- Chile

- /

- Construction

- /

- SNSE:INGEVEC

These 4 Measures Indicate That Ingevec (SNSE:INGEVEC) Is Using Debt Reasonably Well

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Ingevec S.A. (SNSE:INGEVEC) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Ingevec

What Is Ingevec's Debt?

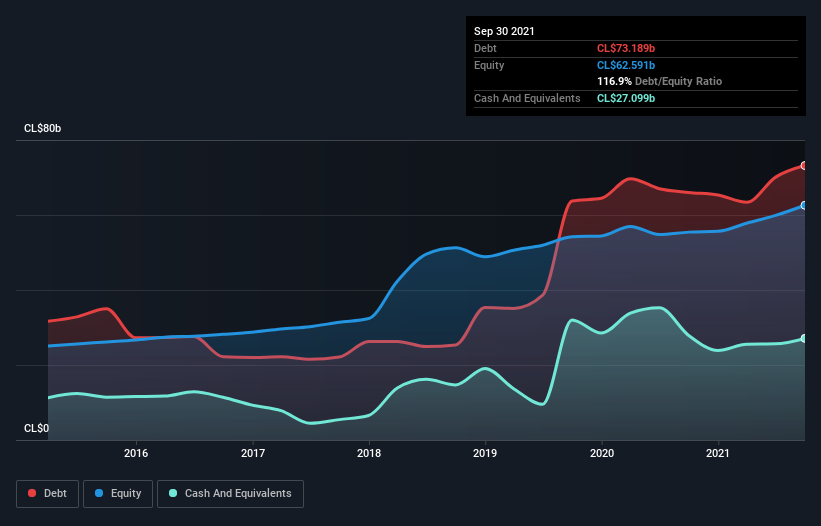

As you can see below, at the end of September 2021, Ingevec had CL$73.2b of debt, up from CL$66.0b a year ago. Click the image for more detail. However, it also had CL$27.1b in cash, and so its net debt is CL$46.1b.

A Look At Ingevec's Liabilities

The latest balance sheet data shows that Ingevec had liabilities of CL$65.5b due within a year, and liabilities of CL$55.3b falling due after that. Offsetting this, it had CL$27.1b in cash and CL$32.5b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CL$61.2b.

When you consider that this deficiency exceeds the company's CL$56.9b market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Ingevec's debt is 3.4 times its EBITDA, and its EBIT cover its interest expense 5.8 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Pleasingly, Ingevec is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 179% gain in the last twelve months. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Ingevec will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Ingevec actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Ingevec's conversion of EBIT to free cash flow was a real positive on this analysis, as was its EBIT growth rate. Having said that, its level of total liabilities somewhat sensitizes us to potential future risks to the balance sheet. When we consider all the elements mentioned above, it seems to us that Ingevec is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Ingevec has 4 warning signs (and 1 which can't be ignored) we think you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:INGEVEC

Ingevec

Engages in the engineering and construction business in Chile.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Very Bullish

Sezzle's Profits to Soar with 27% Margin Boost

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Physical AI" Monopoly – A New Industrial Revolution

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion