Shareholders May Be A Bit More Conservative With LEM Holding SA's (VTX:LEHN) CEO Compensation For Now

Key Insights

- LEM Holding's Annual General Meeting to take place on 27th of June

- CEO Frank Rehfeld's total compensation includes salary of CHF525.0k

- The overall pay is comparable to the industry average

- LEM Holding's EPS grew by 5.5% over the past three years while total shareholder loss over the past three years was 16%

Shareholders of LEM Holding SA (VTX:LEHN) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 27th of June. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

View our latest analysis for LEM Holding

Comparing LEM Holding SA's CEO Compensation With The Industry

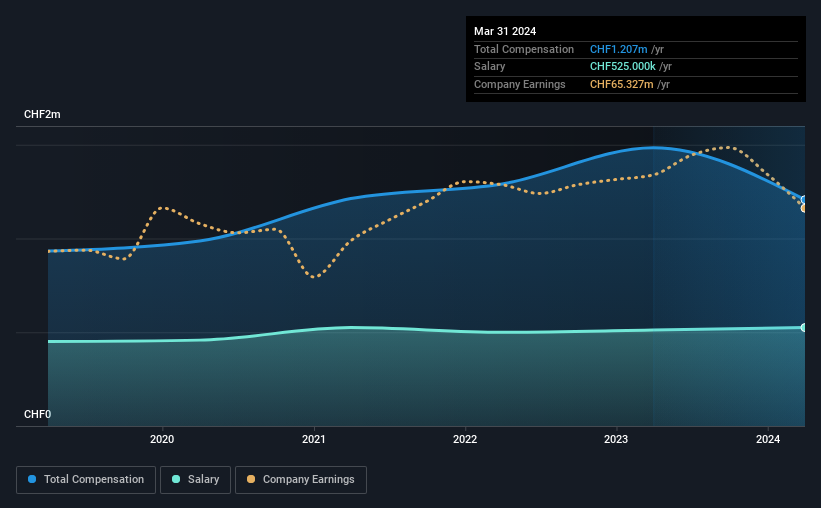

According to our data, LEM Holding SA has a market capitalization of CHF1.7b, and paid its CEO total annual compensation worth CHF1.2m over the year to March 2024. Notably, that's a decrease of 19% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CHF525k.

On examining similar-sized companies in the Swiss Electronic industry with market capitalizations between CHF891m and CHF2.9b, we discovered that the median CEO total compensation of that group was CHF1.2m. This suggests that LEM Holding remunerates its CEO largely in line with the industry average.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CHF525k | CHF512k | 43% |

| Other | CHF682k | CHF972k | 57% |

| Total Compensation | CHF1.2m | CHF1.5m | 100% |

On an industry level, around 43% of total compensation represents salary and 57% is other remuneration. LEM Holding is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at LEM Holding SA's Growth Numbers

LEM Holding SA has seen its earnings per share (EPS) increase by 5.5% a year over the past three years. In the last year, its revenue changed by just 0.1%.

We would argue that the lack of revenue growth in the last year is less than ideal, but it is good to see a modest EPS growth at least. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has LEM Holding SA Been A Good Investment?

Since shareholders would have lost about 16% over three years, some LEM Holding SA investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for LEM Holding that investors should be aware of in a dynamic business environment.

Important note: LEM Holding is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEHN

LEM Holding

Provides solutions for measuring electrical parameters in China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.