- Chile

- /

- Capital Markets

- /

- SNSE:PLANVITAL

Administradora de Fondos de Pensiones PlanVital S.A. (SNSE:PLANVITAL) Stock Rockets 26% But Many Are Still Ignoring The Company

The Administradora de Fondos de Pensiones PlanVital S.A. (SNSE:PLANVITAL) share price has done very well over the last month, posting an excellent gain of 26%. This latest share price bounce rounds out a remarkable 408% gain over the last twelve months.

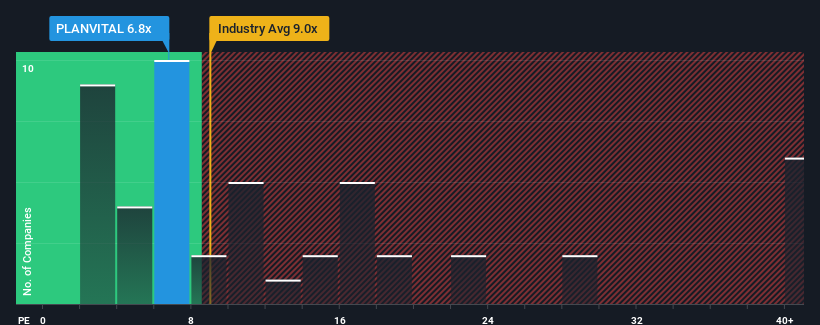

Even after such a large jump in price, there still wouldn't be many who think Administradora de Fondos de Pensiones PlanVital's price-to-earnings (or "P/E") ratio of 6.8x is worth a mention when the median P/E in Chile is similar at about 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been quite advantageous for Administradora de Fondos de Pensiones PlanVital as its earnings have been rising very briskly. The P/E is probably moderate because investors think this strong earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Administradora de Fondos de Pensiones PlanVital

How Is Administradora de Fondos de Pensiones PlanVital's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Administradora de Fondos de Pensiones PlanVital's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 31% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 120% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 17% shows it's noticeably more attractive on an annualised basis.

In light of this, it's curious that Administradora de Fondos de Pensiones PlanVital's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Administradora de Fondos de Pensiones PlanVital appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Administradora de Fondos de Pensiones PlanVital revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look better than current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Administradora de Fondos de Pensiones PlanVital that you need to be mindful of.

Of course, you might also be able to find a better stock than Administradora de Fondos de Pensiones PlanVital. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:PLANVITAL

Administradora de Fondos de Pensiones PlanVital

Administradora de Fondos de Pensiones PlanVital S.A.

Flawless balance sheet with proven track record.