- Chile

- /

- Electric Utilities

- /

- SNSE:ENELCHILE

Enel Chile's (SNSE:ENELCHILE) 640% YoY earnings expansion surpassed the shareholder returns over the past year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. For example, the Enel Chile S.A. (SNSE:ENELCHILE) share price is up 54% in the last 1 year, clearly besting the market return of around 12% (not including dividends). That's a solid performance by our standards! However, the stock hasn't done so well in the longer term, with the stock only up 3.7% in three years.

Since it's been a strong week for Enel Chile shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Enel Chile

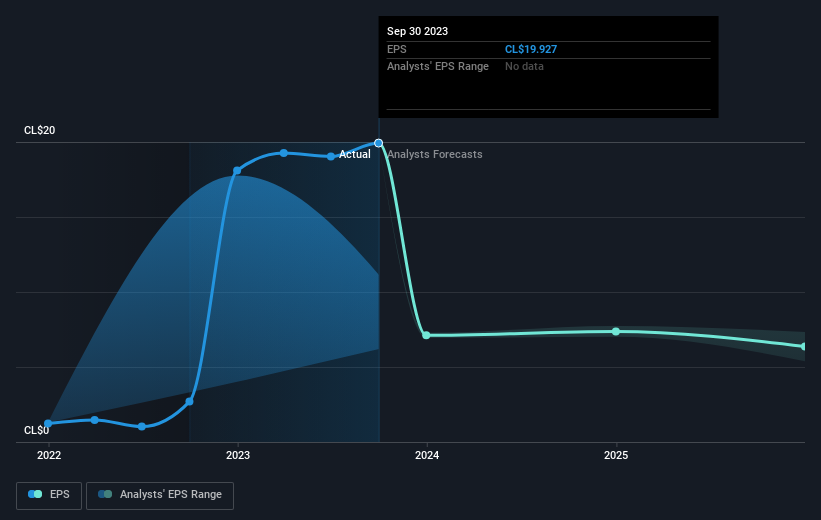

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Enel Chile boasted truly magnificent EPS growth in the last year. This remarkable growth rate may not be sustainable, but it is still impressive. We are not surprised the share price is up. To us, inflection points like this are the best time to take a close look at a stock.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Enel Chile has improved its bottom line over the last three years, but what does the future have in store? Take a more thorough look at Enel Chile's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Enel Chile's TSR for the last 1 year was 74%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Enel Chile shareholders have received a total shareholder return of 74% over the last year. That's including the dividend. That gain is better than the annual TSR over five years, which is 4%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Enel Chile better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Enel Chile you should be aware of, and 1 of them is a bit concerning.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chilean exchanges.

If you're looking to trade Enel Chile, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Enel Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ENELCHILE

Enel Chile

An electricity utility company, engages in the generation, transmission, and distribution of electricity in Chile.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives