- Chile

- /

- Healthcare Services

- /

- SNSE:INDISA

Should You Use Instituto de Diagnóstico's (SNSE:INDISA) Statutory Earnings To Analyse It?

It might be old fashioned, but we really like to invest in companies that make a profit, each and every year. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing Instituto de Diagnóstico (SNSE:INDISA).

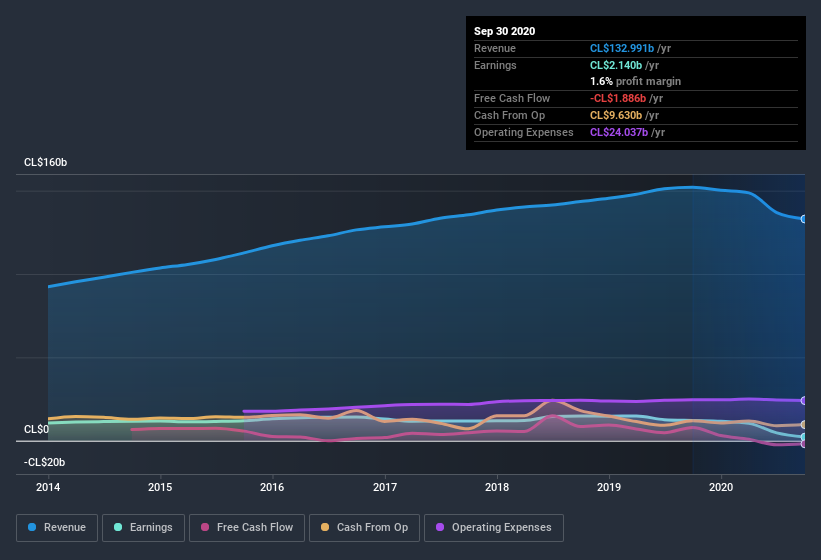

We like the fact that Instituto de Diagnóstico made a profit of CL$2.14b on its revenue of CL$133.0b, in the last year. In the last few years its profit has fallen, although its revenue was steady, as you can see in the chart below.

Check out our latest analysis for Instituto de Diagnóstico

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. Therefore, we think it makes sense to note and understand the impact that a tax benefit has had on Instituto de Diagnóstico's statutory profit in the last twelve months. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Instituto de Diagnóstico.

An Unusual Tax Situation

Instituto de Diagnóstico reported a tax benefit of CL$596m, which is well worth noting. This is meaningful because companies usually pay tax rather than receive tax benefits. The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. While we think it's good that the company has booked a tax benefit, it does mean that there's every chance the statutory profit will come in a lot higher than it would be if the income was adjusted for one-off factors.

Our Take On Instituto de Diagnóstico's Profit Performance

As we have already discussed Instituto de Diagnóstico reported that it received a tax benefit, rather than paying tax, in the last year. Given that sort of benefit is not recurring, a focus on the statutory profit might make the company seem better than it really is. Because of this, we think that it may be that Instituto de Diagnóstico's statutory profits are better than its underlying earnings power. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For example, Instituto de Diagnóstico has 4 warning signs (and 2 which can't be ignored) we think you should know about.

Today we've zoomed in on a single data point to better understand the nature of Instituto de Diagnóstico's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

When trading Instituto de Diagnóstico or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:INDISA

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026