- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

We Think Shareholders Are Less Likely To Approve A Large Pay Rise For mobilezone holding ag's (VTX:MOZN) CEO For Now

Key Insights

- mobilezone holding ag to hold its Annual General Meeting on 3rd of April

- CEO Markus Bernhard's total compensation includes salary of CHF600.0k

- The overall pay is 44% above the industry average

- Over the past three years, mobilezone holding ag's EPS grew by 14% and over the past three years, the total shareholder return was 43%

CEO Markus Bernhard has done a decent job of delivering relatively good performance at mobilezone holding ag (VTX:MOZN) recently. As shareholders go into the upcoming AGM on 3rd of April, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for mobilezone holding ag

Comparing mobilezone holding ag's CEO Compensation With The Industry

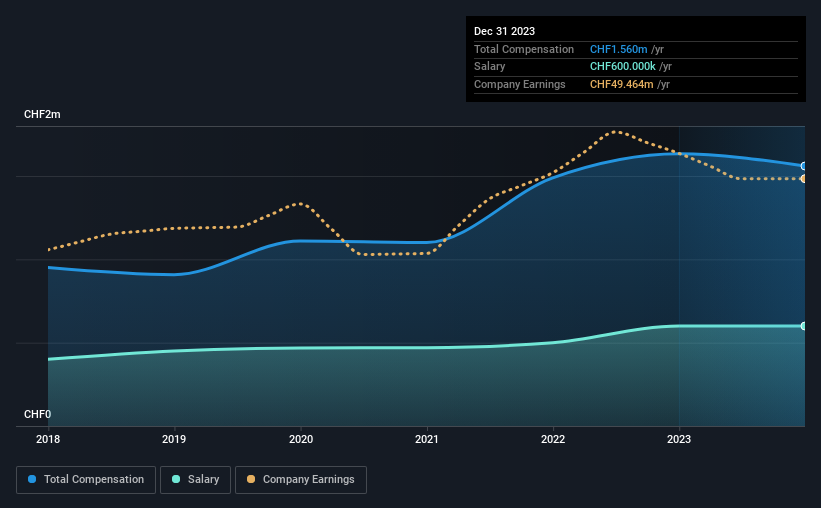

According to our data, mobilezone holding ag has a market capitalization of CHF649m, and paid its CEO total annual compensation worth CHF1.6m over the year to December 2023. We note that's a small decrease of 4.5% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CHF600k.

On examining similar-sized companies in the Switzerland Specialty Retail industry with market capitalizations between CHF362m and CHF1.4b, we discovered that the median CEO total compensation of that group was CHF1.1m. This suggests that Markus Bernhard is paid more than the median for the industry. Furthermore, Markus Bernhard directly owns CHF2.3m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CHF600k | CHF600k | 38% |

| Other | CHF960k | CHF1.0m | 62% |

| Total Compensation | CHF1.6m | CHF1.6m | 100% |

Speaking on an industry level, nearly 56% of total compensation represents salary, while the remainder of 44% is other remuneration. mobilezone holding ag pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at mobilezone holding ag's Growth Numbers

mobilezone holding ag has seen its earnings per share (EPS) increase by 14% a year over the past three years. It achieved revenue growth of 1.1% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has mobilezone holding ag Been A Good Investment?

Boasting a total shareholder return of 43% over three years, mobilezone holding ag has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 3 warning signs for mobilezone holding ag (of which 2 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Important note: mobilezone holding ag is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026