- South Korea

- /

- Electrical

- /

- KOSE:A112610

3 Stocks Estimated To Be Trading At A Discount Of Up To 49.7%

Reviewed by Simply Wall St

In a week marked by geopolitical tensions and economic uncertainties, U.S. stocks experienced a decline, with major indexes finishing lower amid concerns over consumer spending and tariff news. As investors navigate this volatile market landscape, identifying undervalued stocks can present opportunities for those looking to capitalize on potential discounts in stock prices. In such conditions, focusing on companies that demonstrate strong fundamentals despite broader market challenges can be an effective strategy for discerning investors.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.26 | CN¥52.22 | 49.7% |

| Argan (NYSE:AGX) | US$133.63 | US$264.41 | 49.5% |

| CS Wind (KOSE:A112610) | ₩44350.00 | ₩88196.22 | 49.7% |

| Hibino (TSE:2469) | ¥2795.00 | ¥5546.91 | 49.6% |

| Nuvoton Technology (TWSE:4919) | NT$95.80 | NT$191.57 | 50% |

| Neosem (KOSDAQ:A253590) | ₩12050.00 | ₩23935.04 | 49.7% |

| Sobha (NSEI:SOBHA) | ₹1191.35 | ₹2382.65 | 50% |

| Laboratorio Reig Jofre (BME:RJF) | €2.69 | €5.32 | 49.4% |

| Sandfire Resources (ASX:SFR) | A$10.53 | A$21.06 | 50% |

| Integral Diagnostics (ASX:IDX) | A$2.89 | A$5.77 | 49.9% |

Here's a peek at a few of the choices from the screener.

CS Wind (KOSE:A112610)

Overview: CS Wind Corporation manufactures and sells wind towers across various countries including Vietnam, China, Canada, the United Kingdom, Turkey, Taiwan, Malaysia, and Australia; it has a market cap of ₩1.79 trillion.

Operations: The company's revenue segments consist of Tower at ₩2.07 trillion and Bearing Division at ₩77.10 billion.

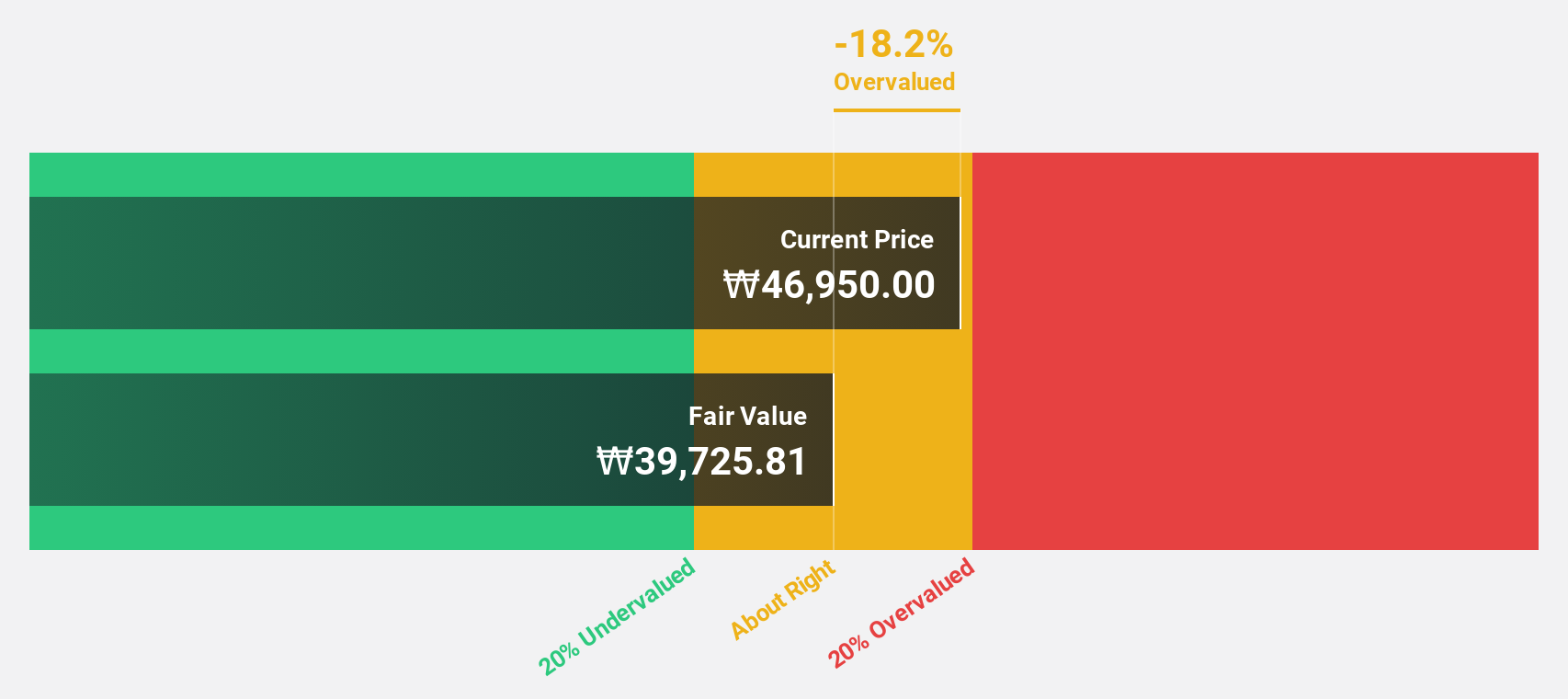

Estimated Discount To Fair Value: 49.7%

CS Wind's stock is trading at ₩44,350, significantly undervalued compared to its estimated fair value of ₩88,196.22. Despite high non-cash earnings and a dividend yield of 2.25% that isn't well covered by free cash flows, the company shows strong potential with earnings forecasted to grow at 30.1% annually—outpacing the KR market's 26%. However, debt coverage by operating cash flow remains a concern for financial stability.

- Our earnings growth report unveils the potential for significant increases in CS Wind's future results.

- Take a closer look at CS Wind's balance sheet health here in our report.

Cicor Technologies (SWX:CICN)

Overview: Cicor Technologies Ltd., along with its subsidiaries, develops and manufactures electronic components, devices, and systems globally, with a market capitalization of CHF311.88 million.

Operations: The company's revenue is primarily derived from its Electronic Manufacturing Services (EMS) Division, which accounts for CHF377.46 million, and the Advanced Substrates (AS) Division, contributing CHF46.24 million.

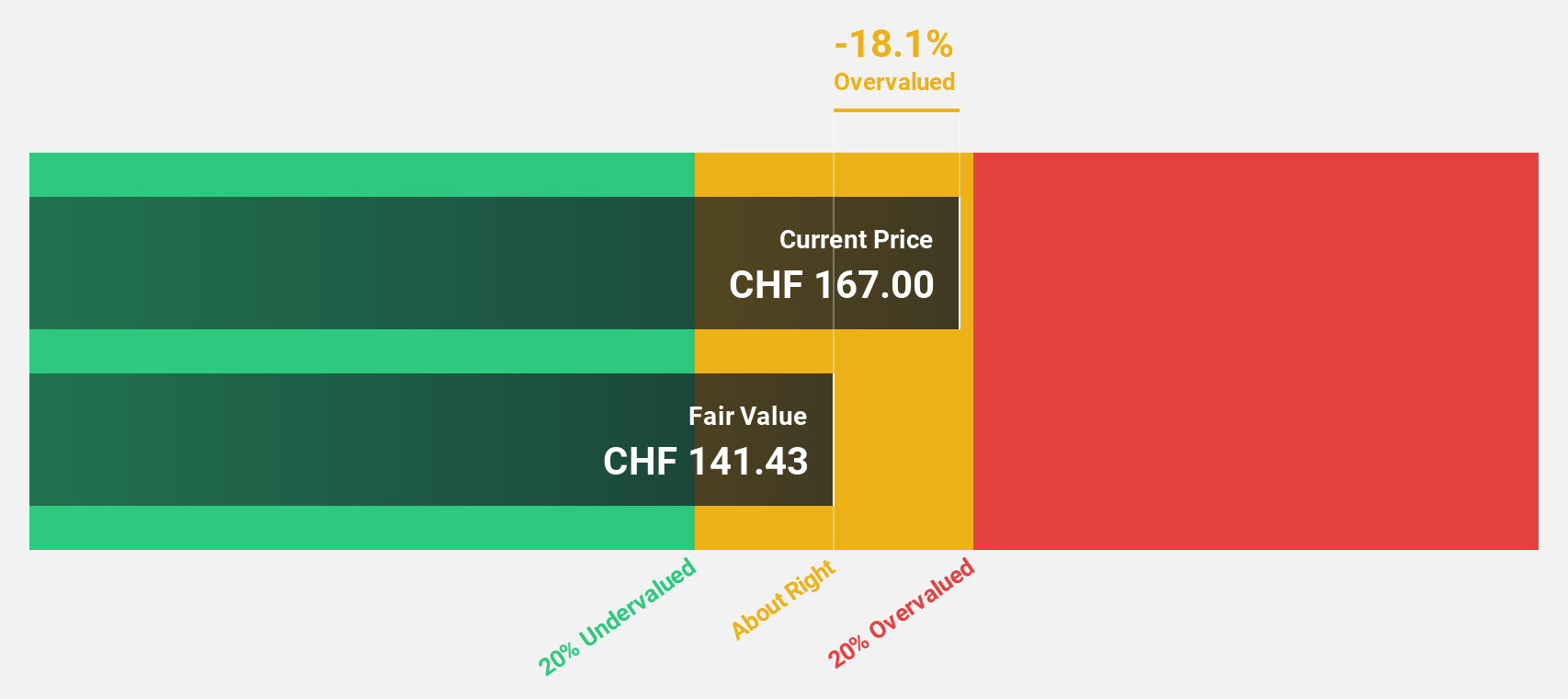

Estimated Discount To Fair Value: 22%

Cicor Technologies is trading at CHF73, undervalued compared to its estimated fair value of CHF93.58, despite high debt levels and past shareholder dilution. Earnings are projected to grow significantly at 28.8% annually, surpassing the Swiss market's growth rate. Recent developments include potential acquisition talks with éolane and a new GBP 25 million aerospace contract, highlighting strategic expansion efforts amid revised lower sales guidance for 2024 between CHF470-490 million.

- Our comprehensive growth report raises the possibility that Cicor Technologies is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Cicor Technologies.

YanKer shop FoodLtd (SZSE:002847)

Overview: YanKer shop Food Co., Ltd engages in the research, development, production, and sale of leisure food products both in China and internationally, with a market cap of CN¥13.55 billion.

Operations: The company generates revenue primarily from the production and sale of snack food, amounting to CN¥4.97 billion.

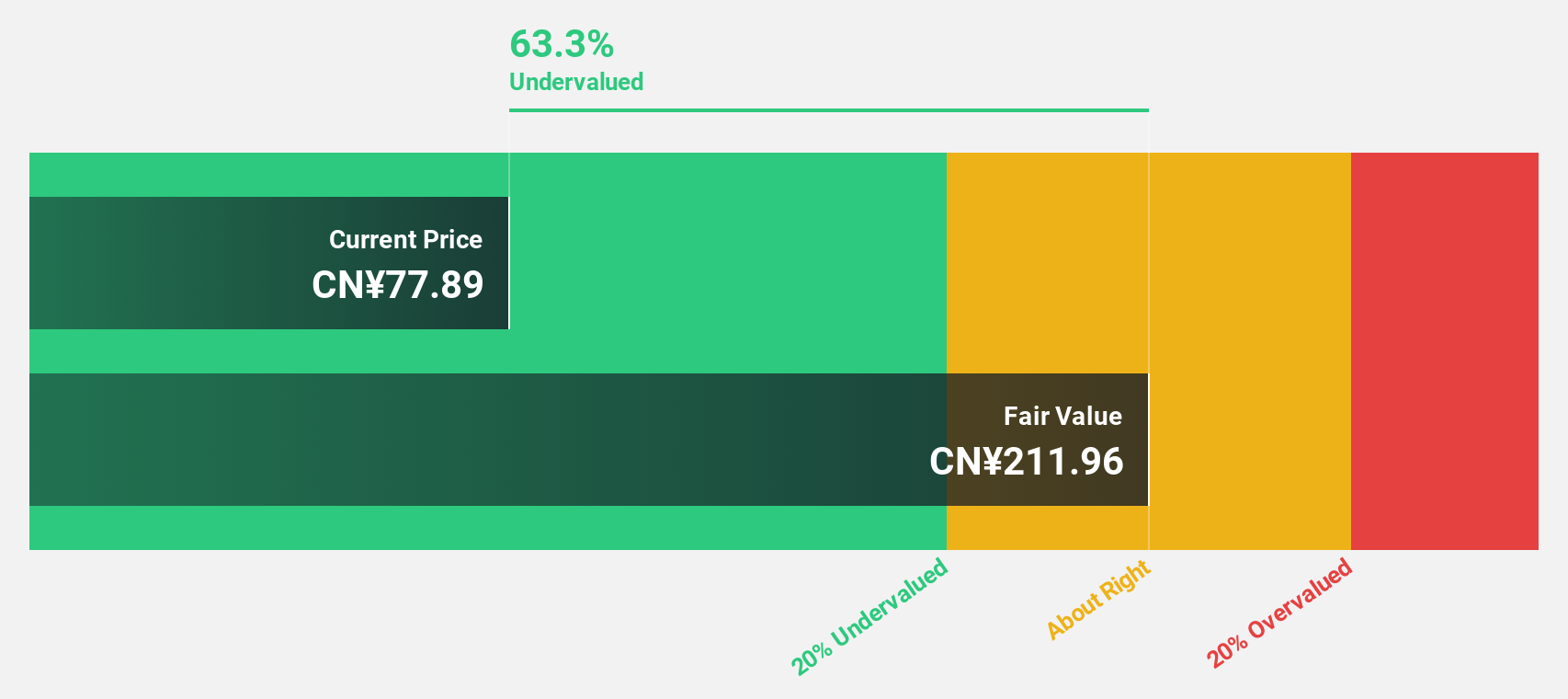

Estimated Discount To Fair Value: 36.8%

YanKer shop FoodLtd is trading at CN¥52.39, significantly below its estimated fair value of CN¥82.85, suggesting undervaluation based on discounted cash flow analysis. Despite large one-off items affecting financial results, the company’s earnings are projected to grow significantly at 22.4% annually over the next three years, although this is slightly slower than China's market average growth rate of 25.3%. Revenue growth forecasts remain robust at 20.4% annually, outpacing the broader market's expected increase.

- Our growth report here indicates YanKer shop FoodLtd may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of YanKer shop FoodLtd stock in this financial health report.

Summing It All Up

- Gain an insight into the universe of 909 Undervalued Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A112610

CS Wind

Manufactures and sells wind towers in Europe, North America, and Asia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives