- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

mobilezone holding ag Just Beat Earnings Expectations: Here's What Analysts Think Will Happen Next

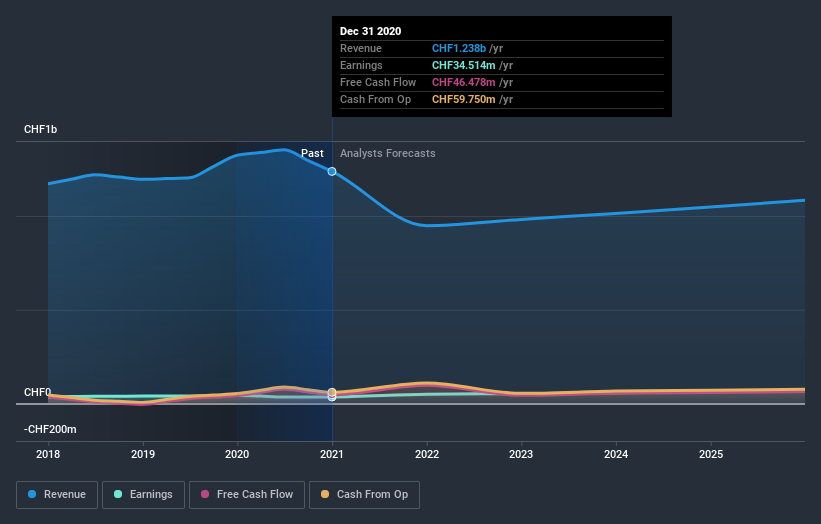

It's been a good week for mobilezone holding ag (VTX:MOZN) shareholders, because the company has just released its latest yearly results, and the shares gained 5.9% to CHF11.88. The result was positive overall - although revenues of CHF1.2b were in line with what the analysts predicted, mobilezone holding ag surprised by delivering a statutory profit of CHF0.77 per share, modestly greater than expected. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for mobilezone holding ag

After the latest results, the consensus from mobilezone holding ag's three analysts is for revenues of CHF948.4m in 2021, which would reflect a disturbing 23% decline in sales compared to the last year of performance. Per-share earnings are expected to soar 44% to CHF1.12. Yet prior to the latest earnings, the analysts had been anticipated revenues of CHF1.12b and earnings per share (EPS) of CHF1.11 in 2021. Indeed we can see that the consensus opinion has undergone some fundamental changes following the latest results, with a real cut to revenues and some minor tweaks to earnings numbers.

The consensus has reconfirmed its price target of CHF12.83, showing that the analysts don't expect weaker sales expectations next year to have a material impact on mobilezone holding ag's market value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values mobilezone holding ag at CHF13.50 per share, while the most bearish prices it at CHF12.00. This is a very narrow spread of estimates, implying either that mobilezone holding ag is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the mobilezone holding ag's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 23% by the end of 2021. This indicates a significant reduction from annual growth of 6.1% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 8.9% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - mobilezone holding ag is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. Still, earnings per share are more important to value creation for shareholders. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have forecasts for mobilezone holding ag going out to 2025, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 1 warning sign for mobilezone holding ag that you need to be mindful of.

If you decide to trade mobilezone holding ag, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026