- Chile

- /

- Renewable Energy

- /

- SNSE:COLBUN

New Forecasts: Here's What Analysts Think The Future Holds For Colbún S.A. (SNSE:COLBUN)

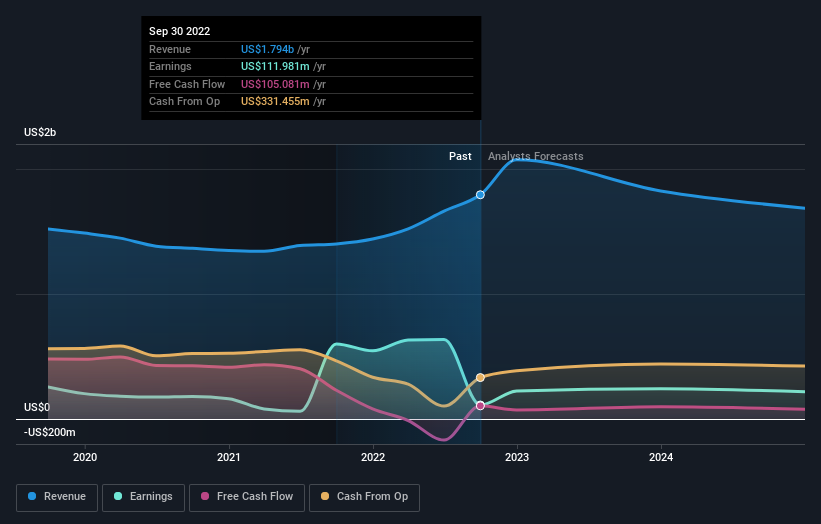

Colbún S.A. (SNSE:COLBUN) shareholders will have a reason to smile today, with the analysts making substantial upgrades to next year's forecasts. The analysts have sharply increased their revenue numbers, with a view that Colbún will make substantially more sales than they'd previously expected.

Following the latest upgrade, Colbún's six analysts currently expect revenues in 2023 to be US$1.8b, approximately in line with the last 12 months. Per-share earnings are expected to surge 94% to US$0.012. Prior to this update, the analysts had been forecasting revenues of US$1.6b and earnings per share (EPS) of US$0.012 in 2023. Sentiment certainly seems to have improved in recent times, with a nice increase in revenue and a small increase to earnings per share estimates.

Check out our latest analysis for Colbún

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of US$0.11, suggesting that the forecast performance does not have a long term impact on the company's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Colbún, with the most bullish analyst valuing it at US$114 and the most bearish at US$86.19 per share. As you can see the range of estimates is wide, with the lowest valuation coming in at less than half the most bullish estimate, suggesting there are some strongly diverging views on how think this business will perform. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. From these estimates it looks as though the analysts expect the years of declining sales to come to an end, given the flat revenue forecast out to 2023. That would be a definite improvement, given that the past five years have seen sales shrink 0.2% annually. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenue grow 3.8% per year. Although Colbún's revenues are expected to improve, it seems that it is still expected to grow slower than the wider industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for next year, expecting improving business conditions. Pleasantly, analysts also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Given that analysts appear to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Colbún.

Analysts are clearly in love with Colbún at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as its declining profit margins. For more information, you can click through to our platform to learn more about this and the 2 other concerns we've identified .

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:COLBUN

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion