The European market has been buoyant recently, with the pan-European STOXX Europe 600 Index rising by 0.90% as inflation slows and the European Central Bank eases monetary policy, alongside strong performances from major stock indexes in Germany, Italy, France, and the UK. In this environment of eased monetary conditions and modest economic growth, high-growth tech stocks in Europe are particularly appealing for their potential to capitalize on technological advancements and innovation-driven demand.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| argenx | 21.82% | 26.90% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Indra Sistemas (BME:IDR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Indra Sistemas, S.A. is a global technology and consulting company specializing in aerospace, defense, and mobility sectors with a market capitalization of approximately €6.19 billion.

Operations: The company generates revenue primarily from its Minsait (IT) segment, which accounts for €3.01 billion, followed by defense at €1.07 billion. Mobility and air traffic contribute €362.45 million and €470.38 million respectively to the total revenue streams.

Indra Sistemas stands out in the European tech landscape with its strategic focus on expanding military-related operations, although it recently decided against bidding for Iveco's defense unit. The company’s revenue growth at 6.9% annually outpaces the Spanish market's 4.5%, reflecting a robust position in its sector. Furthermore, Indra's earnings have surged by 23.4% over the past year, significantly exceeding the IT industry’s average decline of 0.6%. With an anticipated earnings growth of 12.9% per year and a forecasted high return on equity of 21.5% in three years, Indra demonstrates strong financial health and potential for sustained growth, supported by a commitment to R&D that ensures continuous innovation and competitiveness in high-tech markets.

- Navigate through the intricacies of Indra Sistemas with our comprehensive health report here.

Assess Indra Sistemas' past performance with our detailed historical performance reports.

cBrain (CPSE:CBRAIN)

Simply Wall St Growth Rating: ★★★★★☆

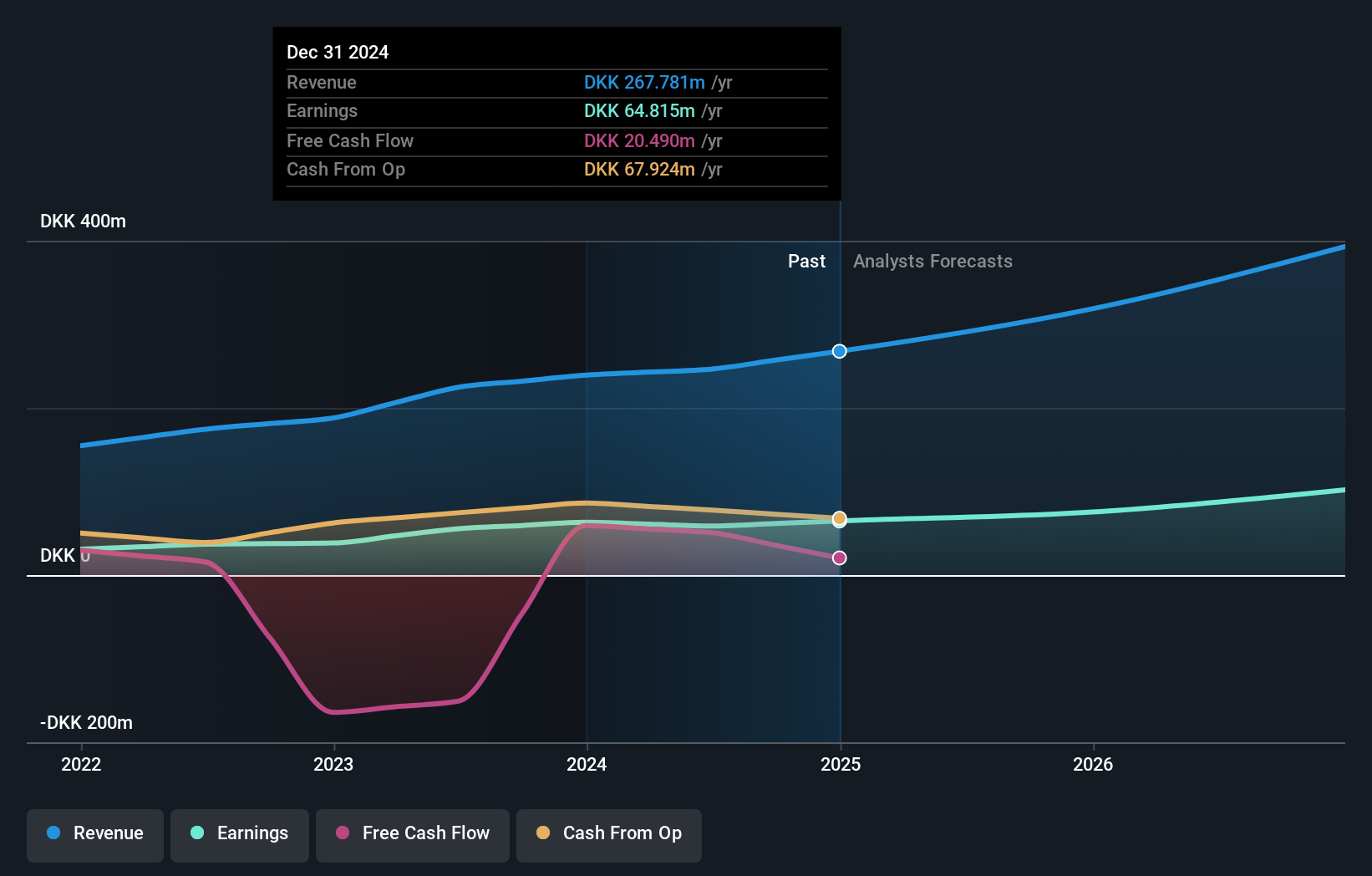

Overview: cBrain A/S is a software company that offers solutions for government, private, education, and non-profit sectors across Denmark and internationally, with a market cap of DKK3.88 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which contributed DKK267.78 million.

cBrain, a dynamic player in the European tech sector, showcases impressive growth metrics that underscore its potential. With an annual revenue increase of 19.2%, the company outperforms the Danish market average of 8.3%. This trend is complemented by a robust earnings growth forecast at 23.1% per year, significantly above Denmark's average of 8.5%. The firm's commitment to innovation is evident from its R&D spending trends which have strategically bolstered its competitive edge in software solutions. Notably, cBrain continues to enhance shareholder value as evidenced by its recent dividend increase to DKK 0.64 per share, reflecting confidence in sustained financial health and future prospects.

- Get an in-depth perspective on cBrain's performance by reading our health report here.

Explore historical data to track cBrain's performance over time in our Past section.

SoftwareOne Holding (SWX:SWON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SoftwareOne Holding AG is a global provider of software and cloud solutions operating across multiple regions including Europe, North America, Latin America, Asia Pacific, and the Middle East with a market capitalization of CHF1.26 billion.

Operations: The company generates revenue primarily from its regional operations, with significant contributions from the DACH region (CHF301.13 million) and EMEA (CHF299.49 million). The NORAM and APAC regions also contribute notably to the revenue streams, at CHF145.93 million and CHF163.44 million respectively, reflecting a diversified geographical presence in software and cloud solutions markets.

SoftwareOne Holding AG, navigating through a transformative phase with new CFO Hanspeter Schraner, is poised for notable financial improvements. The company's revenue growth at 5.8% annually aligns with strategic expansions, albeit below the high-velocity tech sector norm. However, its forecasted earnings surge by 54.21% per year signals robust potential amidst operational shifts. With R&D expenses tailored to fuel innovation and adaptability in a competitive market, SoftwareOne is strategically positioning itself despite current unprofitability and a volatile share price. This approach underpins its commitment to evolving within the tech landscape while managing shareholder expectations through prudent fiscal strategies such as the recent dividend adjustment to CHF 0.30 per share from capital reserves and earnings.

Taking Advantage

- Explore the 227 names from our European High Growth Tech and AI Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IDR

Indra Sistemas

Operates as a technology and consulting company for aerospace, defense, and mobility business worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives