Landis+Gyr Group AG's (VTX:LAND) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Most readers would already be aware that Landis+Gyr Group's (VTX:LAND) stock increased significantly by 51% over the past three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Specifically, we decided to study Landis+Gyr Group's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Landis+Gyr Group

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Landis+Gyr Group is:

2.2% = US$39m ÷ US$1.8b (Based on the trailing twelve months to September 2020).

The 'return' is the amount earned after tax over the last twelve months. Another way to think of that is that for every CHF1 worth of equity, the company was able to earn CHF0.02 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Landis+Gyr Group's Earnings Growth And 2.2% ROE

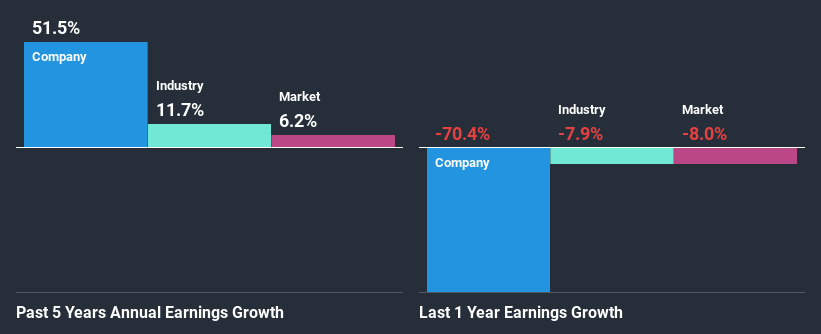

When you first look at it, Landis+Gyr Group's ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 11% either. Despite this, surprisingly, Landis+Gyr Group saw an exceptional 51% net income growth over the past five years. Therefore, there could be other reasons behind this growth. For instance, the company has a low payout ratio or is being managed efficiently.

As a next step, we compared Landis+Gyr Group's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 12%.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. If you're wondering about Landis+Gyr Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Landis+Gyr Group Making Efficient Use Of Its Profits?

Landis+Gyr Group has a significant three-year median payout ratio of 73%, meaning the company only retains 27% of its income. This implies that the company has been able to achieve high earnings growth despite returning most of its profits to shareholders.

Moreover, Landis+Gyr Group is determined to keep sharing its profits with shareholders which we infer from its long history of three years of paying a dividend. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to drop to 55% over the next three years. As a result, the expected drop in Landis+Gyr Group's payout ratio explains the anticipated rise in the company's future ROE to 6.2%, over the same period.

Conclusion

In total, it does look like Landis+Gyr Group has some positive aspects to its business. While no doubt its earnings growth is pretty substantial, we do feel that the reinvestment rate is pretty low, meaning, the earnings growth number could have been significantly higher had the company been retaining more of its profits. Having said that, looking at the current analyst estimates, we found that the company's earnings are expected to gain momentum. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you’re looking to trade Landis+Gyr Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Landis+Gyr Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:LAND

Landis+Gyr Group

Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives