- Switzerland

- /

- Electric Utilities

- /

- SWX:REHN

Samse And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

In a week marked by mixed performances across major stock indices, with growth stocks outpacing their value counterparts significantly, investors are keenly observing the market's response to economic indicators such as job growth and potential interest rate cuts. Amidst this backdrop of record highs for some indices and geopolitical developments in Europe and Asia, dividend stocks continue to attract attention for their potential to provide steady income streams. In this context, identifying strong dividend stocks can be particularly appealing as they offer not only regular income but also the possibility of capital appreciation in a fluctuating market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.21% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.50% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.54% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

Click here to see the full list of 1930 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

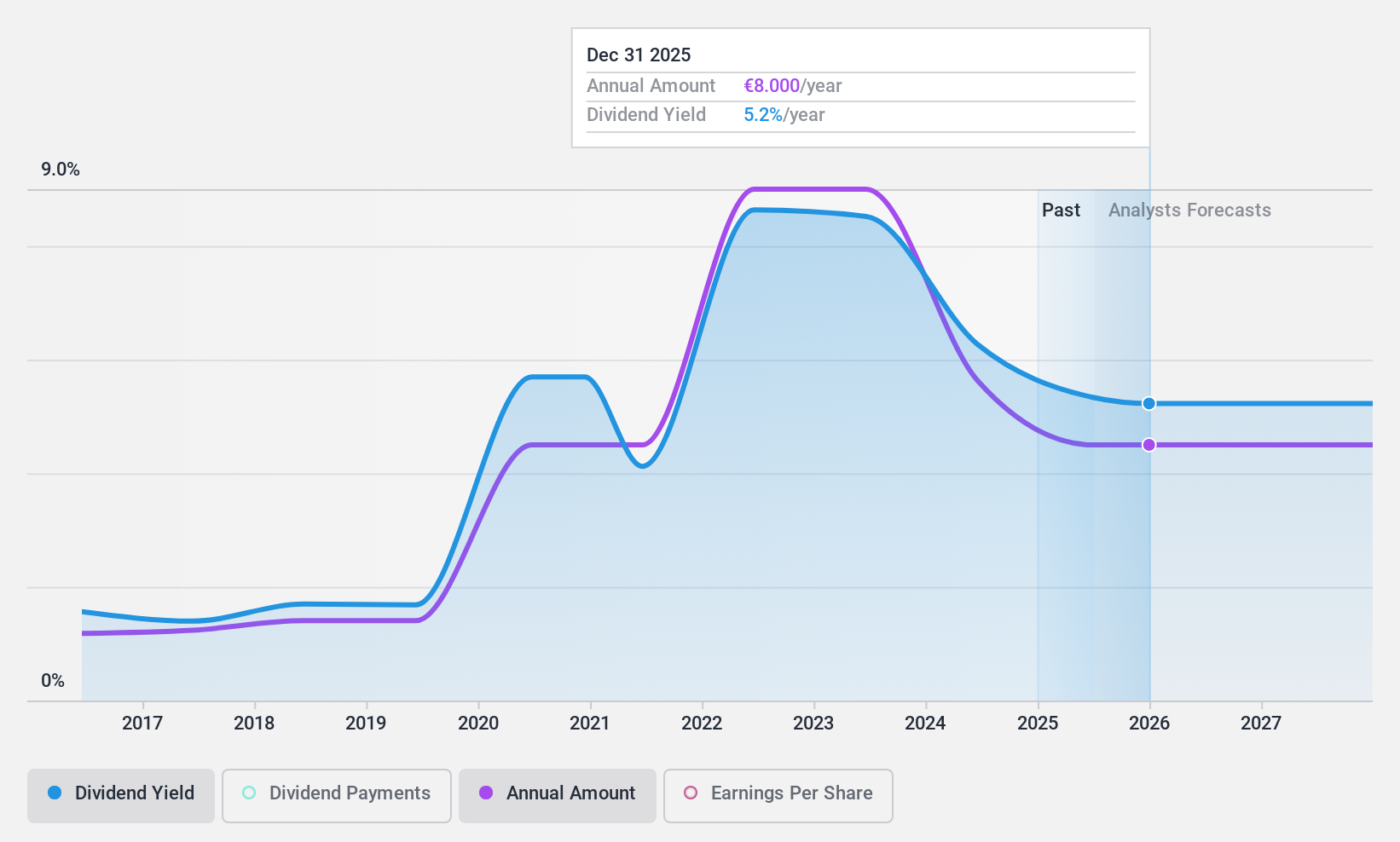

Samse (ENXTPA:SAMS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samse SA is a company that distributes building materials and tools in France, with a market cap of €478.13 million.

Operations: Samse SA generates its revenue from two main segments: Trading, which contributes €1.69 billion, and Do-It-Yourself, which adds €429.36 million.

Dividend Yield: 7.2%

Samse offers a dividend yield of 7.22%, placing it in the top 25% of French dividend payers, though its dividends have been volatile over the past decade. The payout ratio is 79.7%, indicating earnings cover dividends, and a cash payout ratio of 28% suggests strong cash flow support. Despite trading at good value with a P/E ratio below the market average, its profit margins have declined from last year’s figures.

- Click here and access our complete dividend analysis report to understand the dynamics of Samse.

- Our expertly prepared valuation report Samse implies its share price may be lower than expected.

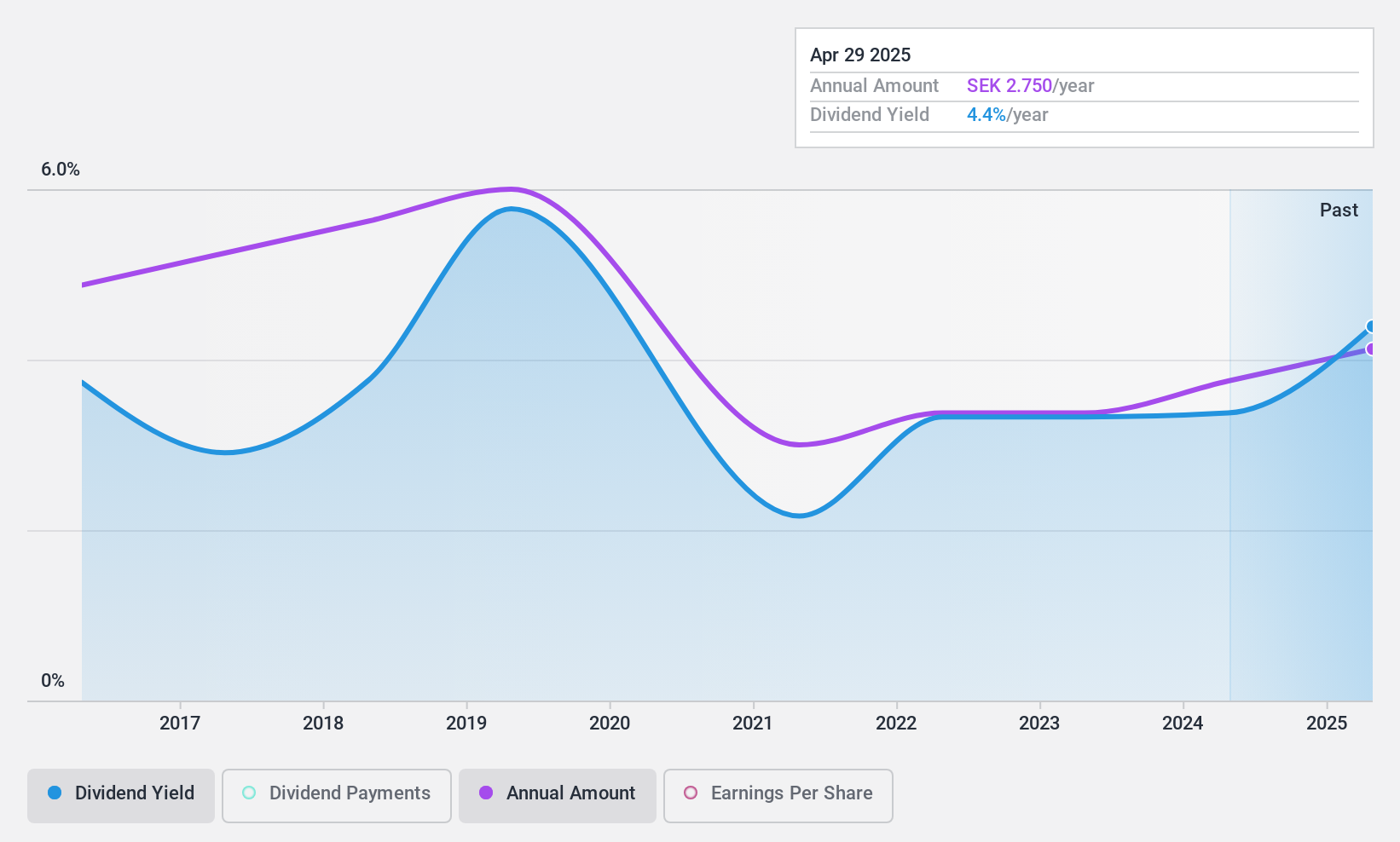

Bulten (OM:BULTEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bulten AB (publ) manufactures and distributes fasteners and related services for various industries including automotive and electronics, with a market cap of SEK1.52 billion.

Operations: Bulten AB (publ) generates revenue of SEK5.98 billion through its operations in manufacturing and distributing fasteners and related solutions across multiple industries worldwide.

Dividend Yield: 3.5%

Bulten's dividend yield of 3.47% is below the top quartile in Sweden, but dividends are well-covered by earnings (payout ratio: 33.6%) and cash flows (cash payout ratio: 68.1%). Despite a history of volatility, recent earnings improvements—net income rose to SEK 135 million for nine months ending September 2024—suggest potential stability. The P/E ratio of 9.7x indicates good value compared to the Swedish market average, yet high debt levels remain a concern.

- Click here to discover the nuances of Bulten with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Bulten is trading beyond its estimated value.

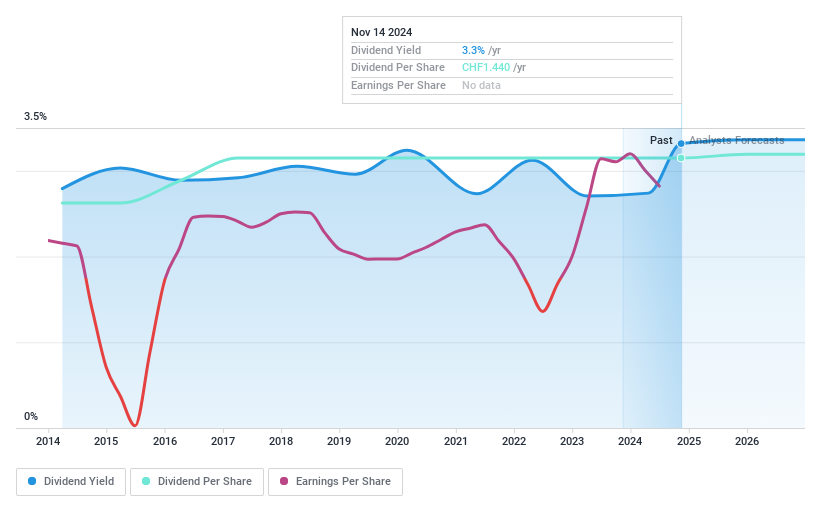

Romande Energie Holding (SWX:REHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Romande Energie Holding SA is a Swiss company involved in the production, distribution, and marketing of electrical and thermal energy with a market cap of CHF1.13 billion.

Operations: Romande Energie Holding SA's revenue is primarily derived from its Energy Solutions segment (CHF486.76 million), followed by Grids (CHF318.28 million), Romande Energie Services (CHF157.72 million), and Corporate activities (CHF59.89 million).

Dividend Yield: 3.2%

Romande Energie Holding's dividend yield of 3.22% is lower than the top quartile in Switzerland, with dividends not covered by free cash flows despite a low payout ratio of 23.5%. The company offers good value with a P/E ratio of 7.3x compared to the Swiss market average. Dividends have been stable and growing over the past decade, but earnings are forecasted to decline by an average of 15.1% annually for the next three years, raising sustainability concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Romande Energie Holding.

- The valuation report we've compiled suggests that Romande Energie Holding's current price could be quite moderate.

Summing It All Up

- Click through to start exploring the rest of the 1927 Top Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:REHN

Romande Energie Holding

Engages in the production, distribution, and marketing of electrical and thermal energy in Switzerland.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives