- Switzerland

- /

- Tech Hardware

- /

- SWX:LOGN

Logitech (SWX:LOGN) Margin Decline Challenges Bullish Narrative Despite Revenue Growth Outpacing Market

Reviewed by Simply Wall St

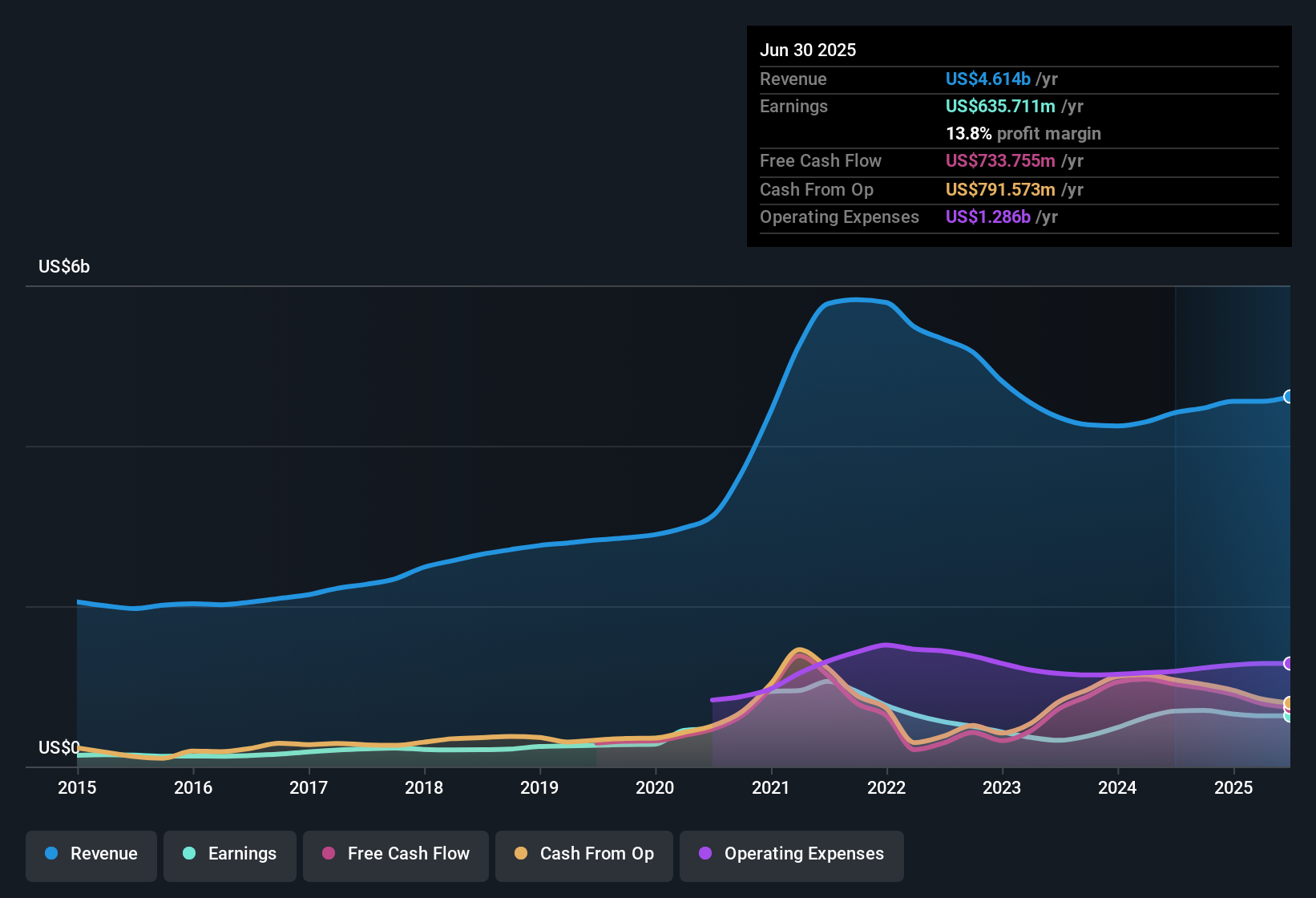

Logitech International (SWX:LOGN) has seen its earnings decline by 8.5% per year over the past five years, with its net profit margin falling to 14.1% from last year's 15.6%. Looking ahead, analysts forecast earnings to grow at a modest 4.2% annually, which is below the Swiss market's projected 10.7% growth rate. Despite the tempered profit outlook and tightening margins, revenue is expected to rise at 5.3% per year, outpacing the wider market, and the company currently trades at a discount to estimated fair value.

See our full analysis for Logitech International.Next, we will see how these headline figures hold up against the market's dominant narratives and where community expectations may diverge from the latest results.

See what the community is saying about Logitech International

Premium Valuation Despite Discount to Fair Value

- Logitech trades at CHF 92.52, which is below its DCF fair value of CHF 107.34. However, its price-to-earnings ratio of 25.8x is higher than both the peer average (19.8x) and the wider European tech industry (24.7x).

- Analysts' consensus view suggests that while the market currently values Logitech at a premium relative to its peers, this higher multiple reflects the company’s reputation for quality earnings and its expected ability to sustain growth, even as profit margins have declined.

- The relatively modest gap between the current price and the consensus price target (CHF 92.52 versus CHF 91.09) points to a market that believes the stock is approximately fairly priced given today’s outlook.

- This backdrop challenges any notion that Logitech is deeply undervalued and instead sets expectations for steady rather than explosive returns if current growth trends hold.

See how the numbers stack up to analyst debates in the full consensus narrative. 📊 Read the full Logitech International Consensus Narrative.

Margin Resilience Faces Pressures

- The company’s net profit margin dropped to 14.1% from 15.6% last year, and consensus forecasts a further decrease to 13.6% in the next three years.

- Analysts' consensus view highlights that despite active cost control and manufacturing diversification, rising input costs and persistent tariff risks continue to threaten long-term profitability.

- Dependency on premium pricing segments and revenue concentration in fast-growing categories like video collaboration provide a buffer. However, intense competition and shifting tech trends could limit further gains.

- Efforts to expand recurring-revenue streams and move into higher-margin software are viewed as important strategic moves. Nonetheless, meaningful margin expansion might remain elusive if cost pressures persist.

Share Count Decline Supports Per-Share Growth

- The number of shares outstanding is expected to fall by 2.83% annually over the next three years, supporting projected earnings per share growth even as total profit growth remains modest.

- Analysts' consensus view notes that while reductions in share count can help prop up per-share results, the underlying fundamental challenge remains that forecasted earnings will only reach $718 million by 2028, well below the most bullish scenario and below broader market growth rates.

- This reinforces the idea that investors should scrutinize the sources of per-share growth, as declining share counts may not fully offset pressured margins and below-market profit expansion.

- The range of analyst forecasts, from $592.3 million on the bearish end to $802.2 million on the bullish, underscores the uncertainty over whether Logitech can outperform conservative expectations for the coming years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Logitech International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Share your insight and shape your personal narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Logitech International.

See What Else Is Out There

Logitech’s declining margins and below-market earnings growth outlook suggest that its future returns may be steady but not especially robust.

If you want to focus on stocks with more consistent profit expansion, check out stable growth stocks screener (2126 results) to discover companies delivering reliability year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LOGN

Logitech International

Through its subsidiaries, designs, manufactures, and markets software-enabled hardware solutions that connect people to working, creating, and gaming worldwide.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion