3 European Growth Companies With Up To 34% Insider Ownership

Reviewed by Simply Wall St

As the European markets navigate through a period of trade negotiations and slowing inflation, indices such as the STOXX Europe 600 have shown resilience with modest gains. In this environment, growth companies with substantial insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 85.7% |

| Lokotech Group (OB:LOKO) | 4.4% | 58.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67% |

| Elliptic Laboratories (OB:ELABS) | 22.9% | 79% |

| Diamyd Medical (OM:DMYD B) | 11.9% | 93% |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 56.1% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Here's a peek at a few of the choices from the screener.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★☆☆

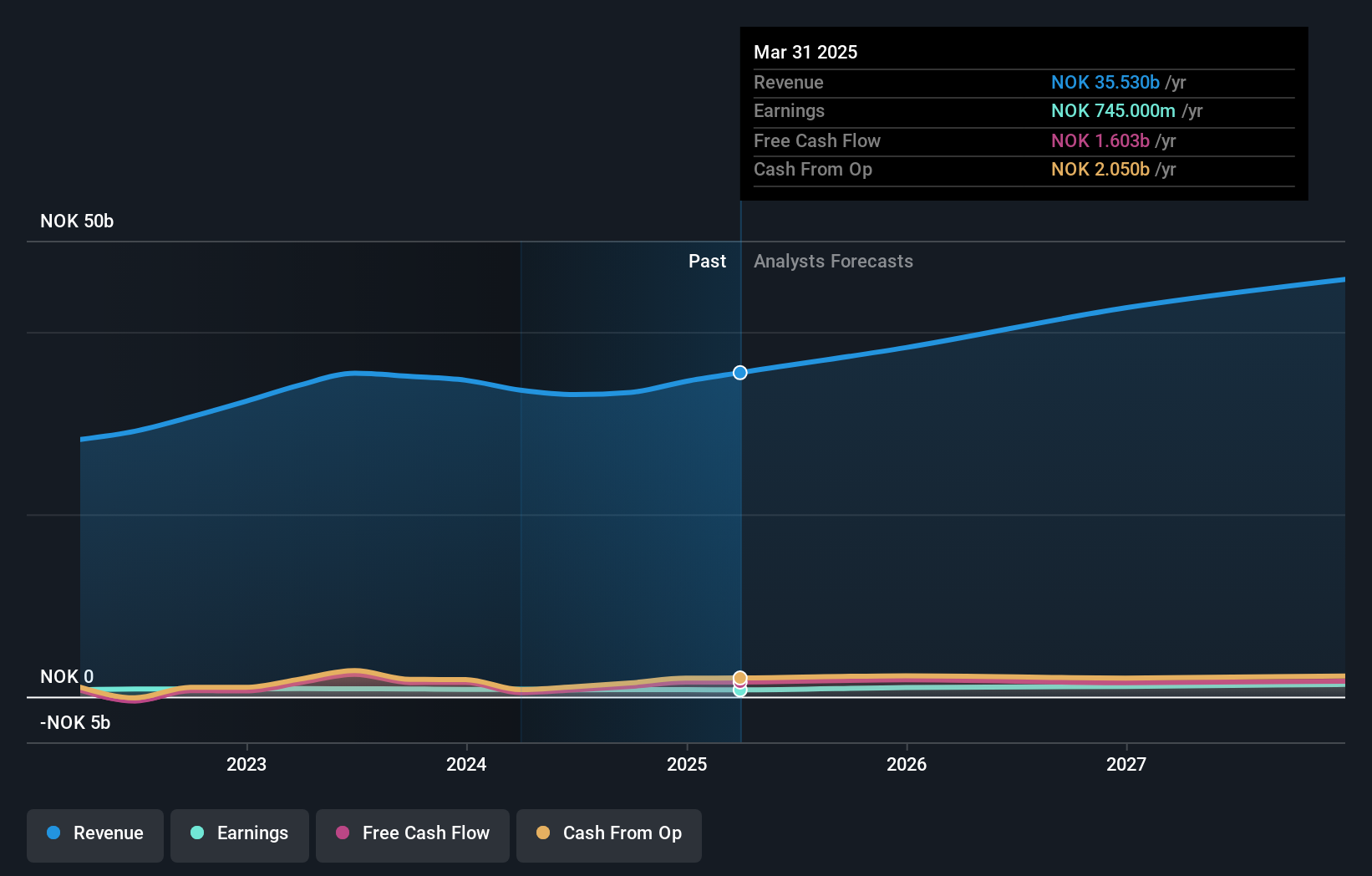

Overview: Atea ASA delivers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK16.73 billion.

Operations: The company's revenue is derived from its operations in various regions, including Norway (NOK9.00 billion), Sweden (NOK13.06 billion), Denmark (NOK8.25 billion), Finland (NOK3.57 billion), the Baltics (NOK1.80 billion), and Group Shared Services (NOK10.81 billion).

Insider Ownership: 29.1%

Atea ASA's revenue is projected to grow at 9.4% annually, outpacing the Norwegian market's 2.6% growth rate, while earnings are expected to rise by 19.7%. Despite trading at nearly 40% below estimated fair value, recent earnings showed a decline in net income and EPS compared to last year. The dividend yield of 4.66% isn't well covered by earnings but was affirmed for distribution in May and November 2025 as a capital repayment.

- Unlock comprehensive insights into our analysis of Atea stock in this growth report.

- Our expertly prepared valuation report Atea implies its share price may be lower than expected.

Hanza (OM:HANZA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hanza AB (publ) offers manufacturing solutions and has a market cap of SEK3.84 billion.

Operations: The company's revenue segments include Main Markets at SEK2.92 billion, Other Markets at SEK2.06 billion, and Business Development and Services contributing SEK32 million.

Insider Ownership: 34.8%

Hanza AB's earnings are forecast to grow significantly at 28.1% annually, outpacing the Swedish market's 15.9%. Despite a lower net profit margin of 2.4% compared to last year's 4.4%, recent Q1 results showed sales of SEK 1.33 billion and net income of SEK 40 million, improving from last year. Insider buying has been substantial recently, indicating confidence in its growth prospects, while the stock trades at a discount to its estimated fair value.

- Take a closer look at Hanza's potential here in our earnings growth report.

- According our valuation report, there's an indication that Hanza's share price might be on the expensive side.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

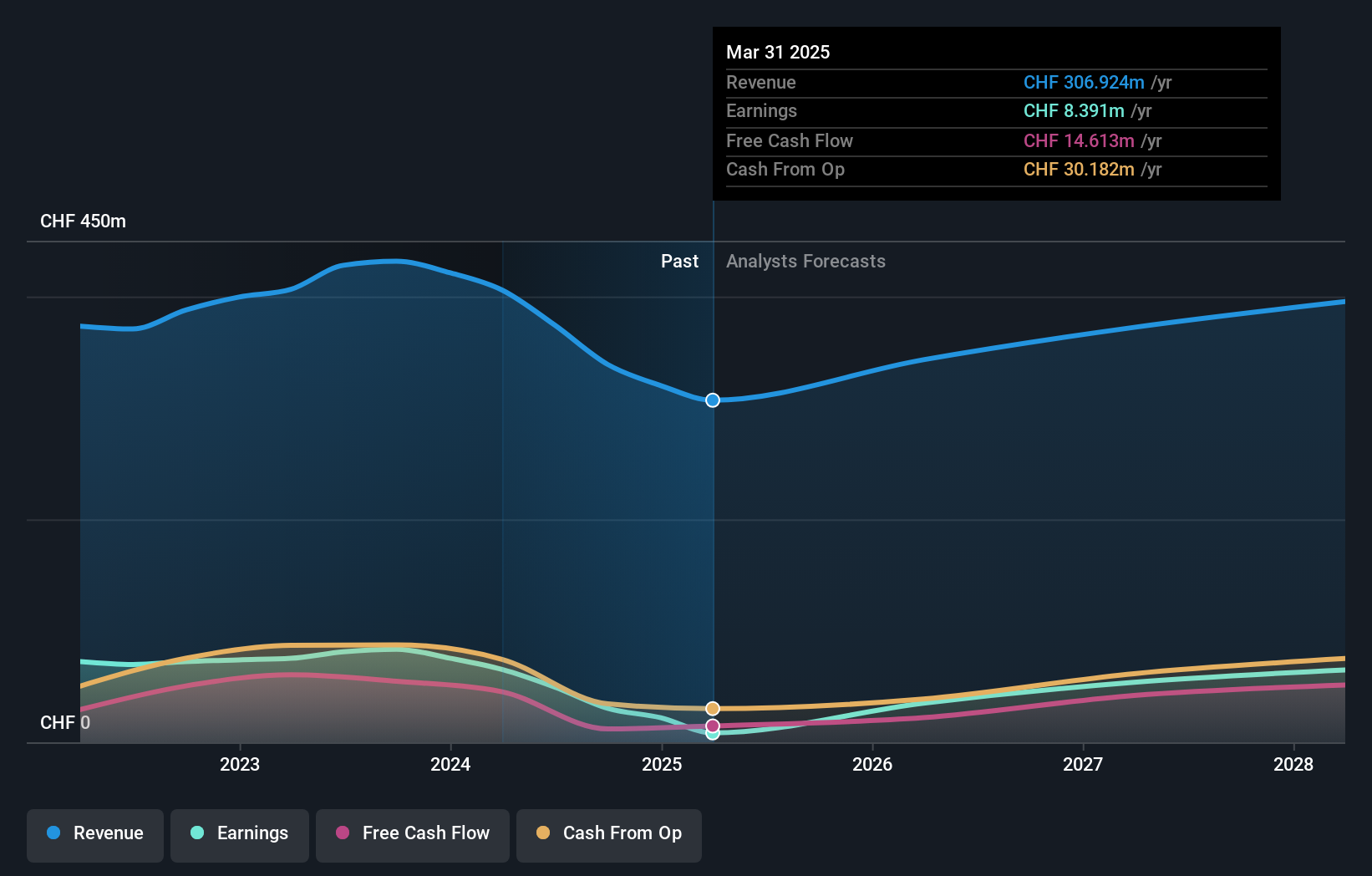

Overview: LEM Holding SA, along with its subsidiaries, offers solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America with a market cap of CHF894.82 million.

Operations: The company's revenue is primarily derived from Asia, contributing CHF168.27 million, and Europe/Americas, which accounts for CHF138.66 million.

Insider Ownership: 29.9%

LEM Holding's earnings are forecast to grow significantly at 48% annually, surpassing the Swiss market's 10.7%. Despite a challenging year with sales dropping to CHF 306.92 million and net income falling sharply, the company trades at a discount of 24.5% below its estimated fair value. No substantial insider trading activity is noted recently, while revenue growth is expected to outpace the market at 9.7% annually, and Return on Equity is projected to reach a high level of 32.5%.

- Click to explore a detailed breakdown of our findings in LEM Holding's earnings growth report.

- Our valuation report here indicates LEM Holding may be undervalued.

Where To Now?

- Click here to access our complete index of 213 Fast Growing European Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ATEA

Atea

Provides IT infrastructure and related solutions for businesses and public sector organizations in the Nordic countries and Baltic regions.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives