The Switzerland market recently experienced a modest uptick, with the SMI index closing slightly higher amid cautious investor sentiment and limited market triggers. In such an environment, identifying high-growth tech stocks requires careful consideration of companies that not only demonstrate robust innovation and adaptability but also possess the resilience to navigate fluctuating economic conditions.

Top 10 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 8.81% | 20.48% | ★★★★★☆ |

| Santhera Pharmaceuticals Holding | 26.80% | 35.40% | ★★★★★★ |

| ALSO Holding | 12.58% | 26.76% | ★★★★☆☆ |

| Comet Holding | 20.43% | 48.65% | ★★★★★★ |

| SoftwareONE Holding | 8.55% | 52.33% | ★★★★★☆ |

| Cicor Technologies | 6.78% | 27.45% | ★★★★☆☆ |

| Addex Therapeutics | 26.51% | 33.31% | ★★★★★☆ |

| Basilea Pharmaceutica | 9.23% | 26.82% | ★★★★★☆ |

| Sensirion Holding | 13.86% | 102.68% | ★★★★☆☆ |

| MCH Group | 4.41% | 100.62% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Basilea Pharmaceutica (SWX:BSLN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basilea Pharmaceutica AG is a commercial-stage biopharmaceutical company specializing in developing oncology and anti-infective products, with a market cap of CHF543.63 million.

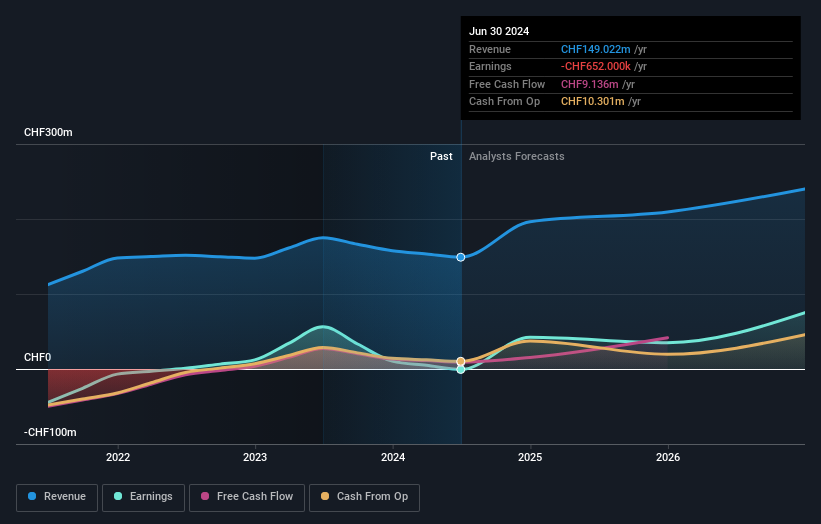

Operations: The company generates revenue primarily from the discovery, development, and commercialization of innovative pharmaceutical products, amounting to CHF149.02 million. Its operations focus on addressing medical needs in oncology and anti-infectives.

Basilea Pharmaceutica, amidst a challenging fiscal landscape marked by a 9.2% annual revenue growth forecast, stands out with its strategic advancements in the pharmaceutical sector. The company recently enhanced its market position through the EC's approval of Cresemba for pediatric use and extended market exclusivity, which not only bolsters its product portfolio but also promises sustained revenue streams with an additional CHF 10 million milestone from Pfizer. Furthermore, Basilea's commitment to innovation is evident from their R&D investments aimed at expanding therapeutic applications. With earnings anticipated to surge by 26.8% annually, these strategic initiatives could significantly shape Basilea's trajectory in the high-growth tech sphere within Switzerland’s competitive landscape.

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★★

Overview: Comet Holding AG, with a market cap of CHF2.32 billion, operates globally through its subsidiaries to deliver X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and other international markets.

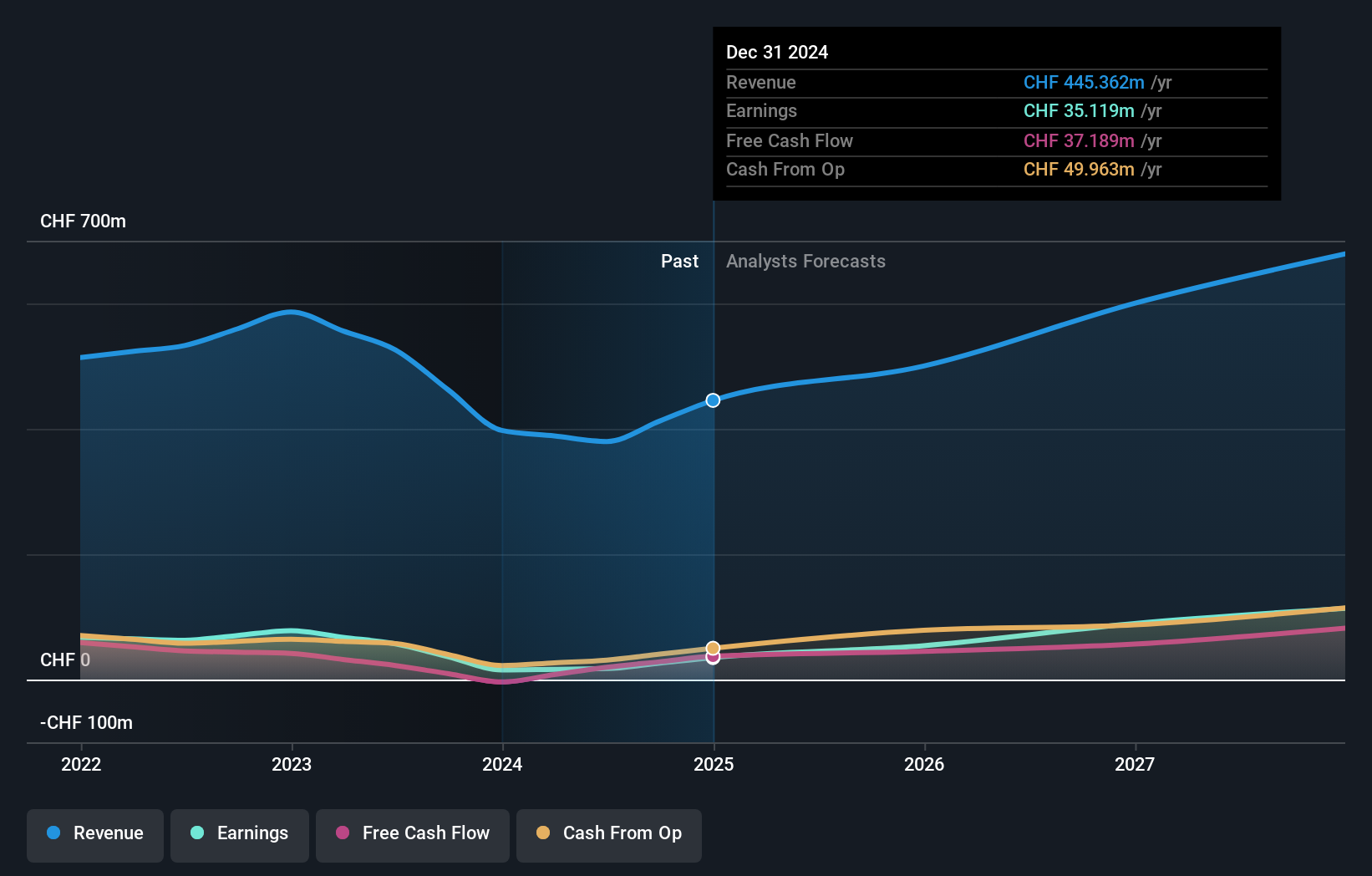

Operations: Comet Holding AG generates revenue primarily from three segments: X-Ray Systems (CHF115.34 million), Industrial X-Ray Modules (CHF95.90 million), and Plasma Control Technologies (CHF180.62 million). The company focuses on providing advanced technology solutions in the fields of X-ray and RF power, serving a diverse range of international markets.

Comet Holding AG, navigating through a challenging fiscal environment, demonstrated resilience with a reported sales increase to CHF 189.32 million and a doubling of net income to CHF 4.06 million in the first half of 2024. This performance is underpinned by significant R&D investments, aligning with an anticipated revenue growth of 20.4% per year—outpacing the Swiss market's average of 4.1%. Moreover, Comet's earnings are projected to surge by approximately 48.6% annually over the next three years, reflecting robust strategic positioning despite its highly volatile share price recently observed. These figures not only underscore Comet’s commitment to innovation but also hint at its potential trajectory in Switzerland's tech landscape amidst intensifying competition and evolving industry demands.

- Unlock comprehensive insights into our analysis of Comet Holding stock in this health report.

Gain insights into Comet Holding's past trends and performance with our Past report.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, Middle East, Africa, NAFTA and Latin America; the company has a market capitalization of CHF1.38 billion.

Operations: LEM Holding specializes in providing electrical measurement solutions across a diverse range of regions. The company generates revenue primarily through its offerings in this sector, with a notable focus on international markets such as Asia, Europe, and the Americas.

Amidst a competitive Swiss tech landscape, LEM Holding shows promising growth prospects with an expected annual revenue increase of 8.8% and earnings poised to rise by 20.5%. These figures not only highlight the company's robust strategic positioning but also its commitment to innovation, underscored by significant R&D investments that align with these growth forecasts. Despite facing challenges such as a high level of debt and lower profit margins compared to the previous year, LEM Holding's financial maneuvers—like recent share repurchases—reflect proactive management actions aimed at bolstering investor confidence. As it stands, the company is well-positioned for future advancements in the electronic sector, potentially outpacing broader market expectations with a forecasted Return on Equity of 29.3% in three years' time.

- Delve into the full analysis health report here for a deeper understanding of LEM Holding.

Explore historical data to track LEM Holding's performance over time in our Past section.

Next Steps

- Access the full spectrum of 12 SIX Swiss Exchange High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:COTN

Comet Holding

Provides X-ray and radio frequency (RF) power technology solutions in Europe, North America, Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives