- Switzerland

- /

- Infrastructure

- /

- SWX:FHZN

A Closer Look at Zurich Airport (SWX:FHZN) Valuation Following Steady Share Price Gains

Reviewed by Simply Wall St

Flughafen Zürich (SWX:FHZN): Should Investors Be Paying Attention?

If you have Flughafen Zürich (SWX:FHZN) on your radar, the latest price moves might leave you wondering what’s driving the stock and whether it signals a meaningful shift. There hasn’t been a headline-grabbing event this week, but sometimes it’s these quieter periods that make investors curious if the market knows something they don’t. When a major transportation hub like Zürich’s airport sees its shares tick up quietly over a month, it can prompt a closer look at the fundamentals and what the market may be expecting next.

Flughafen Zürich is up 12% since the start of the year and has delivered a 27% return over the past 12 months. The past 3 months have also seen a steady upward trend, suggesting momentum has been building rather than fading. That is despite no big shocks or recent announcements. Performance has been driven by consistent revenue and earnings growth, even if at moderate rates.

After this year’s steady climb, is Flughafen Zürich attractively priced for new investors, or is the market already anticipating further growth ahead?

Most Popular Narrative: 2% Undervalued

The most widely followed narrative suggests Flughafen Zürich is trading slightly below its estimated fair value, based on a consensus of future earnings potential and risk factors.

Major capacity and infrastructure investments at Zurich (Dock A replacement, landside commercial expansion, new terminal projects), alongside international ventures (notably Noida Airport launching in late 2025 with a projected rapid passenger ramp-up), are set to boost operational capacity, fee-earning assets, and long-term earnings diversification.

Curious about what’s behind this valuation? The current analysis hinges on bold projections for future growth, expecting increased earnings power and global expansion to justify today’s pricing. Want to know which financial levers and critical forecasts are doing the heavy lifting for the analysts' target? The real surprise may be in how ambitious these future assumptions are, especially compared to recent trends.

Result: Fair Value of CHF248.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a prolonged period of construction and changes in regulated charges could still limit near-term growth and place limits on future margin expansion.

Find out about the key risks to this Flughafen Zürich narrative.Another View: Market-Based Comparison

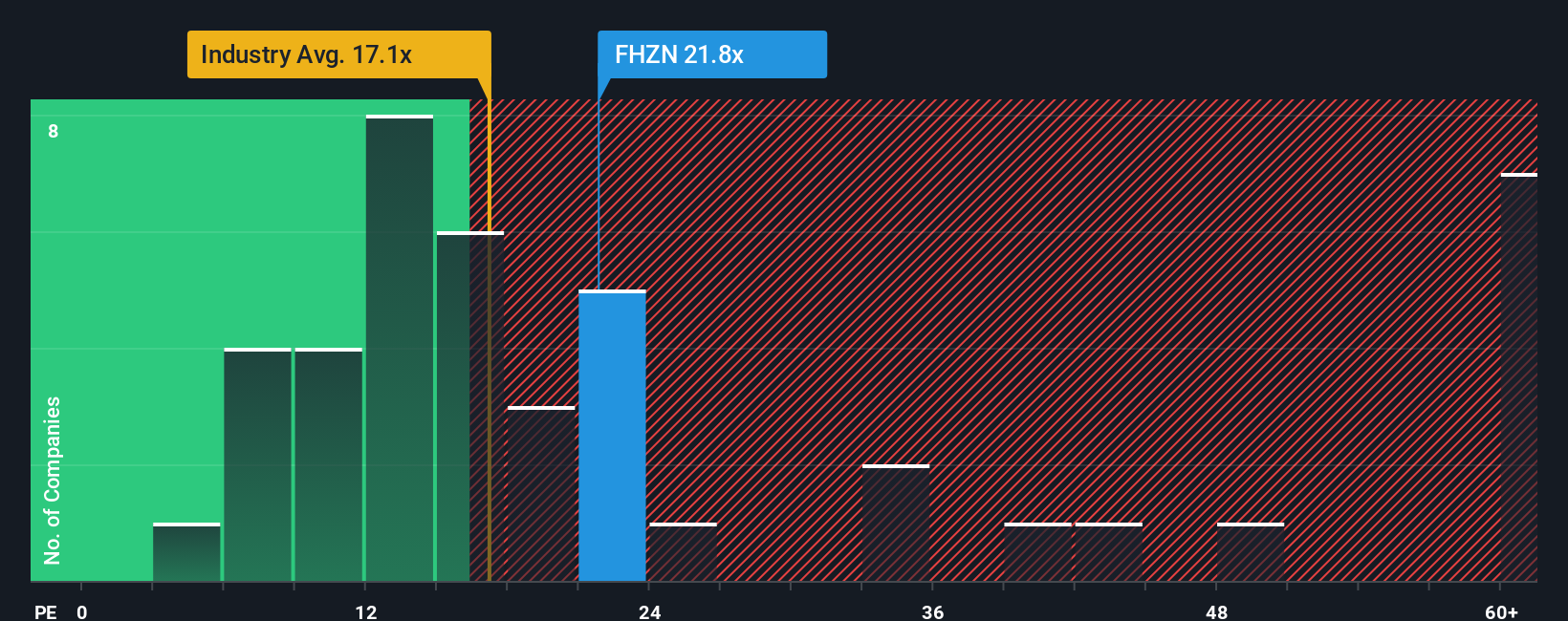

Looking from a different angle, comparing Flughafen Zürich’s current share price with similar stocks in the European infrastructure sector paints a less optimistic picture. With this method, the stock appears somewhat expensive relative to industry norms. Which valuation approach tells the real story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Flughafen Zürich Narrative

If you see things differently or want to chart your perspective, you can explore the data and shape your own airport investment view in just a few minutes by using Do it your way.

A great starting point for your Flughafen Zürich research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio strategy by tapping into fresh opportunities others might miss. These handpicked ideas help you target all corners of the market in seconds.

- Unearth high-potential growth prospects among emerging companies showing real financial strength with penny stocks with strong financials.

- Propel your returns by pinpointing innovative businesses at the frontier of artificial intelligence breakthroughs with AI penny stocks.

- Maximize value with stocks currently trading well below their intrinsic worth by using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SWX:FHZN

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives