Oxiquim S.A. (SNSE:OXIQUIM) On An Uptrend: Could Fundamentals Be Driving The Stock?

Oxiquim's (SNSE:OXIQUIM) stock up by 4.0% over the past three months. As most would know, long-term fundamentals have a strong correlation with market price movements, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. In this article, we decided to focus on Oxiquim's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Oxiquim

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Oxiquim is:

20% = CL$17b ÷ CL$83b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each CLP1 of shareholders' capital it has, the company made CLP0.20 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Oxiquim's Earnings Growth And 20% ROE

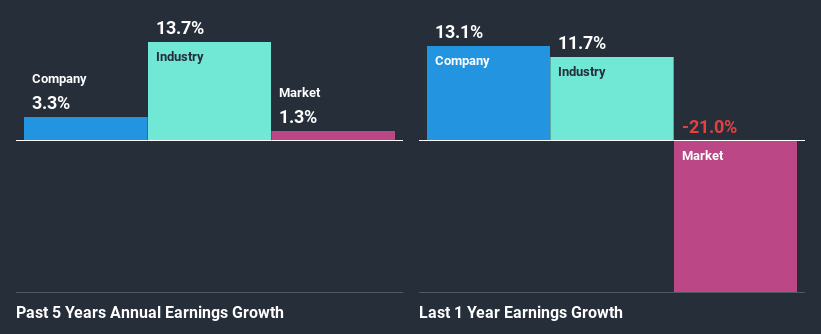

To start with, Oxiquim's ROE looks acceptable. Further, the company's ROE compares quite favorably to the industry average of 12%. Despite this, Oxiquim's five year net income growth was quite low averaging at only 3.3%. This is generally not the case as when a company has a high rate of return it should usually also have a high earnings growth rate. We reckon that a low growth, when returns are quite high could be the result of certain circumstances like low earnings retention or poor allocation of capital.

Next, on comparing with the industry net income growth, we found that Oxiquim's reported growth was lower than the industry growth of 8.6% in the same period, which is not something we like to see.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Oxiquim's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Oxiquim Efficiently Re-investing Its Profits?

Oxiquim has a three-year median payout ratio of 63% (implying that it keeps only 37% of its profits), meaning that it pays out most of its profits to shareholders as dividends, and as a result, the company has seen low earnings growth.

Moreover, Oxiquim has been paying dividends for six years, which is a considerable amount of time, suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

On the whole, we do feel that Oxiquim has some positive attributes. However, while the company does have a high ROE, its earnings growth number is quite disappointing. This can be blamed on the fact that it reinvests only a small portion of its profits and pays out the rest as dividends. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 2 risks we have identified for Oxiquim by visiting our risks dashboard for free on our platform here.

If you decide to trade Oxiquim, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SNSE:OXIQUIM

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.