- Saudi Arabia

- /

- Chemicals

- /

- SASE:2290

3 Stocks Estimated To Be Trading At Discounts Of Up To 37.6%

Reviewed by Simply Wall St

As global markets navigate a choppy start to the year amid inflation concerns and political uncertainties, investors are keenly observing the performance of various indices, with small-cap stocks underperforming their large-cap counterparts. In such volatile environments, identifying undervalued stocks can be an effective strategy for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥17.19 | CN¥34.17 | 49.7% |

| Clear Secure (NYSE:YOU) | US$26.72 | US$53.44 | 50% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.39 | CN¥100.73 | 50% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.60 | CN¥31.06 | 49.8% |

| Ningbo Haitian Precision MachineryLtd (SHSE:601882) | CN¥20.26 | CN¥40.47 | 49.9% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP290.99 | CLP580.39 | 49.9% |

| Constellium (NYSE:CSTM) | US$10.35 | US$20.64 | 49.8% |

| Andrada Mining (AIM:ATM) | £0.0235 | £0.047 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €2.95 | €5.88 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5874.00 | ¥11677.29 | 49.7% |

Let's dive into some prime choices out of the screener.

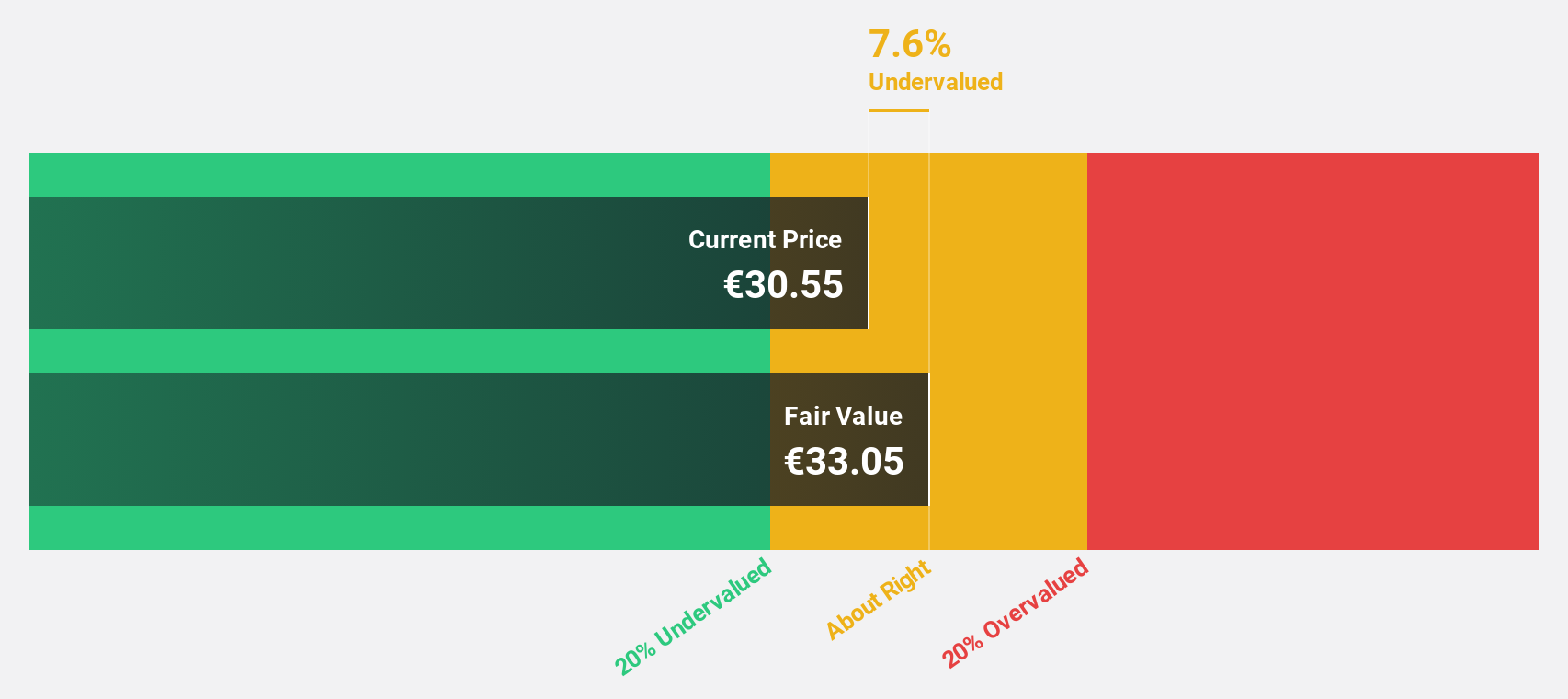

Theon International (ENXTAM:THEON)

Overview: Theon International Plc develops and manufactures customizable night vision, thermal imaging, and electro-optical ISR systems for military and security applications globally, with a market cap of €970.20 million.

Operations: The company's revenue primarily comes from its Optronics segment, which generated €325.57 million.

Estimated Discount To Fair Value: 37.6%

Theon International is currently trading at €13.86, significantly below its estimated fair value of €22.2, indicating it may be undervalued based on discounted cash flow analysis. Despite recent share price volatility, the company has demonstrated strong earnings growth of 86.6% over the past year and is expected to grow earnings by 18.3% annually, outpacing the Dutch market's forecasted growth rate of 15.1%. However, revenue growth remains modest at 9.1% per year.

- The analysis detailed in our Theon International growth report hints at robust future financial performance.

- Click here to discover the nuances of Theon International with our detailed financial health report.

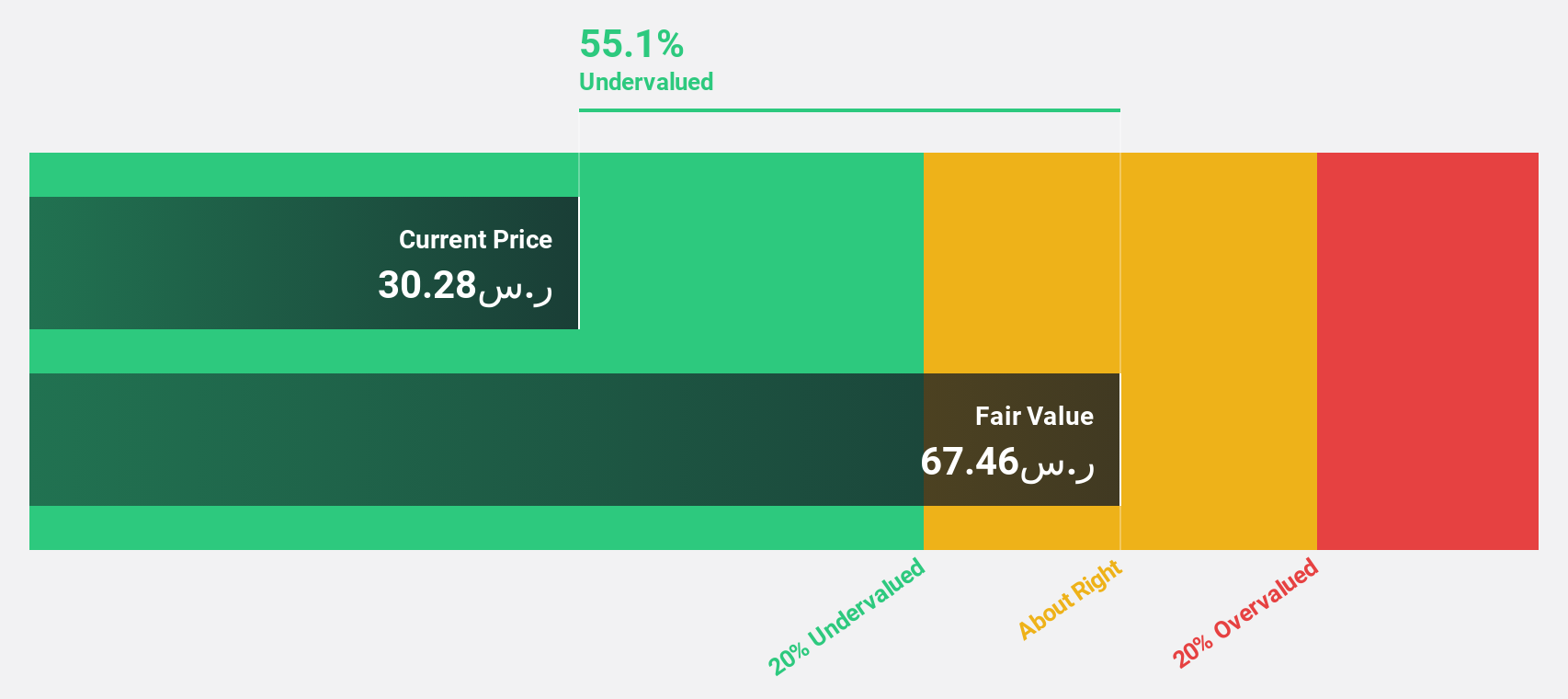

Yanbu National Petrochemical (SASE:2290)

Overview: Yanbu National Petrochemical Company manufactures and sells petrochemical products across various regions including Saudi Arabia, the Americas, Africa, the Middle East, Europe, and Asia with a market cap of SAR20.98 billion.

Operations: The company's revenue from petrochemical products amounts to SAR6.12 billion.

Estimated Discount To Fair Value: 31.9%

Yanbu National Petrochemical is trading at SAR 37.3, significantly below its fair value estimate of SAR 54.81, suggesting it could be undervalued based on discounted cash flow analysis. The company reported a return to profitability this year with earnings expected to grow 27.8% annually, surpassing the Saudi Arabian market's growth rate of 6%. However, its dividend yield of 4.69% is not well covered by earnings and revenue growth remains modest at 6.5% per year.

- Insights from our recent growth report point to a promising forecast for Yanbu National Petrochemical's business outlook.

- Click to explore a detailed breakdown of our findings in Yanbu National Petrochemical's balance sheet health report.

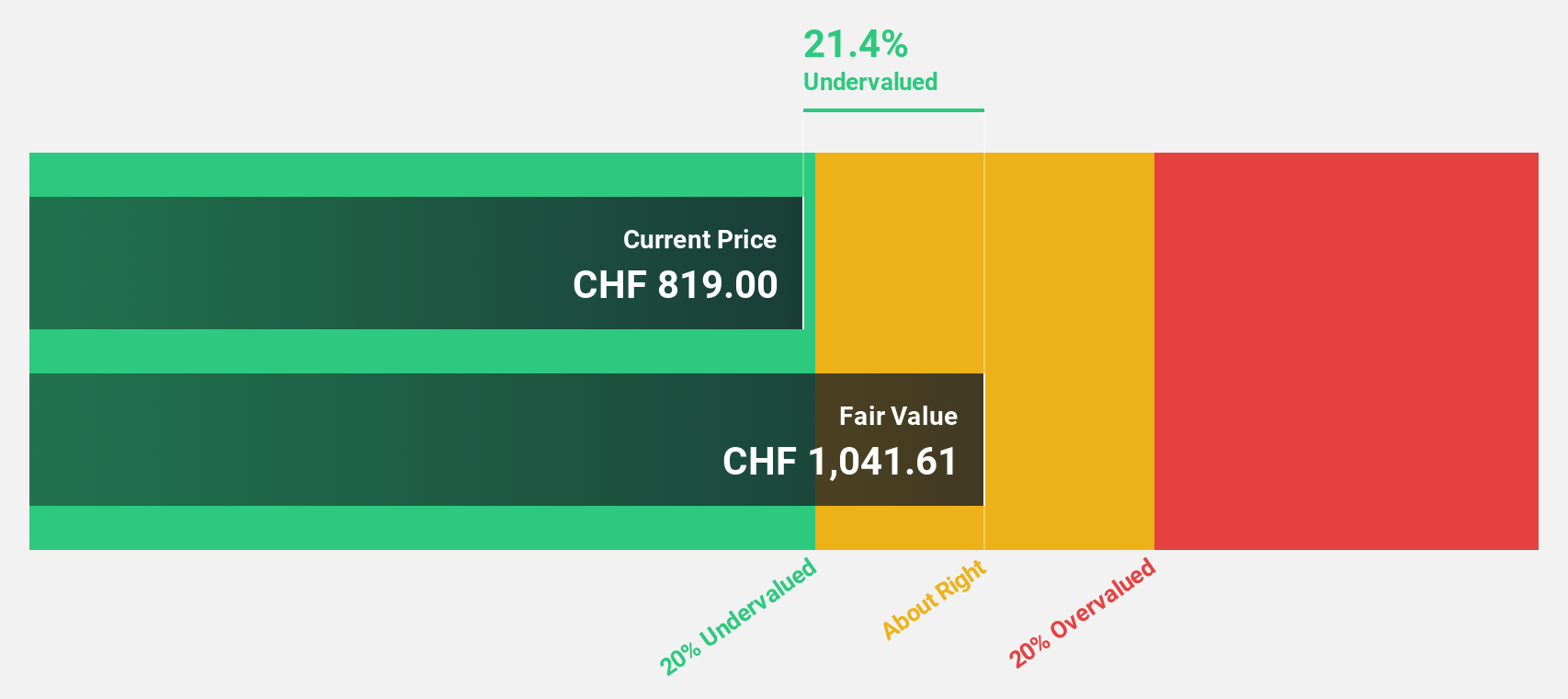

LEM Holding (SWX:LEHN)

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market cap of CHF895.37 million.

Operations: The company's revenue is derived from two main segments: Asia, contributing CHF175.10 million, and Europe/Americas, generating CHF163.88 million.

Estimated Discount To Fair Value: 34.5%

LEM Holding is trading at CHF 786, significantly below its estimated fair value of CHF 1200.19, indicating potential undervaluation based on cash flow analysis. Despite recent earnings challenges, with net income dropping to CHF 8.58 million for the half-year ending September 2024, earnings are forecast to grow at a robust rate of 37.8% annually, outpacing the Swiss market's growth rate. However, its dividend yield of 6.36% lacks coverage from current earnings and cash flows.

- According our earnings growth report, there's an indication that LEM Holding might be ready to expand.

- Get an in-depth perspective on LEM Holding's balance sheet by reading our health report here.

Seize The Opportunity

- Delve into our full catalog of 875 Undervalued Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2290

Yanbu National Petrochemical

Engages in the manufacture and sale of petrochemical products in Saudi Arabia, the Americas, Africa, the Middle East, Europe, and Asia.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives