- Switzerland

- /

- Specialty Stores

- /

- SWX:MOZN

European Stocks Trading Below Estimated Value In October 2025

Reviewed by Simply Wall St

As European markets experience a pullback from recent record highs, driven by political turmoil in France and renewed global trade tensions, investors are keenly observing the region for potential opportunities. In this environment of uncertainty, identifying undervalued stocks becomes crucial as these may offer attractive entry points for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.17 | €2.30 | 49.1% |

| SBO (WBAG:SBO) | €26.80 | €53.44 | 49.8% |

| Mowi (OB:MOWI) | NOK223.20 | NOK436.94 | 48.9% |

| Mo-BRUK (WSE:MBR) | PLN294.50 | PLN582.77 | 49.5% |

| Lingotes Especiales (BME:LGT) | €5.80 | €11.34 | 48.9% |

| High Quality Food (BIT:HQF) | €0.62 | €1.22 | 49% |

| Envipco Holding (ENXTAM:ENVI) | €5.80 | €11.51 | 49.6% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.33 | €6.63 | 49.8% |

| Atea (OB:ATEA) | NOK142.20 | NOK281.61 | 49.5% |

| Allegro.eu (WSE:ALE) | PLN33.65 | PLN66.18 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

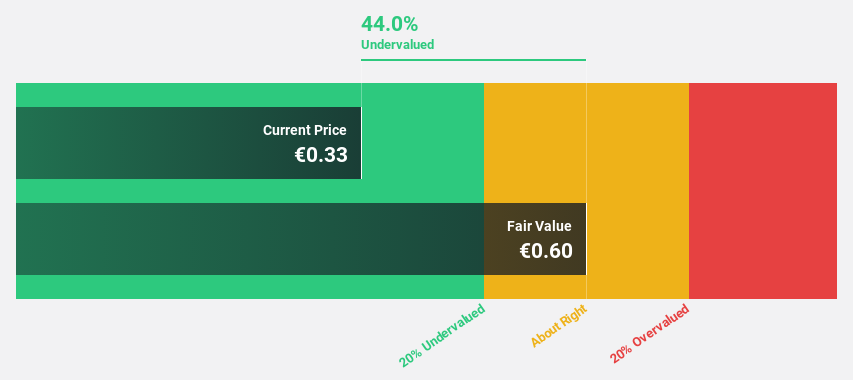

Obrascón Huarte Lain (BME:OHLA)

Overview: Obrascón Huarte Lain, S.A. operates in the construction and concession sectors across various regions including the United States, Canada, Latin America, Europe, and beyond with a market cap of €663.58 million.

Operations: The company's revenue is primarily derived from its Construction segment, which accounts for €3.40 billion, followed by the Industrial segment at €199.92 million.

Estimated Discount To Fair Value: 19.2%

Obrascón Huarte Lain (OHLA) is trading at €0.48, below its estimated fair value of €0.59, indicating it is undervalued based on discounted cash flows by 19.2%. Despite recent volatility and shareholder dilution, OHLA's earnings are forecast to grow significantly by 71.51% annually, with expected profitability in three years and revenue growth slightly outpacing the Spanish market at 4.7% per year. Recent half-year results showed a reduced net loss of €29.65 million compared to the previous year.

- The analysis detailed in our Obrascón Huarte Lain growth report hints at robust future financial performance.

- Dive into the specifics of Obrascón Huarte Lain here with our thorough financial health report.

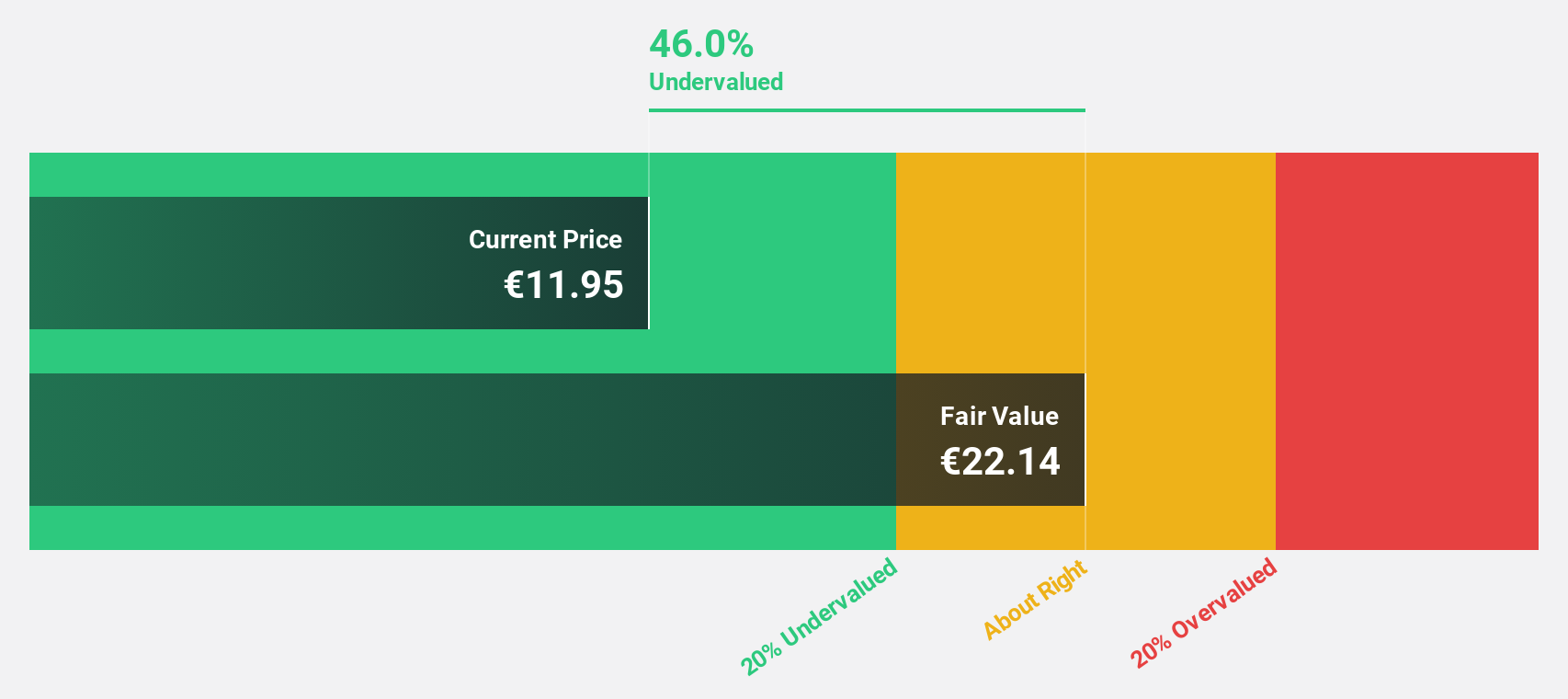

Figeac Aero Société Anonyme (ENXTPA:FGA)

Overview: Figeac Aero Société Anonyme manufactures, supplies, and sells equipment and sub-assemblies for the aeronautics sector in France with a market cap of €542.42 million.

Operations: The company's revenue is primarily derived from Aerostructures & Aeroengines, contributing €398.56 million, with an additional €33.74 million from Diversification Activities.

Estimated Discount To Fair Value: 39.5%

Figeac Aero Société Anonyme is trading at €12.3, significantly below its estimated fair value of €20.32, suggesting it is undervalued based on discounted cash flows by over 20%. The company has become profitable this year and forecasts indicate earnings growth of 59.53% annually, outpacing the French market. Recent contracts with Bombardier and Safran are expected to enhance revenue streams without additional resource strain, supporting anticipated revenue growth of 10.7% per year despite interest payment challenges.

- Our earnings growth report unveils the potential for significant increases in Figeac Aero Société Anonyme's future results.

- Click to explore a detailed breakdown of our findings in Figeac Aero Société Anonyme's balance sheet health report.

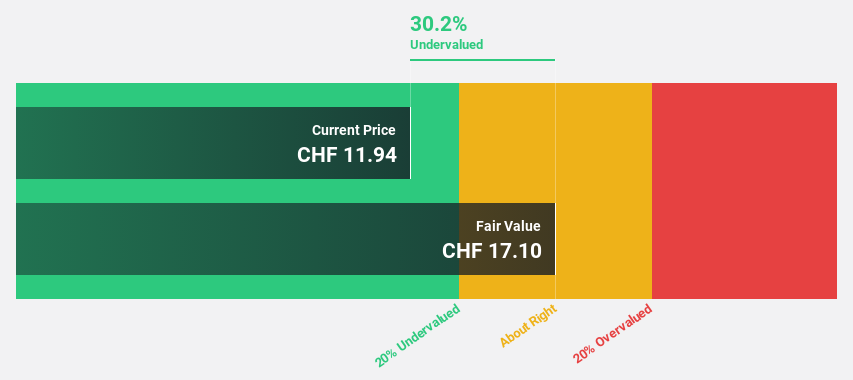

mobilezone holding ag (SWX:MOZN)

Overview: Mobilezone Holding AG, with a market cap of CHF507.55 million, operates in Germany and Switzerland offering mobile and fixed-line telephony, television, and Internet services through its subsidiaries.

Operations: The company generates revenue of CHF697.27 million from Germany and CHF265.95 million from Switzerland through its telecommunication services offerings.

Estimated Discount To Fair Value: 20.9%

Mobilezone holding ag, trading at CHF11.76, is significantly undervalued with a fair value of CHF14.87 based on discounted cash flows. Despite high debt and negative shareholders' equity, earnings are projected to grow substantially at 20.1% annually, surpassing the Swiss market average growth rate. However, profit margins have declined from last year and dividends remain inadequately covered by earnings. Recent guidance confirmed EBIT for 2025 between CHF53 million and CHF60 million amidst declining sales compared to the previous year.

- Upon reviewing our latest growth report, mobilezone holding ag's projected financial performance appears quite optimistic.

- Get an in-depth perspective on mobilezone holding ag's balance sheet by reading our health report here.

Where To Now?

- Reveal the 207 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MOZN

mobilezone holding ag

Provides mobile and fixed-line telephony, television, and Internet services for various network operators in Germany and Switzerland.

Established dividend payer with moderate risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success