- Chile

- /

- Electric Utilities

- /

- SNSE:ECL

If You Had Bought Engie Energia Chile's (SNSE:ECL) Shares Three Years Ago You Would Be Down 34%

Many investors define successful investing as beating the market average over the long term. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Engie Energia Chile S.A. (SNSE:ECL) shareholders have had that experience, with the share price dropping 34% in three years, versus a market decline of about 17%. And the ride hasn't got any smoother in recent times over the last year, with the price 25% lower in that time. It's up 2.0% in the last seven days.

Check out our latest analysis for Engie Energia Chile

While Engie Energia Chile made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years, Engie Energia Chile saw its revenue grow by 11% per year, compound. That's a fairly respectable growth rate. Shareholders have endured a share price decline of 10% per year. This implies the market had higher expectations of Engie Energia Chile. With revenue growing at a solid clip, now might be the time to focus on the possibility that it will have a brighter future.

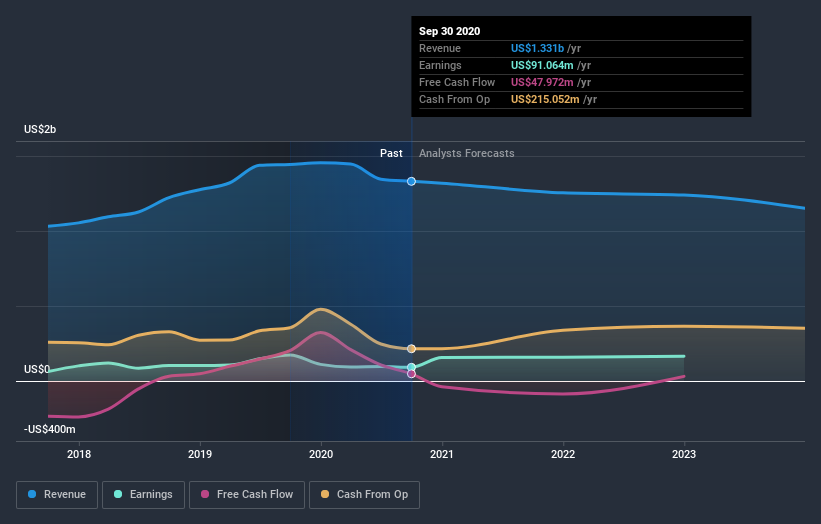

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Engie Energia Chile stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Engie Energia Chile, it has a TSR of -23% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 4.8% in the twelve months, Engie Energia Chile shareholders did even worse, losing 20% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 3% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 4 warning signs for Engie Energia Chile you should be aware of.

We will like Engie Energia Chile better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

If you’re looking to trade Engie Energia Chile, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Engie Energia Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:ECL

Engie Energia Chile

Engages in the generation, transmission, and supply of electricity primarily in Chile and Argentina.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives