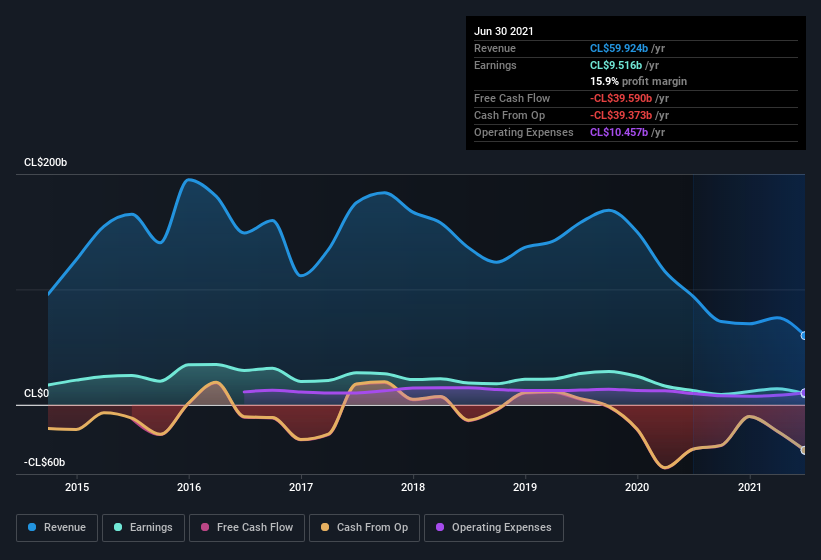

Despite Paz Corp S.A.'s (SNSE:PAZ) recent earnings report having lackluster headline numbers, the market responded positively. While shareholders may be willing to overlook soft profit numbers, we believe that they should also be taking into account some other factors which may be cause for concern.

See our latest analysis for Paz

An Unusual Tax Situation

Paz reported a tax benefit of CL$2.0b, which is well worth noting. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Paz.

Our Take On Paz's Profit Performance

Paz reported that it received a tax benefit, rather than paid tax, in its last report. As a result we don't think its profit result, which includes that tax-boost, is a good guide to its sustainable profit levels. Therefore, it seems possible to us that Paz's true underlying earnings power is actually less than its statutory profit. In further bad news, its earnings per share decreased in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you'd like to know more about Paz as a business, it's important to be aware of any risks it's facing. To that end, you should learn about the 4 warning signs we've spotted with Paz (including 2 which can't be ignored).

This note has only looked at a single factor that sheds light on the nature of Paz's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:PAZ

Paz

A real estate company, engages in housing projects development business in Chile and Peru.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives