- Norway

- /

- Semiconductors

- /

- OB:NOD

European Growth Stocks With Strong Insider Ownership In October 2025

Reviewed by Simply Wall St

As European markets continue to rally, with the STOXX Europe 600 Index reaching record levels amid a surge in technology stocks and expectations for lower U.S. borrowing costs, investors are increasingly looking towards growth companies with strong insider ownership as potential opportunities. In this environment, stocks that combine robust growth prospects with significant insider stakes may offer an appealing blend of confidence and alignment between company leadership and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.7% |

| KebNi (OM:KEBNI B) | 36.3% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

Here's a peek at a few of the choices from the screener.

Nordic Semiconductor (OB:NOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordic Semiconductor ASA is a fabless semiconductor company that develops and sells integrated circuits for short- and long-range wireless applications across Europe, the Americas, and the Asia Pacific, with a market cap of NOK32.47 billion.

Operations: The company's revenue segment is primarily from the design and sale of integrated circuits and related solutions, amounting to $628.11 million.

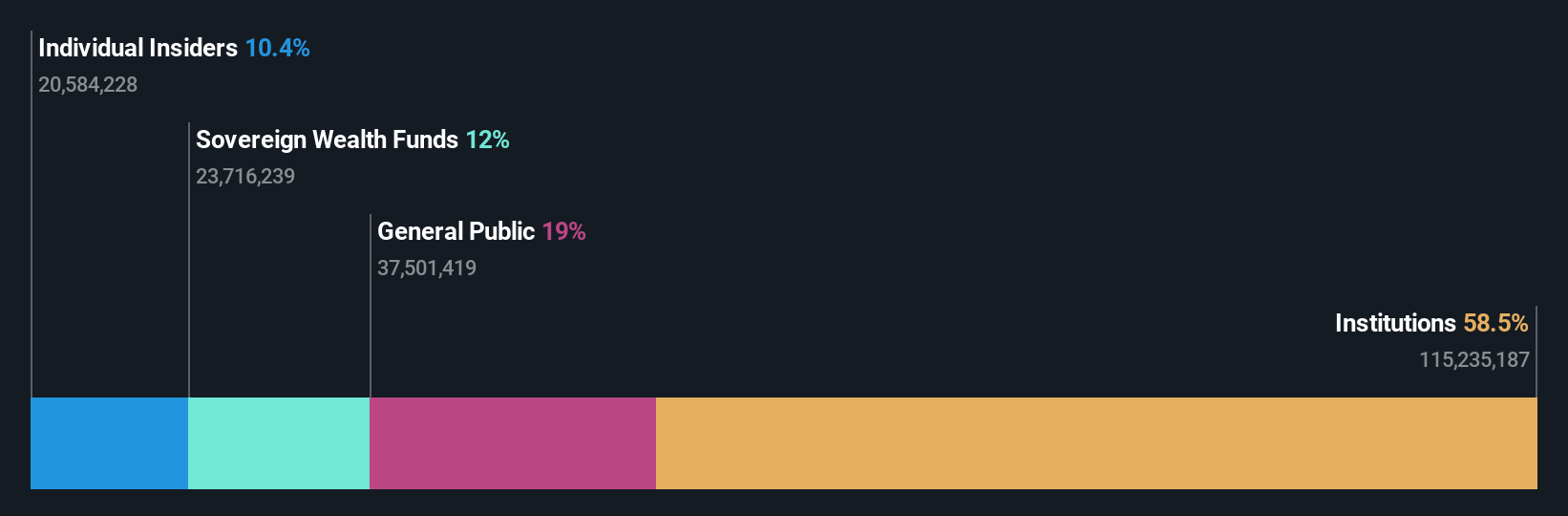

Insider Ownership: 10.4%

Nordic Semiconductor's earnings are forecast to grow significantly at 40.7% annually, outpacing the Norwegian market's growth rate of 13.5%. Despite a slower revenue growth forecast of 11.7%, it exceeds the market average of 2.7%. The company became profitable this year, reporting USD 164.08 million in Q2 sales and USD 10.14 million net income compared to last year's loss. Recently, Nordic completed a NOK 1.05 billion equity offering, enhancing its capital base for future expansion efforts.

- Take a closer look at Nordic Semiconductor's potential here in our earnings growth report.

- Our valuation report unveils the possibility Nordic Semiconductor's shares may be trading at a premium.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedencare AB (publ) develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses across North America, Europe, and internationally with a market cap of SEK5.46 billion.

Operations: Swedencare's revenue is derived from its operations in Europe (SEK557.60 million), production activities (SEK687.30 million), and North America (SEK1.59 billion).

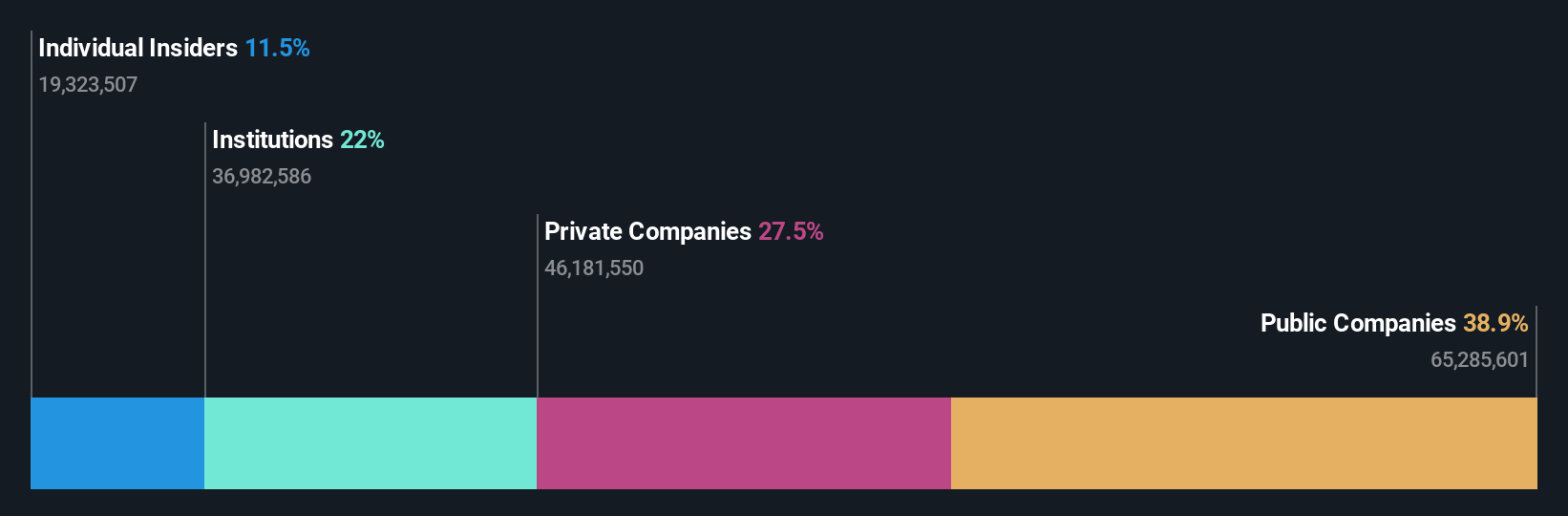

Insider Ownership: 11.5%

Swedencare's earnings are projected to grow significantly at 64.3% annually, surpassing the Swedish market's 16.4%. Despite a forecasted revenue growth of 9.9%, which is below the high-growth threshold, it still exceeds the market average of 5%. The company trades at a substantial discount to its estimated fair value and analysts expect a price rise of 39.6%. Recent insider activity shows more purchases than sales, though not in large volumes.

- Click here to discover the nuances of Swedencare with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Swedencare is priced lower than what may be justified by its financials.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America and has a market cap of CHF566.38 million.

Operations: The company's revenue segments include solutions for measuring electrical parameters across regions such as China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

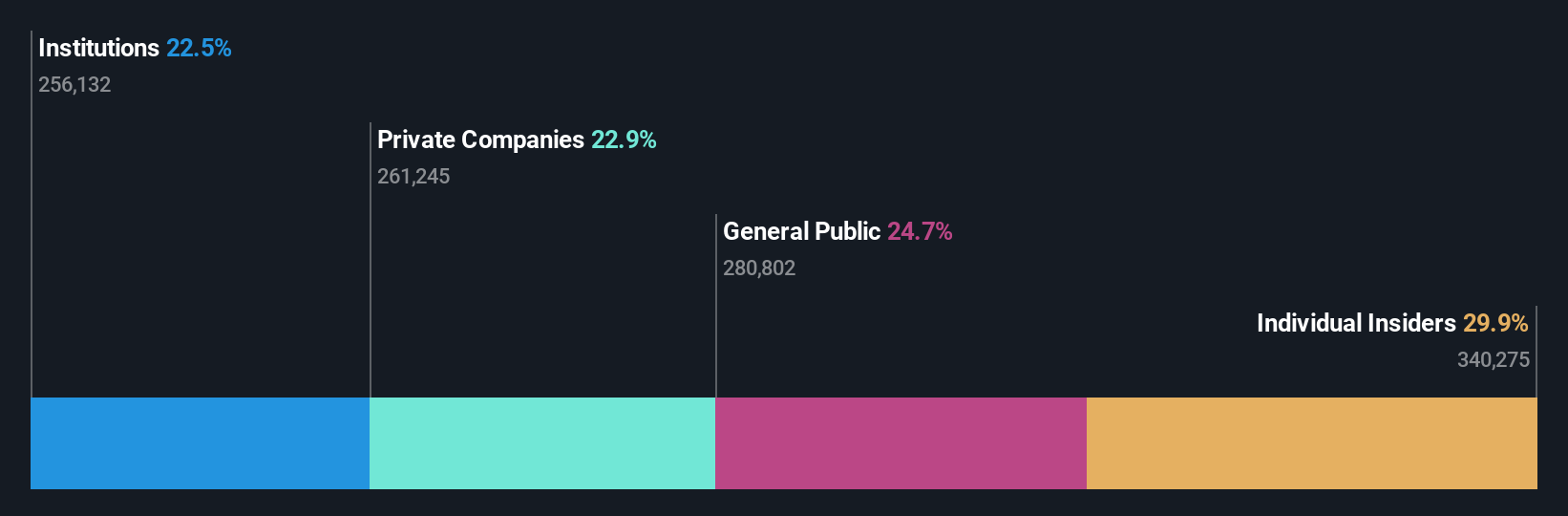

Insider Ownership: 29.9%

LEM Holding's earnings are forecasted to grow significantly at 57.38% annually, outpacing the Swiss market's 10.7%. Despite a slower revenue growth of 9.7%, it exceeds the market average of 3.9%. The company faces challenges with high debt levels and recent profit margin declines, from 13.2% to 1.9%. Trading at a significant discount to its fair value, analysts anticipate a substantial price increase of over 70%. Recent earnings showed decreased sales and net income year-over-year.

- Click to explore a detailed breakdown of our findings in LEM Holding's earnings growth report.

- In light of our recent valuation report, it seems possible that LEM Holding is trading behind its estimated value.

Taking Advantage

- Unlock more gems! Our Fast Growing European Companies With High Insider Ownership screener has unearthed 176 more companies for you to explore.Click here to unveil our expertly curated list of 179 Fast Growing European Companies With High Insider Ownership.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NOD

Nordic Semiconductor

A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives