- Chile

- /

- General Merchandise and Department Stores

- /

- SNSE:HITES

Optimistic Investors Push Empresas Hites S.A. (SNSE:HITES) Shares Up 28% But Growth Is Lacking

Empresas Hites S.A. (SNSE:HITES) shareholders have had their patience rewarded with a 28% share price jump in the last month. Notwithstanding the latest gain, the annual share price return of 4.2% isn't as impressive.

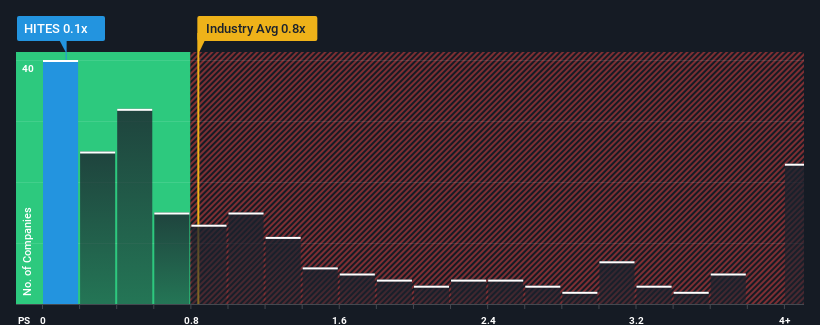

Although its price has surged higher, there still wouldn't be many who think Empresas Hites' price-to-sales (or "P/S") ratio of 0.1x is worth a mention when the median P/S in Chile's Multiline Retail industry is similar at about 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Empresas Hites

What Does Empresas Hites' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Empresas Hites over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Empresas Hites will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Empresas Hites?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Empresas Hites' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 13% shows it's noticeably less attractive.

With this in mind, we find it intriguing that Empresas Hites' P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as a continuation of recent revenue trends is likely to weigh down the shares eventually.

The Bottom Line On Empresas Hites' P/S

Its shares have lifted substantially and now Empresas Hites' P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Empresas Hites revealed its poor three-year revenue trends aren't resulting in a lower P/S as per our expectations, given they look worse than current industry outlook. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Empresas Hites (1 shouldn't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on Empresas Hites, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Empresas Hites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:HITES

Moderate and good value.

Market Insights

Community Narratives