- Chile

- /

- Consumer Durables

- /

- SNSE:MANQUEHUE

Inmobiliaria Manquehue's (SNSE:MANQUEHUE) Promising Earnings May Rest On Soft Foundations

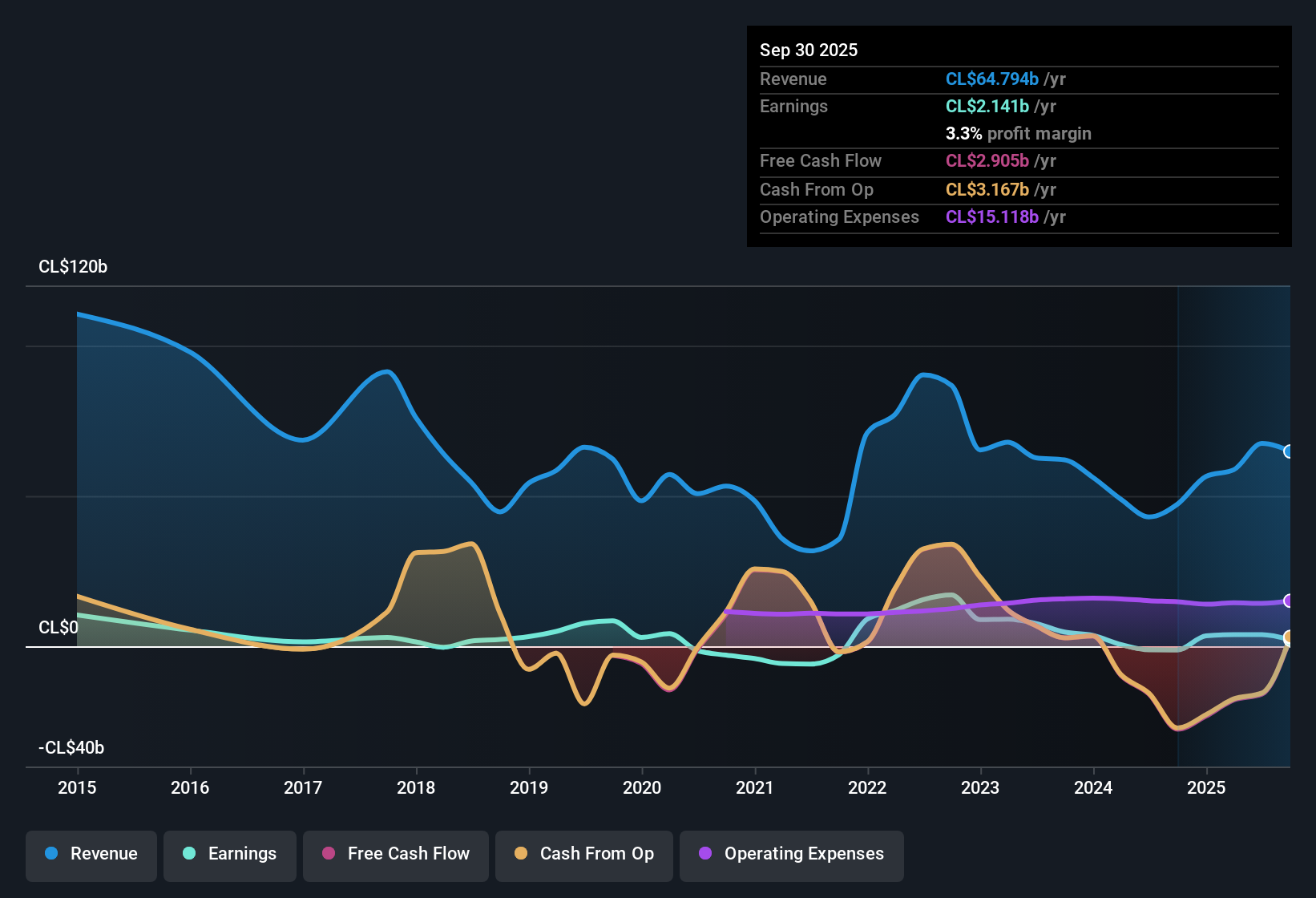

Investors were disappointed with Inmobiliaria Manquehue S.A.'s (SNSE:MANQUEHUE) earnings, despite the strong profit numbers. We think that the market might be paying attention to some underlying factors that they find to be concerning.

An Unusual Tax Situation

We can see that Inmobiliaria Manquehue received a tax benefit of CL$2.9b. This is meaningful because companies usually pay tax rather than receive tax benefits. We're sure the company was pleased with its tax benefit. And given that it lost money last year, it seems possible that the benefit is evidence that it now expects to find value in its past tax losses. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth. So while we think it's great to receive a tax benefit, it does tend to imply an increased risk that the statutory profit overstates the sustainable earnings power of the business.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Inmobiliaria Manquehue.

Our Take On Inmobiliaria Manquehue's Profit Performance

In its most recent report, Inmobiliaria Manquehue disclosed a tax benefit, as we discussed above. Tax is usually an expense, not a benefit, so we don't think the reported profit number is a particularly good guide to the earning potential of the business. As a result, we think it may well be the case that Inmobiliaria Manquehue's underlying earnings power is lower than its statutory profit. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. If you want to do dive deeper into Inmobiliaria Manquehue, you'd also look into what risks it is currently facing. To help with this, we've discovered 3 warning signs (1 doesn't sit too well with us!) that you ought to be aware of before buying any shares in Inmobiliaria Manquehue.

This note has only looked at a single factor that sheds light on the nature of Inmobiliaria Manquehue's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:MANQUEHUE

Inmobiliaria Manquehue

Engages in real estate development business in Chile.

Acceptable track record with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026