and NT$25.05 billion domestically.

Estimated Discount To Fair Value: 46.3%

Nan Ya Printed Circuit Board is trading at NT$226, significantly below its estimated fair value of NT$421.1, highlighting potential undervaluation based on discounted cash flow analysis. Despite recent volatility and a net loss of TWD 187.43 million in Q2 2025, earnings are projected to grow substantially at 80.2% annually, outpacing the Taiwan market's growth rate. However, profit margins have declined from last year and remain a concern for investors seeking stability.

- Upon reviewing our latest growth report, Nan Ya Printed Circuit Board's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Nan Ya Printed Circuit Board's balance sheet health report.

Make It Happen

- Gain an insight into the universe of 518 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601777

Chongqing Afari Technology

Engages in the manufacturing and sale of automobiles and motorcycles in China and internationally.

Reasonable growth potential with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026