Here's Why We Think Landis+Gyr Group (VTX:LAND) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Landis+Gyr Group (VTX:LAND). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Landis+Gyr Group

How Fast Is Landis+Gyr Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Landis+Gyr Group's EPS has grown 24% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

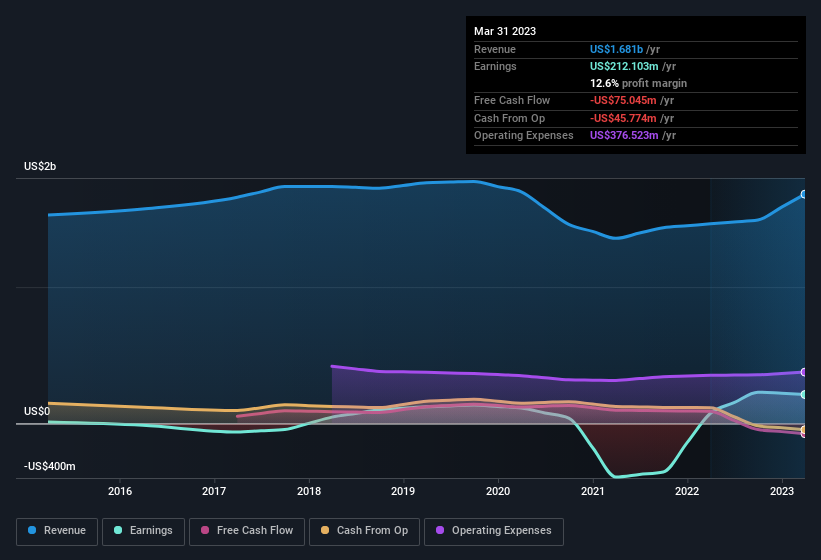

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Landis+Gyr Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 15% to US$1.7b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Landis+Gyr Group's future profits.

Are Landis+Gyr Group Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Landis+Gyr Group followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Notably, they have an enviable stake in the company, worth US$233m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is Landis+Gyr Group Worth Keeping An Eye On?

You can't deny that Landis+Gyr Group has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Landis+Gyr Group's continuing strength. On the balance of its merits, solid EPS growth and company insiders who are aligned with the shareholders would indicate a business that is worthy of further research. Still, you should learn about the 2 warning signs we've spotted with Landis+Gyr Group (including 1 which shouldn't be ignored).

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:LAND

Landis+Gyr Group

Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026