- Chile

- /

- Electric Utilities

- /

- SNSE:ENELCHILE

Investors in Enel Chile (SNSE:ENELCHILE) have made a favorable return of 61% over the past year

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. For example, the Enel Chile S.A. (SNSE:ENELCHILE) share price is up 58% in the last 1 year, clearly besting the market return of around 7.0% (not including dividends). So that should have shareholders smiling. Zooming out, the stock is actually down 38% in the last three years.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Enel Chile

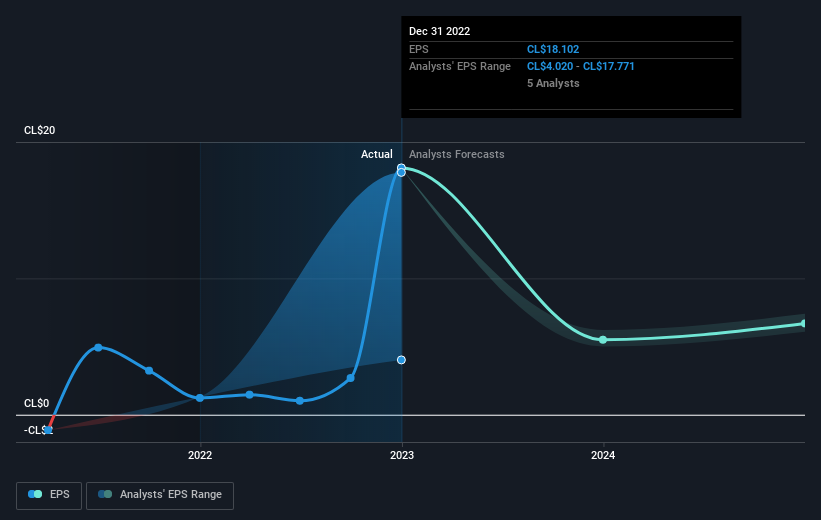

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Enel Chile boasted truly magnificent EPS growth in the last year. This remarkable growth rate may not be sustainable, but it is still impressive. So we'd expect to see the share price higher. Strong growth like this can be evidence of a fundamental inflection point in the business, making it a good time to investigate the stock more closely.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Enel Chile has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Enel Chile's financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Enel Chile's TSR for the last 1 year was 61%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Enel Chile shareholders have received a total shareholder return of 61% over one year. And that does include the dividend. There's no doubt those recent returns are much better than the TSR loss of 7% per year over five years. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for Enel Chile you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enel Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ENELCHILE

Enel Chile

An electricity utility company, engages in the generation, transmission, and distribution of electricity in Chile.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026