- China

- /

- Auto Components

- /

- SHSE:601689

There's Reason For Concern Over Ningbo Tuopu Group Co.,Ltd.'s (SHSE:601689) Massive 27% Price Jump

Those holding Ningbo Tuopu Group Co.,Ltd. (SHSE:601689) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 2.4% over the last year.

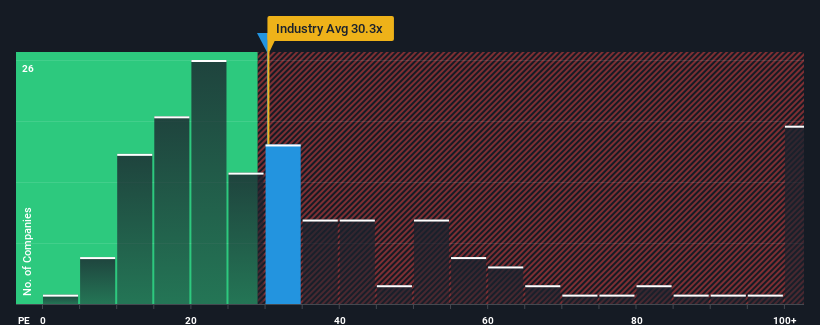

Although its price has surged higher, it's still not a stretch to say that Ningbo Tuopu GroupLtd's price-to-earnings (or "P/E") ratio of 30.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 30x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Ningbo Tuopu GroupLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Check out our latest analysis for Ningbo Tuopu GroupLtd

Is There Some Growth For Ningbo Tuopu GroupLtd?

Ningbo Tuopu GroupLtd's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Retrospectively, the last year delivered an exceptional 41% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 295% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 31% as estimated by the analysts watching the company. With the market predicted to deliver 41% growth , the company is positioned for a weaker earnings result.

In light of this, it's curious that Ningbo Tuopu GroupLtd's P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Ningbo Tuopu GroupLtd's P/E?

Its shares have lifted substantially and now Ningbo Tuopu GroupLtd's P/E is also back up to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Ningbo Tuopu GroupLtd currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Plus, you should also learn about these 2 warning signs we've spotted with Ningbo Tuopu GroupLtd (including 1 which is a bit concerning).

If you're unsure about the strength of Ningbo Tuopu GroupLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Tuopu GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601689

Ningbo Tuopu GroupLtd

Engages in the research and development, production, and sale of auto parts in China and internationally.

Excellent balance sheet with reasonable growth potential.