- China

- /

- Auto Components

- /

- SHSE:600741

The Returns On Capital At HUAYU Automotive Systems (SHSE:600741) Don't Inspire Confidence

When researching a stock for investment, what can tell us that the company is in decline? Typically, we'll see the trend of both return on capital employed (ROCE) declining and this usually coincides with a decreasing amount of capital employed. Ultimately this means that the company is earning less per dollar invested and on top of that, it's shrinking its base of capital employed. So after we looked into HUAYU Automotive Systems (SHSE:600741), the trends above didn't look too great.

What Is Return On Capital Employed (ROCE)?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on HUAYU Automotive Systems is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.071 = CN¥5.0b ÷ (CN¥171b - CN¥100b) (Based on the trailing twelve months to September 2023).

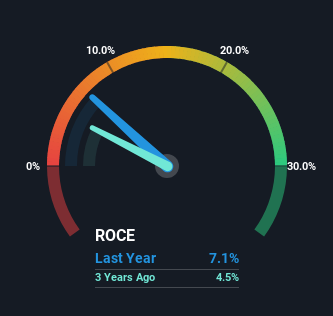

So, HUAYU Automotive Systems has an ROCE of 7.1%. In absolute terms, that's a low return, but it's much better than the Auto Components industry average of 5.8%.

Check out our latest analysis for HUAYU Automotive Systems

In the above chart we have measured HUAYU Automotive Systems' prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering HUAYU Automotive Systems for free.

What Does the ROCE Trend For HUAYU Automotive Systems Tell Us?

There is reason to be cautious about HUAYU Automotive Systems, given the returns are trending downwards. Unfortunately the returns on capital have diminished from the 10% that they were earning five years ago. Meanwhile, capital employed in the business has stayed roughly the flat over the period. Companies that exhibit these attributes tend to not be shrinking, but they can be mature and facing pressure on their margins from competition. If these trends continue, we wouldn't expect HUAYU Automotive Systems to turn into a multi-bagger.

On a side note, HUAYU Automotive Systems' current liabilities are still rather high at 59% of total assets. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. While it's not necessarily a bad thing, it can be beneficial if this ratio is lower.

In Conclusion...

All in all, the lower returns from the same amount of capital employed aren't exactly signs of a compounding machine. And long term shareholders have watched their investments stay flat over the last five years. That being the case, unless the underlying trends revert to a more positive trajectory, we'd consider looking elsewhere.

If you're still interested in HUAYU Automotive Systems it's worth checking out our FREE intrinsic value approximation for 600741 to see if it's trading at an attractive price in other respects.

While HUAYU Automotive Systems may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if HUAYU Automotive Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600741

HUAYU Automotive Systems

Researches and develops, manufactures, and sells automotive parts worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives