European Growth Companies With High Insider Ownership In May 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with the pan-European STOXX Europe 600 Index rising by 3.44% in response to easing tariff concerns and stronger-than-expected economic growth, investors are increasingly focused on identifying promising opportunities amidst this environment. In such a climate, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business, aligning their interests with shareholders and potentially offering stability during market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 76.9% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Lokotech Group (OB:LOKO) | 7.1% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| OrganoClick (OM:ORGC) | 33.7% | 66.8% |

Let's take a closer look at a couple of our picks from the screened companies.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

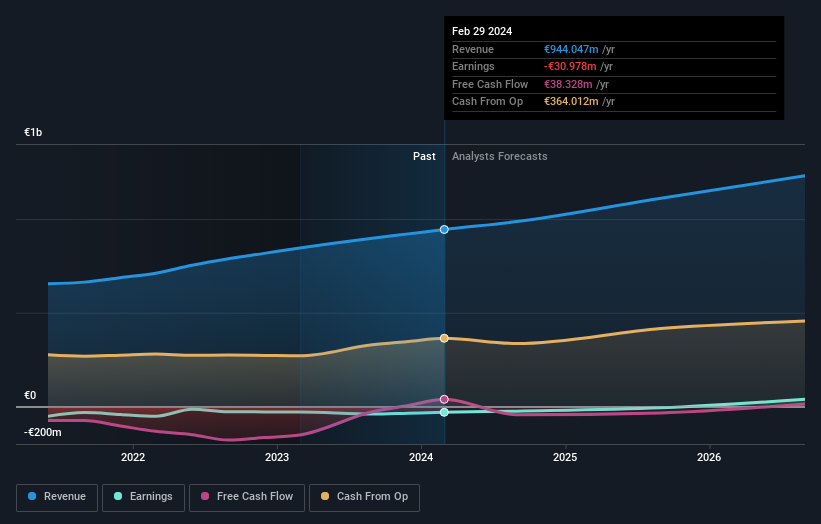

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market cap of approximately €1.92 billion.

Operations: The company's revenue segments include Public Cloud at €198.23 million, Private Cloud at €655.28 million, and Web Cloud & Other at €189.46 million.

Insider Ownership: 12.6%

OVH Groupe is experiencing significant earnings growth, forecasted at 81.4% annually, outpacing the French market's 12.2%. Despite high volatility in its share price recently, OVH has turned profitable this year with half-year sales rising to €536 million and a net income of €7.21 million from a previous loss. The company continues to expand its cloud services through strategic partnerships like HYCU R-Cloud™, enhancing its offerings across seven datacenters globally.

- Click here and access our complete growth analysis report to understand the dynamics of OVH Groupe.

- Our valuation report unveils the possibility OVH Groupe's shares may be trading at a premium.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

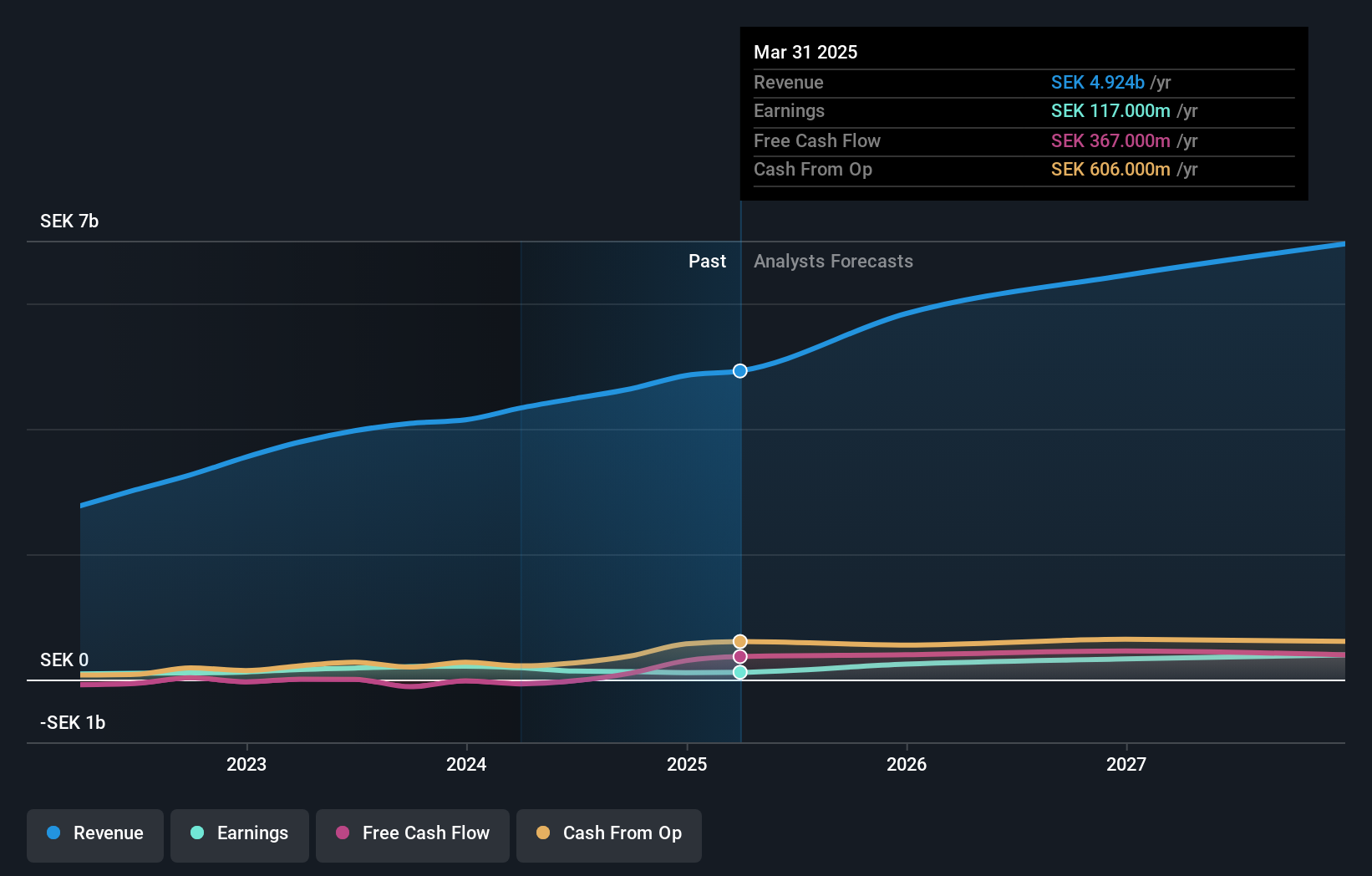

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK3.70 billion.

Operations: Hanza AB's revenue segments include Main Markets at SEK2.90 billion, Other Markets at SEK2 billion, and Business Development and Services contributing SEK31 million.

Insider Ownership: 34.8%

Hanza AB demonstrates promising growth potential with forecasted annual earnings growth of 27.1%, surpassing the Swedish market's rate. Recent Q1 2025 results show sales increased to SEK 1,326 million, and net income rose to SEK 40 million. Despite a decrease in profit margins from the previous year, revenue is expected to grow at 11.3% annually. The company has not reported significant insider trading activity recently, maintaining stable insider ownership amidst these financial developments.

- Take a closer look at Hanza's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Hanza is priced higher than what may be justified by its financials.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market cap of CHF829.30 million.

Operations: Revenue segments for LEM Holding include providing solutions for measuring electrical parameters across regions such as China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

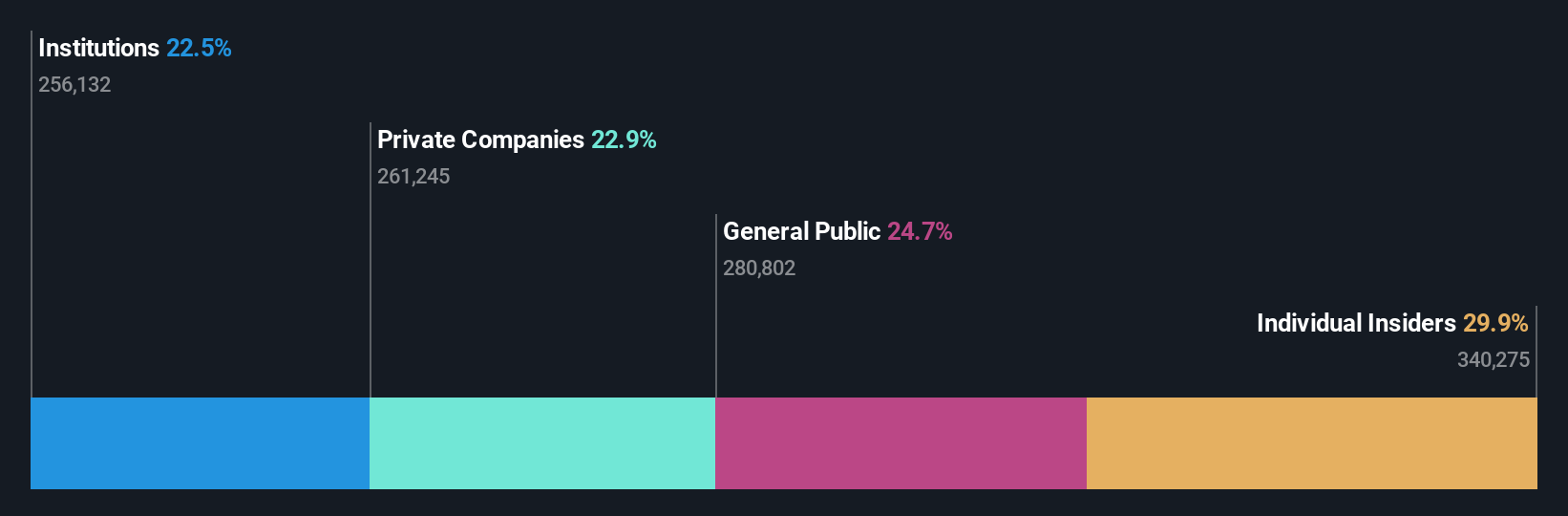

Insider Ownership: 29.9%

LEM Holding's earnings are projected to grow significantly at 56.4% annually, outpacing the Swiss market's 10.8% rate, though profit margins have decreased from last year. The stock trades well below its estimated fair value and analysts predict a 61.7% price increase. Despite high debt levels and a dividend not covered by earnings, LEM is in a strong growth position with substantial insider ownership but no recent significant insider trading activity noted.

- Click to explore a detailed breakdown of our findings in LEM Holding's earnings growth report.

- Our expertly prepared valuation report LEM Holding implies its share price may be lower than expected.

Turning Ideas Into Actions

- Access the full spectrum of 214 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Looking For Alternative Opportunities? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade LEM Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEHN

LEM Holding

Provides solutions for measuring electrical parameters in China, Japan, South Korea, India, Southeast Asia, Europe, Middle East, Africa, NAFTA and Latin America.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives