- Chile

- /

- Wireless Telecom

- /

- SNSE:ALMENDRAL

Investors Will Want Almendral's (SNSE:ALMENDRAL) Growth In ROCE To Persist

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, Almendral (SNSE:ALMENDRAL) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What is it?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Almendral, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.054 = CL$233b ÷ (CL$5.2t - CL$854b) (Based on the trailing twelve months to June 2021).

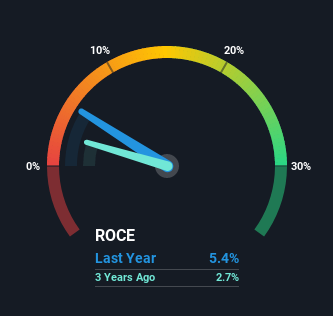

Thus, Almendral has an ROCE of 5.4%. In absolute terms, that's a low return and it also under-performs the Wireless Telecom industry average of 8.8%.

See our latest analysis for Almendral

Historical performance is a great place to start when researching a stock so above you can see the gauge for Almendral's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Almendral, check out these free graphs here.

The Trend Of ROCE

Even though ROCE is still low in absolute terms, it's good to see it's heading in the right direction. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 5.4%. The amount of capital employed has increased too, by 47%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

Our Take On Almendral's ROCE

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Almendral has. Given the stock has declined 37% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. So researching this company further and determining whether or not these trends will continue seems justified.

On a final note, we found 3 warning signs for Almendral (1 is concerning) you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:ALMENDRAL

Almendral

Through its subsidiaries, provides telecommunication services in Chile and Peru.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026