Landis+Gyr Group (SWX:LAND) Eyes Profitability as Earnings Forecasts Outpace Revenue Declines

Reviewed by Simply Wall St

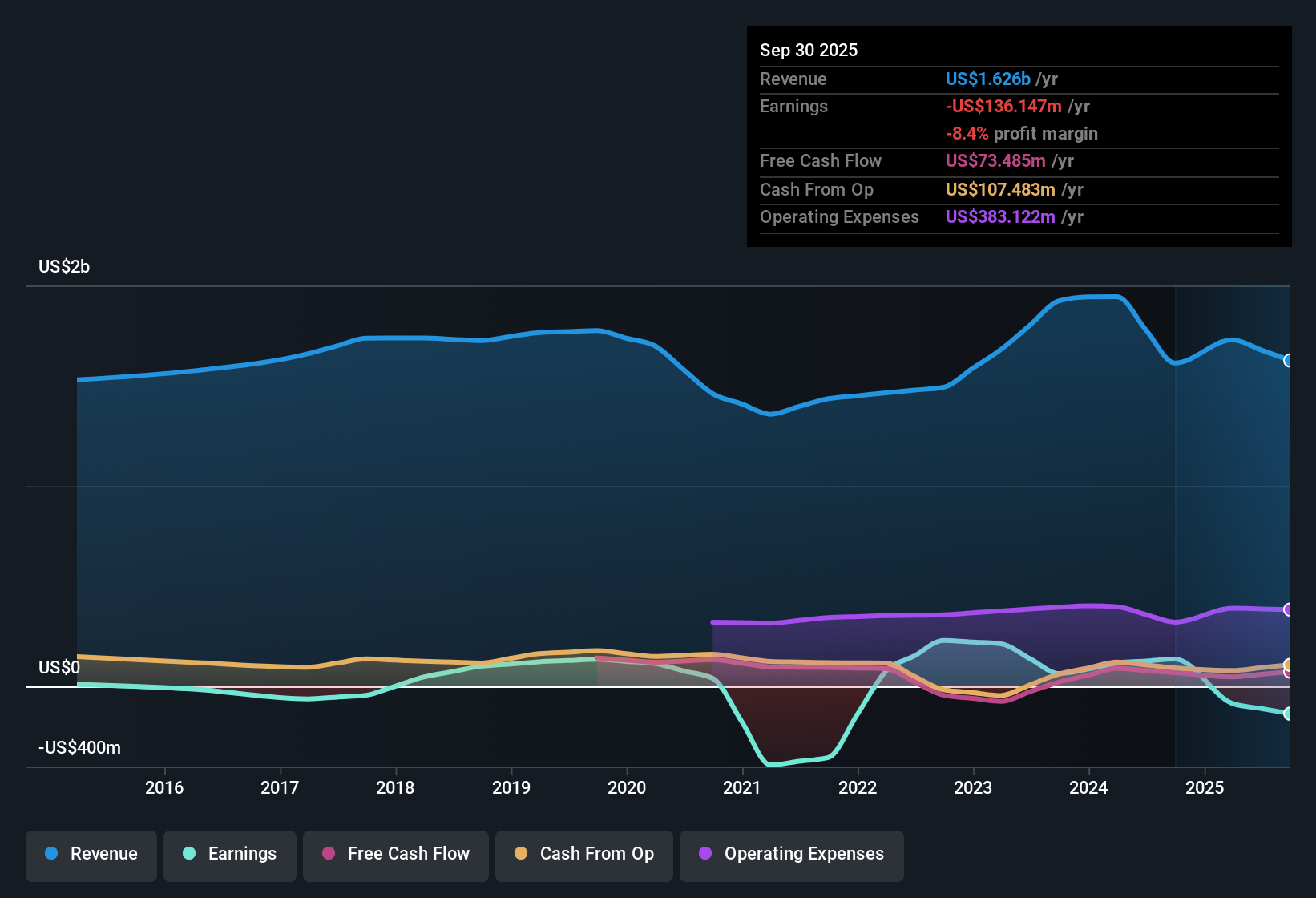

Landis+Gyr Group (SWX:LAND) remains unprofitable, but it has reduced its losses by an average of 25.2% per year over the last five years. Looking ahead, the company is forecast to become profitable within three years, with earnings expected to surge by 93.67% per year, even as revenue is set to decline at a rate of 3.3% annually. For investors, the standout is the aggressive earnings growth on the horizon, positioning LAND as a turnaround story despite the top-line headwind.

See our full analysis for Landis+Gyr Group.The next section takes these headline numbers and puts them head-to-head with the most-followed market narratives, revealing where consensus holds and where surprises could shake things up.

See what the community is saying about Landis+Gyr Group

Americas Margin Upside Offsets EMEA Drag

- The analysts forecast the company’s profit margins to improve from -5% today to 6.6% in three years, driven by a heavier strategic focus on the Americas and gains in software revenue (now 24% of group revenue).

- According to the analysts' consensus view, higher U.S. margins and investment in integrated energy management are expected to push group EBITDA and net margins higher.

- The consensus narrative notes a U.S. listing could open up capital and strengthen margins, especially as the Americas region is positioned as the main profit engine.

- However, the expected margin lift is tested by EMEA declines and restructuring complexity, which may weaken the pace of profitability improvements groupwide.

See how the market weighs the narrative as Landis+Gyr navigates margin pressure and regional bets. 📊 Read the full Landis+Gyr Group Consensus Narrative.

Peer Discount, But Industry Premium

- LAND’s price-to-sales ratio sits at 1.4x, a discount to direct peers’ 3x average, but above the broader European Electronic industry at 1.2x. This shows a mixed valuation context depending on which group you compare it to.

- Analysts' consensus view parses this valuation as supportive of a relative value case for peer-to-peer comparisons.

- Yet it cautions against overreliance on this metric because, relative to the industry average, LAND screens as slightly expensive. Sector rotation or industry headwinds could quickly challenge the perceived value if revenue cuts persist.

- The DCF fair value estimate is CHF35.92, well below the current price of CHF61, which further complicates the value argument.

Price Target Gap Widens

- The current share price of CHF61 trails analysts’ consensus price target of CHF65.76 by about 7.8%, signaling modest expected upside from here if forecasts play out.

- Analysts' consensus view centers this gap on the expectation that, by 2028, LAND will hit $2.1 billion in revenue and $141.2 million in earnings, trading at a forward PE of 21.6x.

- However, there is notable spread in targets. Bullish analysts cite CHF82.04 while the most bearish go as low as CHF56.91. Hitting the high end would require LAND to exceed forecasts in both growth and margin expansion.

- Investors should check these numbers against their own expectations since operational and restructuring risks may disrupt the path to consensus.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Landis+Gyr Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures above? Shape your perspective and add your voice to the story in just a few minutes with Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Landis+Gyr Group.

See What Else Is Out There

Landis+Gyr faces an overvalued share price versus fair value, shrinking revenue, and profit growth hurdles that may stall progress if industry headwinds worsen.

Concerned about paying too much for lackluster growth? Seek better-priced opportunities with stronger outlooks among these 854 undervalued stocks based on cash flows. These companies currently screen as undervalued based on their cash flows and forecasts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LAND

Landis+Gyr Group

Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)