- Chile

- /

- Construction

- /

- SNSE:INGEVEC

These 4 Measures Indicate That Ingevec (SNSE:INGEVEC) Is Using Debt Extensively

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Ingevec S.A. (SNSE:INGEVEC) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Ingevec

What Is Ingevec's Debt?

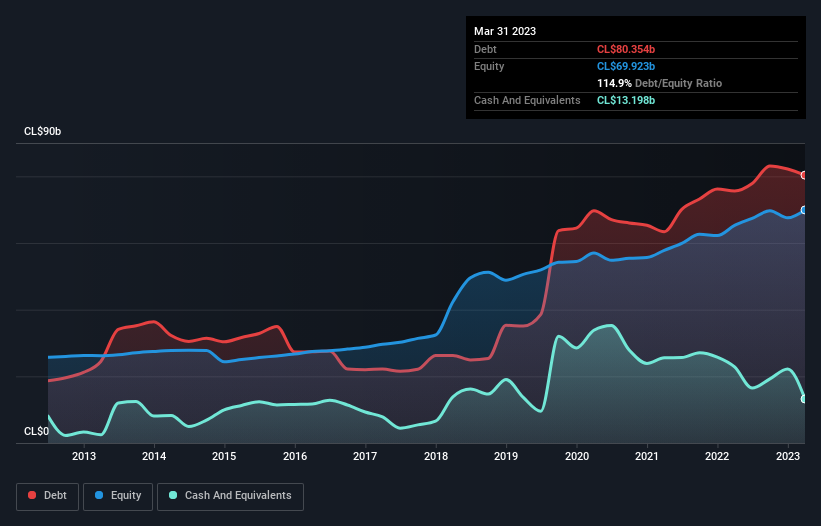

As you can see below, at the end of March 2023, Ingevec had CL$80.4b of debt, up from CL$75.6b a year ago. Click the image for more detail. However, because it has a cash reserve of CL$13.2b, its net debt is less, at about CL$67.2b.

How Strong Is Ingevec's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Ingevec had liabilities of CL$101.0b due within 12 months and liabilities of CL$56.8b due beyond that. On the other hand, it had cash of CL$13.2b and CL$84.6b worth of receivables due within a year. So it has liabilities totalling CL$60.0b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of CL$56.1b, we think shareholders really should watch Ingevec's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 7.2, it's fair to say Ingevec does have a significant amount of debt. However, its interest coverage of 2.6 is reasonably strong, which is a good sign. Even worse, Ingevec saw its EBIT tank 34% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Ingevec will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Ingevec produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

To be frank both Ingevec's net debt to EBITDA and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Overall, it seems to us that Ingevec's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Ingevec is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:INGEVEC

Ingevec

Engages in the engineering and construction business in Chile.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Promigas E.S.P looks to a promising future with 35% revenue growth

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

BWX Technologies (BWXT): Powering the Nuclear Renaissance from Naval Depths to Medical Frontiers.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks